Secure Energy Services Leads Trio of Solid Canadian Dividend Stocks

Canada's main stock index, the TSX, has been riding a wave of positive momentum, closing up at 21,849.15 and marking its fifth consecutive weekly gain with materials sector stocks leading the charge. Amidst this backdrop of a strengthening market buoyed by rising copper prices and solid energy performance, investors may find particular value in dividend-paying stocks that offer potential for steady income and stability.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.45% | ★★★★★★ |

First National Financial (TSX:FN) | 6.81% | ★★★★★☆ |

Canadian Imperial Bank of Commerce (TSX:CM) | 5.36% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.79% | ★★★★★☆ |

Richards Packaging Income Fund (TSX:RPI.UN) | 4.11% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.11% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.23% | ★★★★★☆ |

Primo Water (TSX:PRMW) | 2.03% | ★★★★★☆ |

Empire (TSX:EMP.A) | 2.20% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.44% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

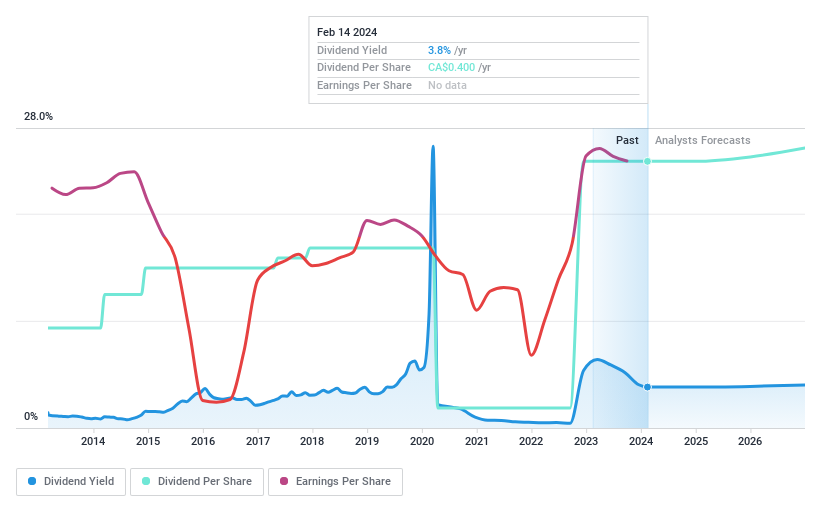

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. is a company that specializes in waste management and energy infrastructure primarily across Canada and the United States, with a market capitalization of approximately CA$3.24 billion.

Operations: Secure Energy Services Inc.'s revenue is derived from three main segments: Oilfield Services contributing CA$399 million, Energy Infrastructure at CA$6.80 billion, and Environmental Waste Management generating CA$1.05 billion.

Dividend Yield: 3.4%

Secure Energy Services recently confirmed a C$0.10 quarterly dividend, aligning with its history of stable payouts. The company's earnings have shown resilience, with net income rising to C$195 million on sales of C$8.24 billion. Notably, SES is optimizing its capital structure by redeeming high-interest debt, enhancing financial flexibility for strategic initiatives and potentially benefiting shareholder returns. However, its dividend yield at 3.44% trails the Canadian market's top payers and SES carries a high debt level despite recent repayments and buybacks totaling C$101 million for 3.49% of shares outstanding.

