SEHK Top Utilities Dividend Paying Stocks

Generally, companies in the utilities sector, such as Asia Satellite Telecommunications Holdings and CITIC Telecom International Holdings, often provide attractive dividend yields due to relatively stable earnings as these are considered defensive sectors that can make money in any economic environment. These businesses, therefore, generate robust cash flows and payout high income to shareholders, making them valuable diversifiers during downturns. If you’re a long term investor, these high-dividend utilities stocks can boost your monthly portfolio income.

Asia Satellite Telecommunications Holdings Limited (SEHK:1135)

1135 has a large dividend yield of 6.55% and pays 37.44% of it’s earnings as dividends . Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. The company has a lower PE ratio than the HK Telecom industry, which interested investors would be happy to see. The company’s PE is currently 6 while the industry is sitting higher at 13.1. Dig deeper into Asia Satellite Telecommunications Holdings here.

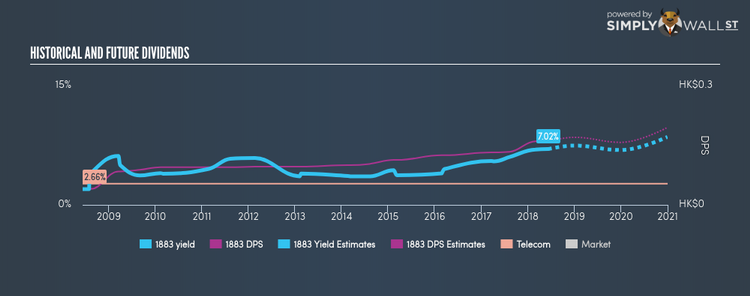

CITIC Telecom International Holdings Limited (SEHK:1883)

1883 has a substantial dividend yield of 7.02% and pays out 64.28% of its profit as dividends . 1883’s DPS have risen to HK$0.16 from HK$0.041 over a 10 year period. The company has been a reliable payer too, not missing a payment during this time. Interested in CITIC Telecom International Holdings? Find out more here.

SmarTone Telecommunications Holdings Limited (SEHK:315)

315 has an appealing dividend yield of 6.91% and their payout ratio stands at 92.30% . Despite some volatility in the yield, DPS has risen in the last 10 years from HK$0.28 to HK$0.60. The company has a lower PE ratio than the Asia Wireless Telecom industry, which interested investors would be happy to see. The company’s PE is currently 15.7 while the industry is sitting higher at 15.7. Continue research on SmarTone Telecommunications Holdings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.