Seeking at Least 8% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Markets are up this year – the S&P 500 has gained 14% year-to-date, while the NASDAQ is up an even more impressive 30% – and are close to erasing last year’s losses. Along with the market gains, the high inflation that plagued us for over a year, peaking at 9.1% annualized last June, has now subsided to just 4% annualized as of last month. These changes have come hand-in-hand with an improvement in investor sentiment; a positive mood that has been both influenced by and fed into the market gains in a virtuous circle. But Is the horizon darkening for the markets?

Scott Wren, senior global equity strategist from Wells Fargo, is sounding a warning for all who care to listen, saying, “We’re expecting a recession. We’re not expecting the Fed to cut rates, we think earnings estimates are too high. So for us, we want to fade this rally and look to pick up some stocks at lower levels. We’ve been defensive, that’s how we stand right now. We do not want to chase this rally.”

For stock investors, the situation presents a natural move: a shift into defensive equities. The classic defensive play is dividend stocks, especially the high-yield dividend stocks. With their reliable passive income streams, and inflation-beating yields, these stocks present investors with resources to weather a storm.

Wall Street’s top analysts would agree – they have been picking out top dividend stocks for investors to buy, and focusing on div shares that will give yields of at least 8% going forward. Let’s take a closer look.

MPLX LP (MPLX)

We’ll start our look at high-yield div payers with MPLX, a master limited partnership that got its start as the midstream arm of Marathon Petroleum and spun-off as an independent entity in 2011. MPLX now owns and operates an extensive network of midstream energy transport assets, including the parent company’s legacy network and assets acquired since spinning off.

MPXL’s network includes a wide range of assets for the transport, storage, and terminalling of crude oil, natural gas, and natural gas liquids. The company operates a web of pipelines, and its inland marine segment has barges and tugs on the major navigable rivers of North America. Along with the transport assets, MPLX controls various coastal export terminals, oil and gas refineries, tank farms, and other storage facilities.

Its wide range of assets, and its continuing links to the oil giant Marathon, combine to make MPLX one of North America’s largest midstream energy firms. MPLX brought in $2.71 billion in total revenues during 1Q23, a revenue figure that was $110 million ahead of the forecast and up 3.8% year-over-year. The company’s earnings, at 91 cents per share on the bottom line, beat the forecast by 8 cents per share, and were up almost 17% from the year-ago quarter.

Of particular interest to dividend investors, MPLX saw its distributable cash flow grow 5% y/y, to reach $1.27 billion. This total supported a dividend payment of 77.5 cents per common share, or $3.10 per share annualized. At this rate, the dividend gives a high yield of 9.22%.

The combination of growing earnings and a capability to increase an already generous dividend were among the key factors that attracted Truist’s 5-star analyst Neal Dingmann, who wrote, “MPLX did a good job of laying out its strategic plan that focuses on EBITDA growth. In addition to core operation growth that will stem from contractual price escalators, increased tariff rates, among other factors, the company is also factoring in EBITDA generation from its JV’s. However, and understandably so, MPLX does not include the associated debt with these JV’s in their net leverage.”

“Aside from this,” the analyst added, “we believe the company remains on track hitting its annual expectations, as G&P operations in crude-heavy basins continue to remain strong. In addition, we think the company could perhaps look to buyback some shares, but ultimately we think the company’s main capital allocation priority is to tick its distribution rate higher, which is in-line with what we heard on the company’s last earnings call.”

Quantifying his stance, Dingmann gives MPLX stock a Buy rating, with a $40 price target that suggests a ~20% one-year upside potential. Based on the current dividend yield and the expected price appreciation, the stock has 29% potential total return profile. This projection justifies Dingmann’s Buy rating on the stock. (To watch Dingmann’s track record, click here)

All in all, MPLX gets a Moderate Buy from the analyst consensus rating, with recent reviews including 6 Buys, 2 Holds, and 1 Sell. The shares are trading for $33.43 and the average price target of $40 matches Dingmann’s, with its 20% gain predicted for the next 12 months. (See MPLX stock forecast)

Ladder Capital Corporation (LADR)

Next on our list, Ladder Capital, marks a shift in our focus from energy midstream to real estate – specifically, to real estate investment trusts, or REITs. The REITs have long been known for their high dividends; tax regulations require them to pay out a certain percentage of their profits directly to shareholders, and dividends make a convenient mode of compliance.

