Seeking Growth? 3 Small-Caps Worth a Look

As many know, small-caps’ volatile nature can sometimes turn investors away.

However, many small-cap stocks turn out to be big winners in the long run, and they typically have less analyst coverage, providing investors an opportunity to get in "early" before the crowd.

For those seeking exposure to small-caps, three stocks – BJ’s Restaurants BJRI, Commercial Vehicle Group CVGI, and LSI Industries LYTS – could all be considered.

All three sport a favorable Zacks Rank, indicating optimism among analysts. Let’s take a closer look at each.

BJ’s Restaurants

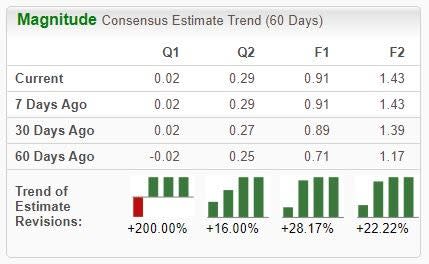

BJ's Restaurants, a current Zacks Rank #1 (Strong Buy), owns and operates a chain of high-end casual dining restaurants in the U.S. Analysts have taken their earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

The company’s earnings are forecasted to soar 430% on 5.5% higher revenues in its current year, likely reflecting effective cost controls. And looking ahead to FY24, estimates allude to a further 57% earnings improvement paired with a 4% sales bump.

Image Source: Zacks Investment Research

BJRI posted a sizable beat in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 50%. In fact, the company has surpassed bottom line expectations by an average of 120% across its last four releases.

Commercial Vehicle Group

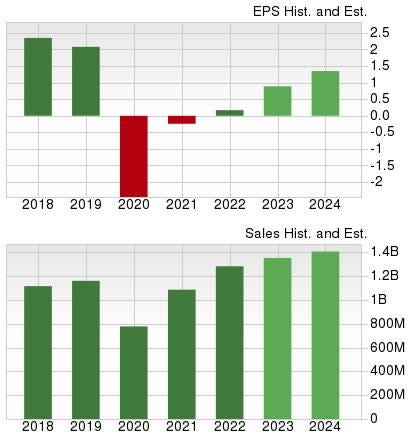

Commercial Vehicle Group supplies interior systems, vision safety solutions, and other cab-related products for the global commercial vehicle market. The stock is a Zacks Rank #2 (Buy), with earnings expectations moving higher across several timeframes.

Image Source: Zacks Investment Research

It’s hard to ignore the company’s growth trajectory, further reflected by its Style Score of “A” for Growth. Earnings are forecasted to witness 100% growth in its current year on 4% higher revenues, with FY24 earnings and revenue expected to improve by 12% and 3%, respectively.

In addition, shares aren’t expensive given the company’s growth, with the current 7.6X forward earnings multiple sitting on the lower end of the spectrum and in line with the five-year median. Shares have traded as high as 17.9X over the last five years.

LSI Industries

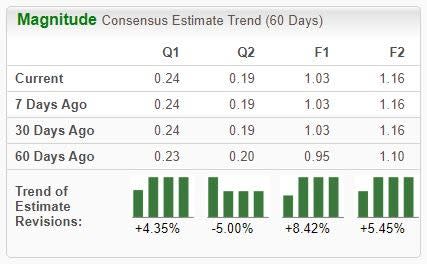

LSI Industries is an Image Solutions company combining integrated design, manufacturing, and technology to supply high-quality lighting fixtures and graphics elements for applications in several markets.

Analysts have raised their current and next year's earnings expectations over the last 60 days, helping land the stock into a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company’s bottom line is forecasted to enjoy nearly 30% growth paired with a 4% sales bump in its current year (FY24), with FY25 earnings and revenue expected to see improvements of 22% and 9%, respectively.

It’s worth noting that LYTS shares saw notable buying pressure following its latest release, moving well higher post-earnings. The company posted a sizable 64% EPS beat paired with a 3.5% revenue surprise, reflecting the seventh consecutive double-beat.

The favorable reaction of LYTS shares post-earnings is illustrated in the chart below by the green arrow circled.

Image Source: Zacks Investment Research

Bottom Line

Small-cap stocks could be solid considerations for those who can handle a higher level of volatility and have a less conservative approach.

While their price swings can undoubtedly become spooky, their growth potential is impressive.

And all three above – BJ’s Restaurants BJRI, Commercial Vehicle Group CVGI, and LSI Industries LYTS – boast strong growth trajectories paired with improved earnings outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Commercial Vehicle Group, Inc. (CVGI) : Free Stock Analysis Report

LSI Industries Inc. (LYTS) : Free Stock Analysis Report