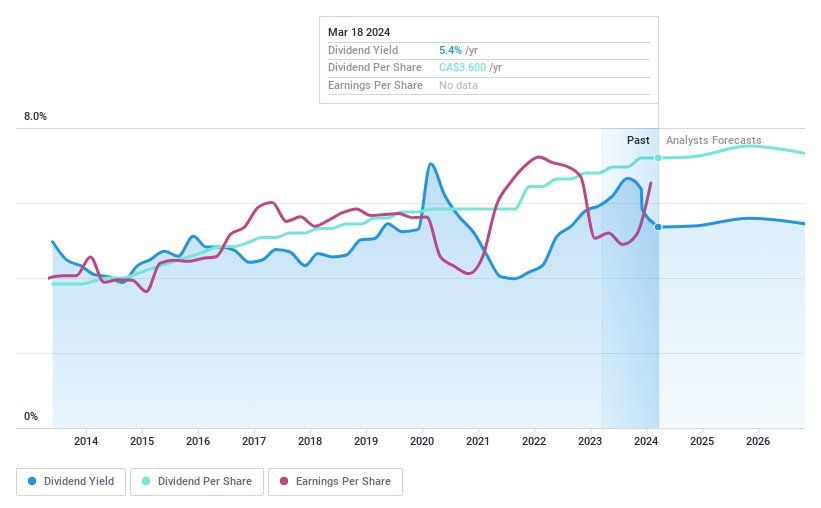

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce (TSX:CM) is a diversified financial institution offering a range of financial products and services to individuals, businesses, public sector entities, and institutional clients across Canada, the United States, and globally, with a market capitalization of approximately CA$62.95 billion.

Operations: Canadian Imperial Bank of Commerce generates its revenues primarily through Canadian Personal and Business Banking (CA$8.49 billion), Canadian Commercial Banking and Wealth Management (CA$5.31 billion), Capital Markets (CA$5.53 billion), and U.S. Commercial Banking and Wealth Management (CA$1.67 billion).

Dividend Yield: 5.4%

Canadian Imperial Bank of Commerce offers a consistent dividend, currently at C$0.90 per share, reflecting a yield of 5.36%, which is modest relative to Canada's top dividend payers. The bank's recent earnings growth of 31.6% bolsters its ability to sustain dividends with a payout ratio of 53.4%. Dividends have been reliable over the past decade, though shareholder dilution occurred in the past year. Amidst leadership changes and fixed-income offerings, CM faces a C$153 million settlement for unpaid overtime but trades at 42.3% below estimated fair value, suggesting potential upside for investors seeking income and value.

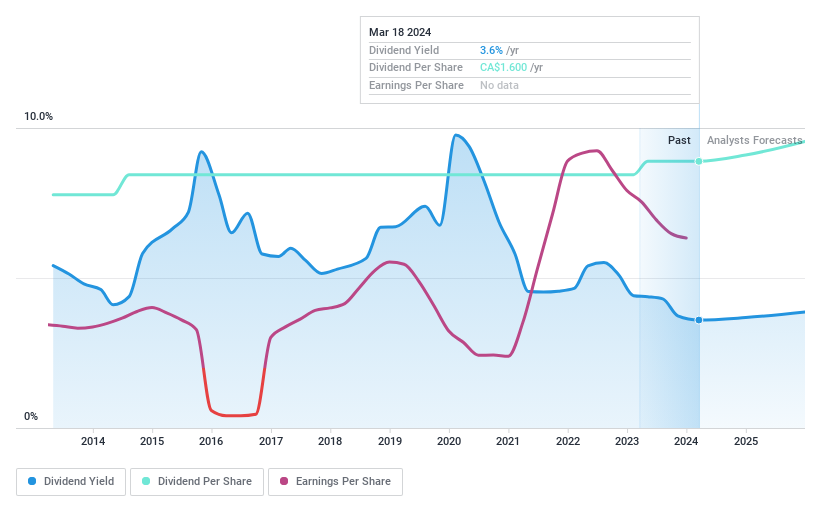

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a Canadian-based metal distribution and processing company with operations in Canada and the United States, boasting a market capitalization of approximately CA$2.68 billion.

Operations: Russel Metals Inc.'s revenue is primarily derived from three segments: Metals Service Centers generating CA$3.03 billion, Energy Field Stores contributing CA$987.2 million, and Steel Distributors accounting for CA$466.3 million.

Dividend Yield: 3.6%

Russel Metals maintains a steady dividend history, with a recent declaration of C$0.40 per share, despite facing a decline in year-over-year earnings and sales for both the fourth quarter and full fiscal year. The company's dividends are comfortably covered by earnings with a payout ratio of 36.5% and by cash flows at 24.8%, indicating sustainability even as projected earnings may drop annually over the next three years. Additionally, Russel Metals trades below its estimated fair value, offering potential value to investors amidst its share repurchase program completion of 1.5% for C$37.3 million.

Take a closer look at Russel Metals' potential here in our dividend report.

Our valuation report here indicates Russel Metals may be undervalued.

Where To Now?

Discover the full array of 21 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com