Seagate's (STX) Q2 Earnings Beat Estimates, Revenues Miss

Seagate Technology Holdings plc STX reported second-quarter fiscal 2024 non-GAAP earnings of 12 cents per share. The Zacks Consensus Estimate was pegged at a loss of 7 cents per share. The company reported non-GAAP earnings of 16 cents in the year-ago quarter.

Management anticipated second-quarter fiscal 2024 non-GAAP loss to be 10 cents (+/- 20 cents).

Non-GAAP revenues of $1.555 billion missed the Zacks Consensus Estimate by 0.3%. The figure declined 18% on a year-over-year basis. However, revenues improved 7% sequentially. Management projected revenues to be $1.55 billion (+/- $150 million) for the fiscal second quarter.

Seagate Technology Holdings PLC Price, Consensus and EPS Surprise

Seagate Technology Holdings PLC price-consensus-eps-surprise-chart | Seagate Technology Holdings PLC Quote

Sequentially, the company witnessed mass capacity demand improvement owing to stronger nearline cloud demand, which offset declines in the VIA market.

Seagate noted that the launch of the Mozaic 3+ hard drive platform last week, which features Heat-Assisted Magnetic Recording technology, positions it well to capture share in the mass capacity storage solutions market.

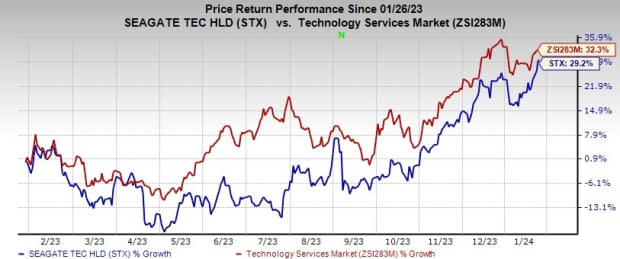

In the past year, STX has increased 29.2% compared with the sub-industry’s growth of 32.3%.

Image Source: Zacks Investment Research

Exabyte Shipments in Detail

In the reported quarter, Seagate shipped 95.1 exabytes of HDD storage, down 15% year over year. However, this marked an increase of 6% sequentially.

Average mass capacity increased 12% year over year and 11% sequentially to 8.2TB.

The company shipped 83.2 exabytes for the mass-capacity storage market (including nearline, video and image applications, and network-attached storage). This recorded a year-over-year plunge of 14% in exabytes shipments. However, exabyte shipments rose 5% sequentially. Average mass capacity per drive jumped sequentially to 11.9 TB from 10.3 TB.

In the nearline market, it shipped 65.1 exabytes of HDD, down 18% year over year but up 16% sequentially.

Seagate shipped 12 exabytes for the legacy market (which includes mission-critical notebooks, desktops, gaming consoles, digital video recorders or DVR and external consumer devices), down 25% year over year but up 15% sequentially. Average capacity improved by 19% year over year to 2.6 TB.

Revenues by Product Group

Total revenues of HDD (89% of revenues) tumbled 17% year over year to $1.384 billion in the reported quarter. On a sequential basis, revenues were up 7%.

Systems, SSD & Other segment’s revenues (11%), including enterprise data solutions, cloud systems and solid-state drives, were $171 million, down 24% on a year-over-year basis but up 8% sequentially.

Our estimates for revenues from HDD and non-HDD segments were $1.386 billion and $159 million, respectively.

Margin Details

Non-GAAP gross margin improved to 23.6% from 21.4% in the prior-year quarter.

Non-GAAP operating expenses were down 18% on a year-over-year basis to $240 million.

Non-GAAP income from operations totaled $127 million, up from $109 million a year ago. Non-GAAP operating margin increased to 8.2% from 5.8% in the year-earlier quarter.

Balance Sheet and Cash Flow

As of Dec 29, 2023, cash and cash equivalents were $787 million compared with $795 million as of Sep 29, 2023.

As of Dec 29, 2023, long-term debt (including the current portion) was $5.669 billion compared with $5.666 billion as of Sep 29, 2023.

Cash flow from operations was $169 million compared with $251 million in the previous quarter. Free cash flow amounted to $99 million compared with $172 million in the previous quarter.

STX paid $146 million as dividends in the fiscal second quarter. It exited the quarter with 210 million shares outstanding.

Seagate announced a quarterly cash dividend of 70 cents per share. The dividend will be paid out on Apr 4, 2024, to shareholders of record as of the close of business on Mar 21, 2024.

Outlook

Management anticipates third-quarter fiscal 2024 revenues to be $1.65 billion (+/- $150 million).

Non-GAAP loss for the fiscal third quarter is expected to be 25 cents per share (+/- 20 cents).

STX expects incremental improvements in mass capacity demand from cloud and enterprise clients to more than offset seasonal downtick in demand in both VIA and the legacy markets.

The non-GAAP operating expenses are expected to be $260 million. At the midpoint of the revenue guidance, management expects the non-GAAP operating margin to expand to the low double-digit percentage range (including underutilization expenses of $50 million).

Zacks Rank

Currently, Seagate carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Other stocks worth consideration in the broader technology space are Watts Water Technologies WTS, NETGEAR NTGR and Blackbaud BLKB. While NETGEAR and Blackbaud currently sport a Zacks Rank #1 (Strong Buy) each, Watts Water carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved by 1% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 26.2% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days. NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR were down 26.8% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS has improved by 1% in the past 60 days to $3.86.

BLKB’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have gained 33.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report