Is Sealed Air Corp (SEE) Significantly Undervalued?

Sealed Air Corp (NYSE:SEE), a leading player in the Packaging & Containers industry, has seen a daily gain of 2.72% and a 3-month loss of -14.16%. With an Earnings Per Share (EPS) (EPS) of 2.68, the question arises: is Sealed Air significantly undervalued? This article aims to provide an in-depth valuation analysis of Sealed Air, offering readers valuable insights into its financial performance and intrinsic value.

Company Overview

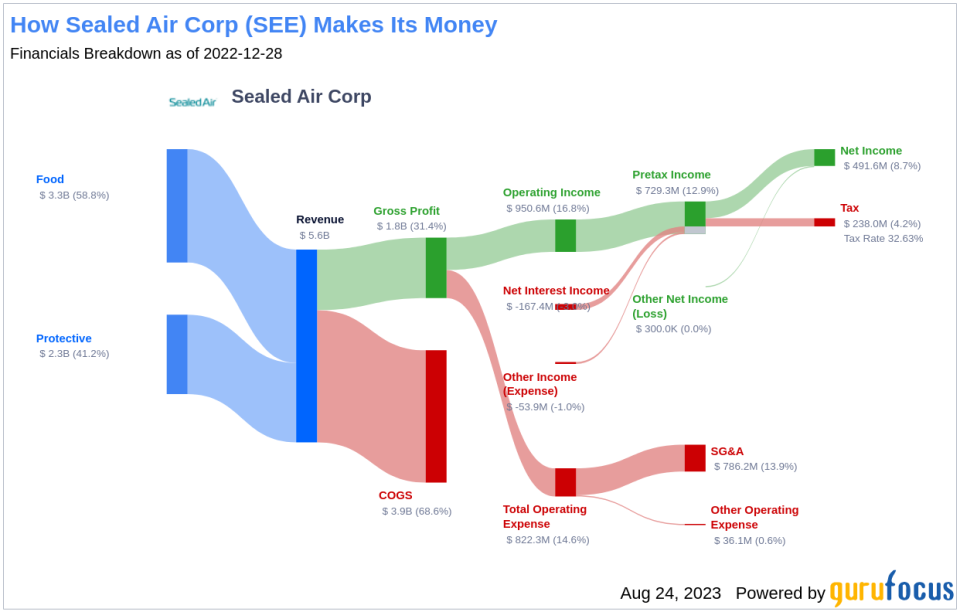

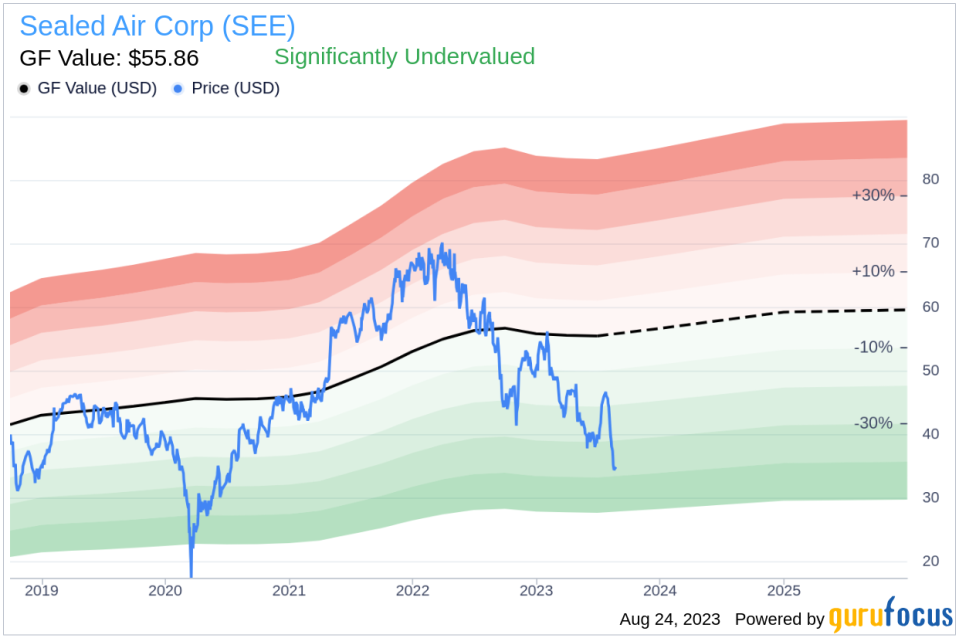

Sealed Air Corp operates through two reporting segments: Food care and Product care. The Food care segment includes food packaging products such as Cryovac, Darfresh, and OptiDure, primarily aimed at meats. The Product care segment comprises Sealed Air's Bubble Wrap, Instapak, Jiffy mailers, and shrink film packaging systems catering to industrial and e-commerce applications. With a stock price of $35.16 and a market cap of $5.10 billion, Sealed Air has a GF Value of $55.86, indicating that the stock could be significantly undervalued.

