SeaWorld Entertainment Inc CEO Marc Swanson Sells 4,000 Shares

On September 7, 2023, Marc Swanson, the CEO of SeaWorld Entertainment Inc (NYSE:SEAS), sold 4,000 shares of the company. This move is part of a larger trend of insider selling within the company over the past year.

Marc Swanson has been with SeaWorld Entertainment Inc for over 20 years, serving in various roles including CFO and interim CEO before being appointed as the permanent CEO. Under his leadership, the company has navigated through challenging times and continues to focus on delivering exceptional experiences for its guests while driving shareholder value.

SeaWorld Entertainment Inc is a leading theme park and entertainment company that provides experiences that matter and inspire guests to protect animals and the wild wonders of our world. The company owns or licenses a portfolio of recognized brands including SeaWorld, Busch Gardens, and Sesame Place. Over its more than 60-year history, SeaWorld has welcomed more than 160 million guests, inspiring them with the power of entertainment, education, and the importance of animal welfare.

Over the past year, Marc Swanson has sold a total of 28,000 shares and has not purchased any shares. This recent sale of 4,000 shares is part of this larger trend.

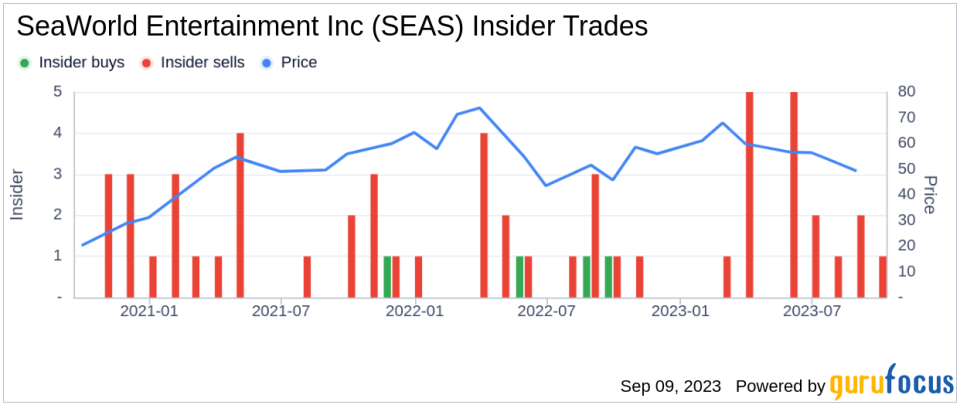

The insider transaction history for SeaWorld Entertainment Inc shows a trend of more insider selling than buying. Over the past year, there has been only one insider buy compared to 19 insider sells. This could indicate that insiders believe the stock is currently overvalued.

On the day of the insider's recent sale, shares of SeaWorld Entertainment Inc were trading for $48.3 apiece, giving the stock a market cap of $3.112 billion. The price-earnings ratio is 12.67, which is lower than the industry median of 19.85 and lower than the companys historical median price-earnings ratio.

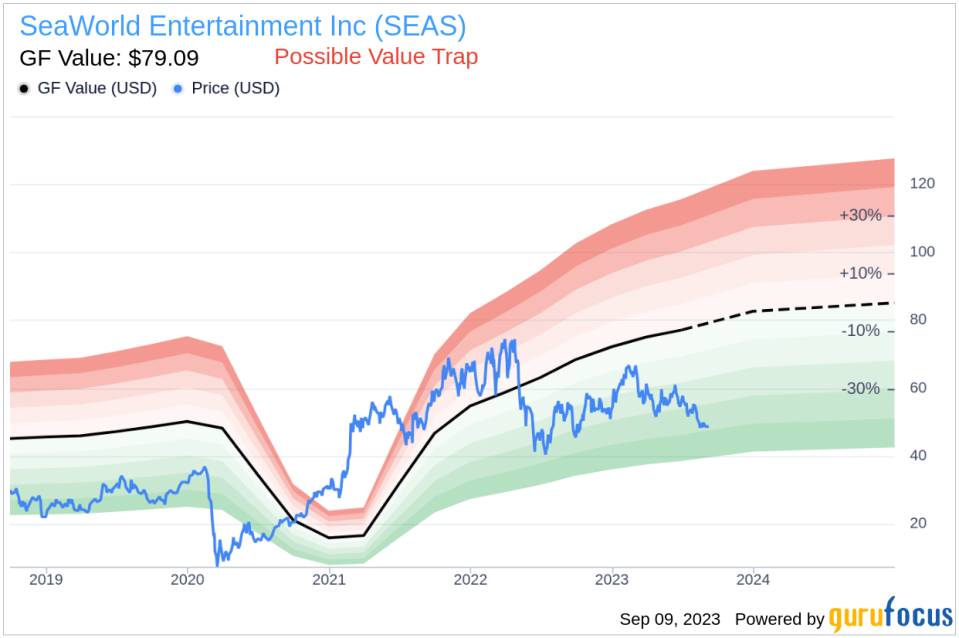

With a price of $48.3 and a GuruFocus Value of $79.09, SeaWorld Entertainment Inc has a price-to-GF-Value ratio of 0.61. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus that takes into account historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sale of shares by CEO Marc Swanson is part of a larger trend of insider selling at SeaWorld Entertainment Inc. While the company's stock appears to be undervalued based on its GF Value, the high level of insider selling suggests that insiders may believe the stock is overvalued. Investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.