Sealed Air (SEE) Declines 38% in a Year: Will It Recover in 2024?

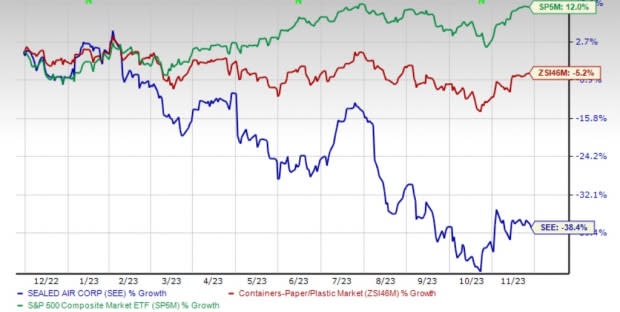

The performance of packaging stocks this year has been reflecting the weak demand in the industry as inflationary pressures led to muted consumer spending. Customers have been working to lower their high inventory levels. One of the major players in the Containers - Paper and Packaging industry, Sealed Air Corporation SEE, has not been immune to this, which has also been reflected in its price performance over the past year, having declined 38%. Meanwhile, the industry has dipped 5.2%, whereas the S&P 500 has risen 12% in the same timeframe.

Weak Volumes Weigh on SEE’s Results

In the first quarter of 2022, Sealed Air first witnessed a drop in volumes that continued to intensify over the remaining three quarters of the year. Overall, the company reported a 6% year-over-year decline in volume in 2022. This trend has continued in 2023 as well, with the company reporting 9.3%, 8.2% and 5.9% declines in the first, second and third quarters of 2023, respectively.

Image Source: Zacks Investment Research

The volume decline was more pronounced in the Protective segment where it was down 11% in 2022 and 18% in the first quarter of 2023, 19% in the second quarter and 13% in the third quarter. This reflects the recessionary pressures in the industrial and fulfillment markets. In the Food segment, volumes decreased 2% in 2022 followed by 2.6% in the first quarter of 2023, 0.2% in the second quarter and 0.8% in the third quarter. This was driven by food retail market declines and the impact of supply disruptions.

Supply-Chain Issues, High-Interest Expense Ail

In 2022, Sealed Air experienced supply disruptions such as the limited availability of certain raw materials and equipment components. During the course of this year, many of these shortages related to raw materials have lessened. However, the company has still noted supply shortages for certain equipment components and long lead times to procure these equipment components.

Also, SEE’s total debt to total capital ratio remained high at 0.92 as of Sep 30, 2023. The figure is much higher than the industry’s 0.67.

Due to the abovementioned headwinds, Sealed Air projects adjusted earnings per share to be in the range of $2.75 to $2.95 for 2023. Compared with adjusted earnings per share of $4.10 in 2022, the guidance indicates a 30.5% plunge.

Pickup in Volume Imminent, Acquisitions to Aid Growth

Volumes are expected to pick up eventually as the situation normalizes and customers' inventory resumes normal levels. Growing demand for automated and sustainable packaging solutions that maximize food safety, protect goods, reduce waste and deliver savings to customers through productivity will drive Sealed Air’s food and protected packaging segments. The strategic acquisition of Liquibox is expected to boost results. The acquisition is highly complementary to the Cryovac Fluids & Liquids business and will further the company’s vision to become a leader in fluids and liquid packaging.

Around 63% of Sealed Air’s revenues come from the packaging of protein, foods, fluids and goods for the medical and life sciences industries. The food segment will benefit from the shift in demand for case-ready, shrink bags and pre-packaged meals and snacks designed for home consumption. In the medical and life sciences portfolio, demand for protected packaging solutions for medical supplies, pharmaceuticals and personal protective equipment remains high. It is also benefiting from growth in online shipments of medical equipment and pharmaceuticals.

Sealed Air continues to capitalize on the global e-commerce growth and increased demand for recyclable materials, fiber-based solutions and automated packaging. Thus, with around 74% of its revenues originating from essential end-markets, the company will deliver solid top-line performance.

Strategic Initiatives to Aid Growth

The company’s Reinvent SEE Strategy program, which was implemented in 2018, was focused on innovations, SG&A productivity, product-cost efficiency, channel optimization and customer-service enhancements. This year, the company has embarked on the Reinvent SEE 2.0 initiative, which will advance the next phase of its transformation as it continues to build on the success of Reinvent SEE.

Per the new program, the company will focus on expanding the Fluids & Liquids Vertical segment by leveraging Cryovac and Liquibox. It will aim to enhance its competitive capabilities by combining highly complementary solutions within the fluids & liquids business while generating strong synergies and accelerating innovation. The company will expand and grow its portfolio of automation solutions and also advance prismiq digital packaging and printing solutions. Sealed Air will broaden and diversify its product portfolio with new sustainable innovations while expanding the digital e-commerce platform.

Zacks Rank & Stocks to Consider

Sealed Air currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS. BRC currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $4.00. The consensus estimate for 2023 earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC have gained 15% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 25% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 31% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sealed Air Corporation (SEE) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report