Ladder, which holds a portfolio worth $5.9 billion, has built its business on a differentiated set of investments. The company got its start in 2008, went public in 2014, and today invests in a combination of investment-grade securities, loans, and real estate, focusing on commercial real estate underwriting and flexible capital solutions. Ladder’s average loan size is $25 million, reflecting the company’s commitment to granularity and diversity in its investments.

Those investments have totaled more than $45 billion over the past 15 years, a figure that includes more than $30 billion in loan origination for properties in 475 cities across 48 states. Ladder has shown a preference for senior secured assets in building this portfolio. The company also owns and operates commercial real estate, especially net leased properties, and its investment grade security investments are typically secured by first mortgage loans on commercial real estate.

Reporting its 1Q23 financial results this past April, Ladder showed total revenues of $74.89 million. This was down 37% y/y, but it beat the forecast by $5.66 million. The company’s bottom line included a distributable (non-GAAP) income of 38 cents per share, up from 31 cents in the previous quarter and 8 cents per share over expectations.

Since these results were released, Ladder has declared its upcoming dividend distribution for 2Q23. The company will pay out 23 cents per common share on July 17. This marks the fourth payment in a row at this level. The annualized rate, of 92 cents per common share, generates a solid yield of 8.67%.

For JMP analyst Steven DeLaney, this stock stands to reap strong benefits from the current interest rate regime, as he explains: “Rising interest rates remain a tailwind to earnings, with the increase in one-month LIBOR in the second quarter alone generating an additional $0.10 per share of annual net interest income (NII)… Ladder remains one of the best-positioned CMREITs to operate in a rising rate environment, in our opinion. While 88% of the loan portfolio carries a floating interest rate, only 48% of Ladder’s debt is floating rate. This mismatch creates an asymmetrical benefit from rising LIBOR/SOFR rates.”

In line with these comments, DeLaney gives LADR an Outperform (i.e. Buy) rating, and his price target, set at $12, implies ~15% upside potential on the one-year time horizon. (To watch DeLaney’s track record, click here)

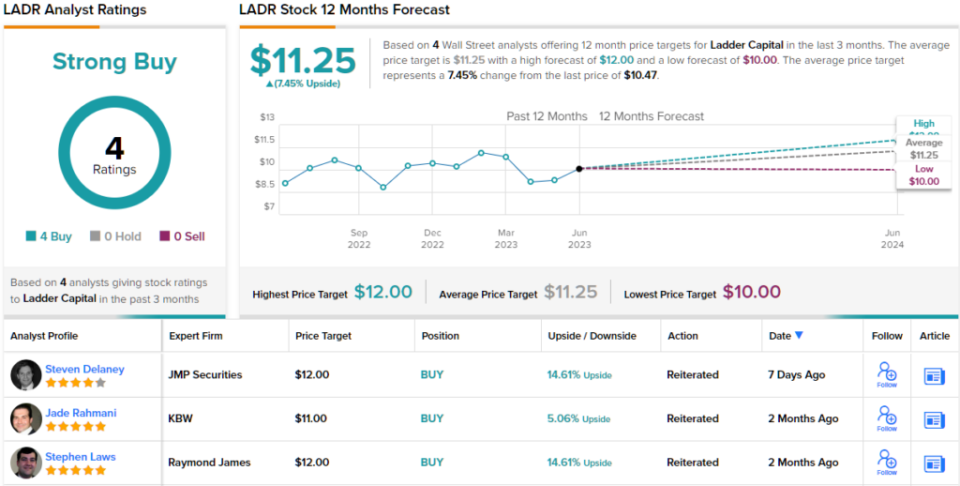

With 4 recent analyst reviews on file, all positive, LADR shares have a unanimous Strong Buy consensus rating from the Street’s analysts. The shares are currently trading for $10.47 and their $11.25 average price target implies an upside of ~7% from current levels. (See LADR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.