Understanding the GF Value

The GF Value is a proprietary valuation measure that provides an estimate of a stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page presents an overview of the fair value at which the stock should ideally be traded.

Sealed Air's current stock price is significantly below the GF Value Line, indicating that it is undervalued. As such, the long-term return of Sealed Air's stock is likely to be much higher than its business growth.

Financial Strength

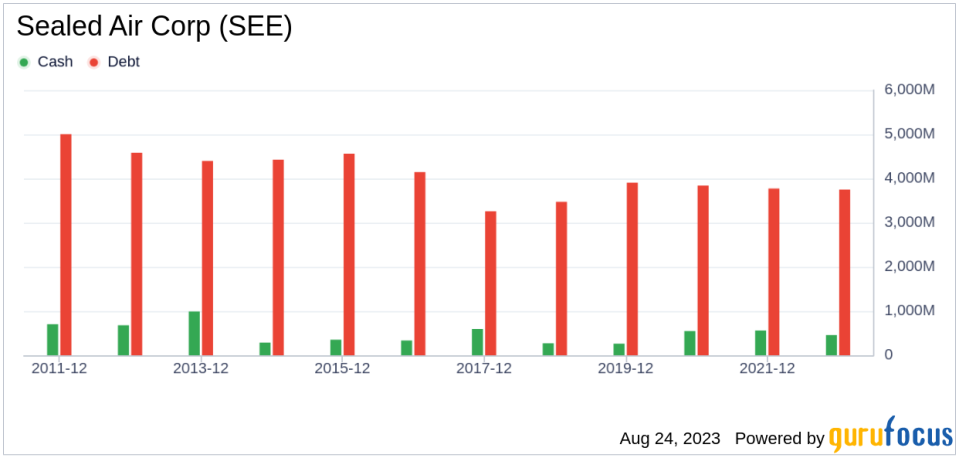

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before investing. Sealed Air has a cash-to-debt ratio of 0.06, which ranks lower than 84.3% of 363 companies in the Packaging & Containers industry. Based on this, GuruFocus ranks Sealed Air's financial strength as 4 out of 10, suggesting a weak balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk, especially those that have demonstrated consistent profitability over the long term. Sealed Air has been profitable for 10 years over the past 10 years. With revenues of $5.50 billion and Earnings Per Share (EPS) of $2.68 in the past 12 months, its operating margin of 15.23% is better than 91.28% of 367 companies in the Packaging & Containers industry. This indicates strong profitability.

Growth is a crucial factor in the valuation of a company. Sealed Air's 3-year average annual revenue growth rate is 7.4%, which ranks better than 53.54% of 353 companies in the Packaging & Containers industry. Its 3-year average EBITDA growth rate is 17.4%, which ranks better than 73.65% of 334 companies in the industry.

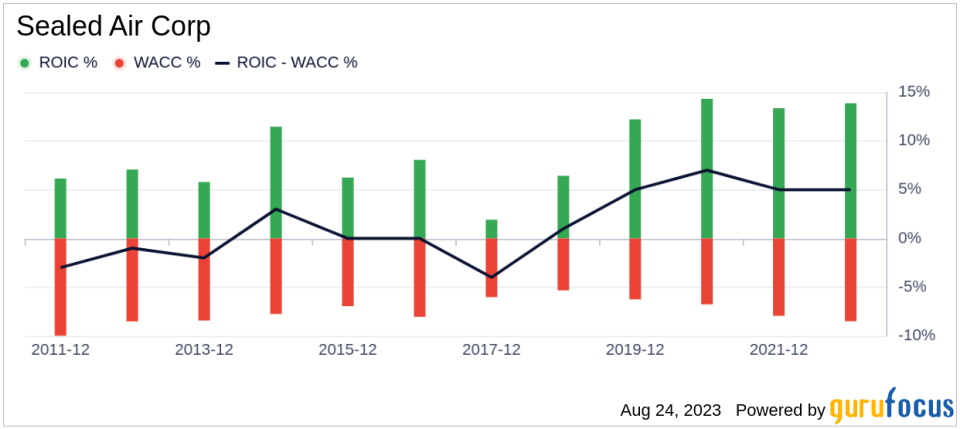

ROIC vs WACC

Comparing a company's Return on invested capital (ROIC) and the Weighted average cost of capital (WACC) is another way to evaluate its profitability. Sealed Air's ROIC is 10.03, and its WACC is 7.67, indicating that the company generates a higher return on its invested capital than its cost of capital.

Conclusion

In conclusion, Sealed Air's stock appears to be significantly undervalued. The company's financial condition is weak, but its profitability is strong. Its growth ranks better than 73.65% of 334 companies in the Packaging & Containers industry. To learn more about Sealed Air stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.