Sealed Air (SEE) Hits 52-Week High: What's Driving the Rally?

Shares of Sealed Air Corporation SEE scaled a fresh 52-week high of $59.70 during the Jul 1 trading session, before retracting to close at $59.14. The ongoing strength in packaging demand for food, medical supplies and consumer staples; rise in e-commerce demand amid the coronavirus pandemic and anticipated benefits from its Reinvent SEE Strategy on earnings are driving the rally. The company’s recent announcement that it has earmarked more than $30 million in capital to expand global production capacity and invest in new equipment systems to meet the accelerating demand for Automated Packaging Systems’ Autobag brand solution has also contributed to the rally.

The company has a market capitalization of around $9 billion. Sealed Air has an expected long-term earnings per share growth rate of 8.3%. The company has a trailing four-quarter earnings surprise of 21.4%, on average.

Sealed Air’s current-year earnings estimates have been revised upward by 5% to $3.51 per share over the past 60 days, reflecting analysts’ optimism. Meanwhile, the same for 2022 has moved north by 7% to $3.88 per share. The Zacks Consensus Estimate for earnings for 2021 and 2022 suggests year-over-year growth of 10% and 10.5%, respectively.

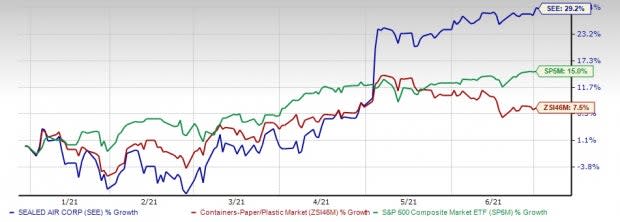

Share Price Performance

The stock has gained 29.2% year to date, compared with the industry’s growth of 7.5%. Meanwhile, the S&P500 has rallied 15% in the same time frame.

Image Source: Zacks Investment Research

Driving Factors

Better-Than-Expected Q1 Results: Sealed Air’s first-quarter 2021 adjusted earnings per share improved 7% year over year to 78 cents on higher volumes and benefits from the company’s Reinvent SEE initiatives. The bottom line beat the Zacks Consensus Estimate of 71 cents. Total revenues were up 8% year over year to $1.27 billion in the reported quarter highlighting strength in e-Commerce, food retail and equipment, and pickup in industrial activity. The top line also beat the Zacks Consensus Estimate of $1.22 billion

Upbeat 2021 Guidance: For 2021, Sealed Air expects net sales in the range of $5.25 billion to $5.35 billion, which indicates an increase of 7% to 9% as reported and 6% to 8% in constant dollars, driven by increased volume and prices. Adjusted EBITDA is projected between $1.12 billion and $1.15 billion in 2021. Adjusted earnings per share is now anticipated in the band of $3.40 to $3.55. The mid-point of the range suggests year-over-year growth of 9%.

Strong Demand Amid the Pandemic: Around 63% of Sealed Air’s revenues come from packaging of protein, foods, fluids and goods for the medical and life sciences industries. The food care business continues to benefit from the shift in demand for case ready, shrink bags and pre-packaged meals and snacks designed for home consumption amid the pandemic-induced restrictions. In the medical and life sciences portfolio, demand for protected packaging solutions for medical supplies, pharmaceuticals, and personal protective equipment remains high. It is also gaining from growth in online shipments of medical equipment and pharmaceuticals. The company is witnessing increased demand for temperature assurance packaging solution that ensures safe and secure distribution of COVID-19 vaccines. Further, e-commerce sales, which contribute around 14% to the company’s sales, have been on the rise amid the stay-at-home scenario.

Expected Savings From Reinvent SEE Strategy: Sealed Air’s Reinvent SEE Strategy, which is focused on innovations, SG&A productivity, product-cost efficiency, channel optimization and customer-service enhancements, has been instrumental in driving earnings growth. One of most vital aspects of this strategy involves investment in technology and resources focusing on new and existing high-growth markets. In 2021, the company is on track to realize benefits of around $65 million from Reinvent SEE.

Investing in Growth Areas: Sealed Air’s focus on automation, digital and sustainability is expected to drive above-market growth in its core business, enabling it to expand into new and adjacent markets. The company’s SEE automated solutions strategy is driving growth for the next phase of its Reinvent SEE business transformation. Sealed Air is meeting customers' most critical needs for safety, productivity and labor scarcity with its touchless automated solutions. The company expects equipment sales to grow 12% in 2021 to over $250 million. Its pipeline for automated equipment continues to improve, and the company has set a target of over $500 million by 2025.

In 2019, the company had acquired Automated Packaging Systems, a leading manufacturer of high-reliability, automated bagging systems, which expands breadth of its automated solutions and sustainable packaging offerings. Sealed Air recently announced that it is making capital investments of more than $30 million to expand its global production capacity and invest in new equipment to fulfill the surging demand for Automated Packaging Systems Autobag solutions. The acceleration of e-commerce driven by the pandemic has increased demand for automated packaging solutions across multiple end markets including e-retailers, consumer goods, medical supplies, industrials, and food.

Zacks Rank & Other Stocks to Consider

Sealed Air currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the Industrial Products sector include Greif, Inc. GEF, Lindsay Corporation LNN and Pentair plc PNR. All of these stocks sport a Zacks Rank #1.

Greif has an estimated earnings growth rate of 47.1% for the ongoing fiscal. The company’s shares have gained 29% year to date.

Lindsay has a projected earnings growth rate of 1% for fiscal 2021. The company’s shares have appreciated 29% so far this year.

Pentair has an expected earnings growth rate of 26% for the current year. The stock has surged 27% year to date.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sealed Air Corporation (SEE) : Free Stock Analysis Report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research