Seeking Income? 3 High-Yield Stocks to Buy

Everybody loves dividends, as they provide a passive income stream and more than one way to reap a return from an investment. In addition, dividend-paying stocks are generally less volatile by nature, another positive benefit.

And for those seeking payouts, three high-yield stocks – USA Compression Partners USAC, Black Stone Minerals BSM, and Kimbell Royalty KRP – could all be considerations. Let’s take a closer look at each.

USA Compression Partners

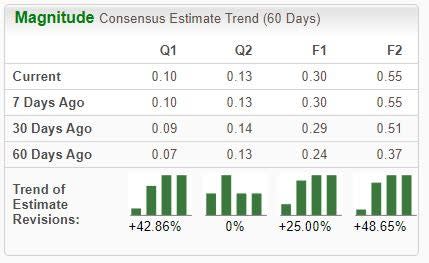

USA Compression Partners is one of the largest independent natural gas compression services providers across the U.S. in terms of fleet horsepower. The stock is a Zacks Rank #1 (Buy), with earnings expectations increasing across nearly all timeframes.

Image Source: Zacks Investment Research

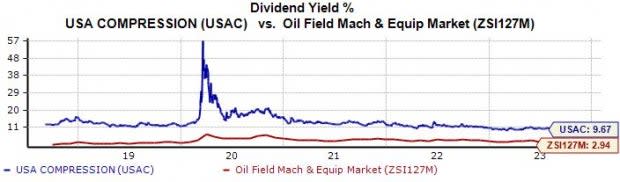

USAC shares currently yield a sizable 9.7% annually, nicely above the respective Zacks industry average of 2.9%.

Image Source: Zacks Investment Research

The company’s growth profile is impossible to ignore, with earnings forecasted to see 260% growth on 18% higher revenues. And peeking ahead to FY24, expectations allude to a further 83% jump in earnings paired with a 6% sales bump.

Black Stone Minerals

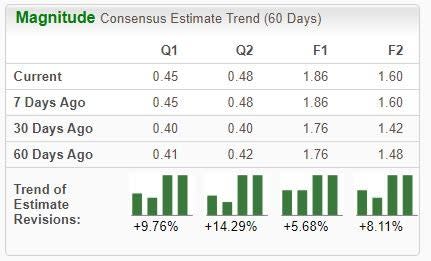

Black Stone Minerals is an owner of oil and natural gas minerals primarily in the United States. The company’s earnings outlook has improved across the board, pushing it into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

BSM shares yield a rock-solid 10.8% annually, well above the respective Zacks industry average. The company has been committed to increasing its payout, carrying a 5.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

It’s worth noting that the company is forecasted to witness a growth slowdown in its current year, with the $1.86 Zacks Consensus EPS Estimate suggesting a 16% pullback in earnings year-over-year.

Kimbell Royalty

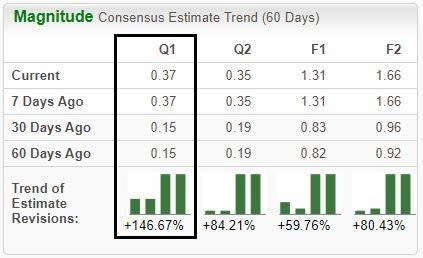

Kimbell Royalty, a current Zacks Rank #1 (Strong Buy), owns and acquires mineral and royalty interests in oil and natural gas properties. The company has seen positive revisions hit the tape across the board, with the revisions trend particularly notable for its upcoming release expected in early November.

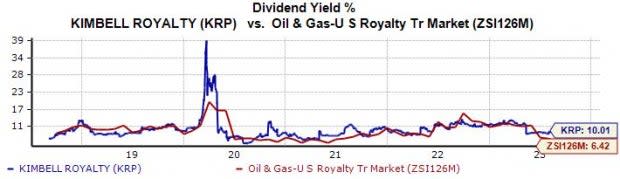

Image Source: Zacks Investment Research

KRP shares yield 10% annually paired with a payout ratio sitting at 84% of the company’s earnings. Impressively, the company has boosted its payout ten times over the last five years, translating to a 3.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

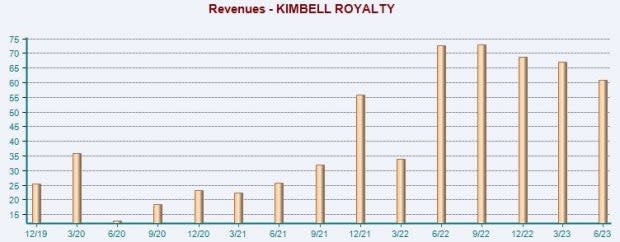

The company has been a standout earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of more than 95% across its last four releases. Just in its latest print, the company penciled in a 91% EPS beat and reported revenue 13% ahead of expectations.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Dividend-paying stocks can allow investors to build a cash pile quickly. After all, isn’t payday the best?

And for those seeking high yields, all three stocks above – USA Compression Partners USAC, Black Stone Minerals BSM, and Kimbell Royalty KRP – precisely fit the criteria currently.

On top of sizable payouts, all three sport a favorable Zacks Rank, indicating bullishness among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Black Stone Minerals, L.P. (BSM) : Free Stock Analysis Report

Kimbell Royalty (KRP) : Free Stock Analysis Report