SecureWorks Corp (SCWX) Reports Fiscal 2024 Earnings: Taegis Drives Growth Amidst Strategic Shifts

Annual Recurring Revenue (ARR): Taegis ARR up 9% year-over-year to $285 million.

Quarterly Revenue: Q4 revenue at $89.2 million, with Taegis revenue climbing 15% to $68.9 million.

Gross Margin Expansion: Q4 GAAP and non-GAAP gross margins for Taegis improved to 70.8% and 73.1%, respectively.

Adjusted EBITDA: Q4 adjusted EBITDA exceeded guidance at $3.8 million, marking a significant turnaround.

Net Loss Improvement: GAAP net loss narrowed to $8.3 million in Q4, from $40 million in the prior year.

Financial Outlook: FY 2025 guidance anticipates revenue between $325 million to $335 million and adjusted EBITDA of $4 million to $12 million.

On March 14, 2024, SecureWorks Corp (NASDAQ:SCWX), a global cybersecurity leader, released its 8-K filing, detailing the financial outcomes for the fourth quarter and full fiscal year 2024, which concluded on February 2, 2024. The company, known for its SaaS solutions, managed solutions, and professional services in cybersecurity, has shown resilience in a challenging market by leveraging its Taegis platform to drive growth and margin expansion.

Performance and Strategic Focus

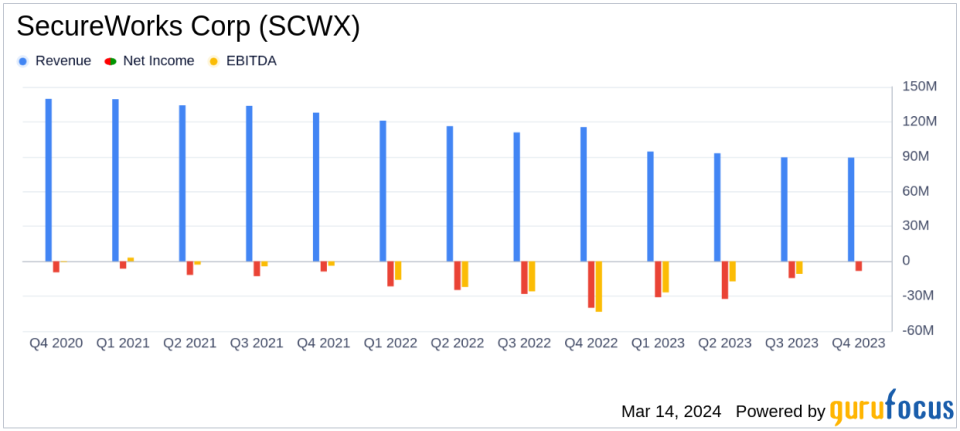

SecureWorks Corp's strategic wind-down of its Other MSS business is reflected in the total revenue for the fourth quarter, which stood at $89.2 million, a decrease from $115.3 million in the same period last year. Despite this, the company's Taegis platform has been a beacon of growth, with its revenue increasing by 15% year-over-year to $68.9 million in the fourth quarter. The company's focus on Taegis is evident as it continues to expand its gross margins, with GAAP and non-GAAP gross margins for Taegis reaching 70.8% and 73.1%, respectively.

Financial Achievements and Challenges

SecureWorks Corp's financial achievements in the fourth quarter are underscored by its adjusted EBITDA of $3.8 million, which not only exceeded its guidance but also represents a significant improvement from the adjusted EBITDA loss of $19.7 million in the same quarter of the previous fiscal year. This achievement is particularly noteworthy for a company in the software industry, where efficient capital allocation and margin improvements are critical for sustainable growth.

However, the company's GAAP net loss of $8.3 million, although an improvement from a net loss of $40 million in the prior year's quarter, highlights the ongoing challenges SecureWorks faces in achieving profitability. The company's strategic shift away from certain businesses may pose short-term revenue headwinds but is expected to strengthen its financial position in the long run.

Key Financial Metrics

SecureWorks Corp's balance sheet ended the fourth quarter with $68.7 million in cash and cash equivalents, with no borrowings on its credit facility. The full-year fiscal 2024 saw total revenue of $365.9 million, down from $463.5 million in fiscal 2023, largely due to the strategic business realignment. The GAAP net loss for the fiscal year was $86.0 million, an improvement from a net loss of $114.5 million in the previous year.

"Our fourth quarter results demonstrated how our unique cloud architecture creates a win-win situation, fueling the delivery of the best security outcomes for our customers with spend predictability, while contributing to our expanding margins," said Alpana Wegner, Chief Financial Officer, Secureworks.

The company's operational efficiency and focus on the high-margin Taegis platform are pivotal in understanding its financial trajectory. SecureWorks Corp's ability to exceed its adjusted EBITDA guidance and improve gross margins are indicators of its strategic progress and operational discipline.

Looking Forward

For fiscal year 2025, SecureWorks Corp anticipates total ARR to exceed $300 million, with revenue projections between $325 million to $335 million. The company's guidance also forecasts a non-GAAP net income ranging from $0 million to $7 million, translating to $0.00 to $0.08 per share, and an adjusted EBITDA of $4 million to $12 million. This forward-looking guidance reflects the company's confidence in its strategic direction and the continued growth of its Taegis platform.

SecureWorks Corp's earnings report and its focus on the Taegis platform underscore the company's commitment to evolving its business model to meet the dynamic demands of the cybersecurity market. The company's strategic decisions and financial results are of keen interest to value investors and potential GuruFocus.com members seeking insights into SecureWorks Corp's future prospects.

Explore the complete 8-K earnings release (here) from SecureWorks Corp for further details.

This article first appeared on GuruFocus.