SEI Investments Co Reports Growth Amid Market Volatility in Q4 2023

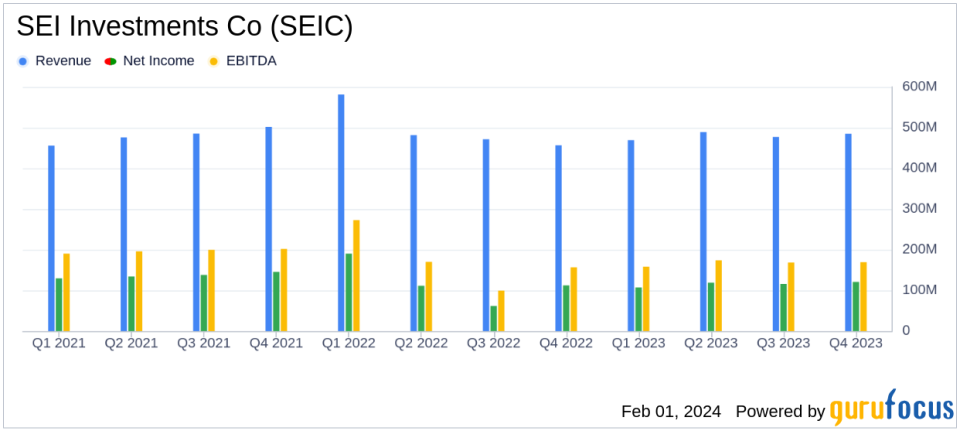

Revenue: Increased by 6% to $484.9 million in Q4 2023 compared to $456.6 million in Q4 2022.

Net Income: Rose by 8% to $120.7 million in Q4 2023 from $112.2 million in Q4 2022.

Diluted Earnings Per Share (EPS): Improved by 10% to $0.91 in Q4 2023, up from $0.83 in Q4 2022.

Assets Under Management (AUM): Average AUM in equity and fixed income programs increased by 3% to $167.4 billion in Q4 2023.

Assets Under Administration (AUA): Average AUA surged by 17% to $923.4 billion in Q4 2023.

Operational Expenses: Increased due to higher personnel costs, competitive labor markets, and inflation impacts.

Share Repurchase: SEIC repurchased 1.2 million shares for $68.9 million at an average price of $58.08 per share in Q4 2023.

On January 31, 2024, SEI Investments Co (NASDAQ:SEIC) released its 8-K filing, revealing its financial results for the fourth quarter of 2023. SEIC, a leading provider of investment processing, management, and operations services, reported a revenue increase and higher net income despite the challenging market conditions throughout the year.

Company Overview

SEI Investments Co operates in four main segments: private banks, investment advisors, institutional investors, and investment managers. With a minority interest in LSV Asset Management, SEIC manages, administers, or advises on over $1.4 trillion in assets as of December 2023. The company's robust technology and investment solutions serve a wide range of financial institutions and professionals.

Financial Performance and Challenges

SEIC's performance in the fourth quarter of 2023 was marked by a 6% increase in revenues to $484.9 million, compared to $456.6 million in the same period last year. Net income also saw an 8% increase to $120.7 million, and diluted EPS grew by 10% to $0.91. These results demonstrate the company's resilience and ability to achieve growth amid variable market conditions.

However, the company faced challenges, including negative cash flows from SEI fund programs in the Investment Advisors segment and client losses in the Institutional Investors segment. Operational expenses also increased due to higher personnel costs and investments in compliance infrastructure. These challenges highlight the importance of managing expenses and adapting to market changes to maintain profitability.

Financial Achievements and Importance

SEIC's financial achievements, such as the increase in average assets under management and administration, underscore the company's strength in attracting and retaining assets despite market volatility. The growth in revenues from assets under management, administration, and distribution fees, particularly from the Investment Managers segment, reflects the company's ability to innovate and offer new products and services that resonate with clients.

Key Financial Metrics

SEIC's balance sheet remains strong, with cash and cash equivalents of $834.7 million as of December 31, 2023. The company's shareholder equity also increased, indicating a solid financial position. The increase in interest and dividend income to $11.6 million in the fourth quarter, primarily due to higher interest rates, further highlights the company's diversified revenue streams.

"Despite variable market conditions throughout the year, we navigated through uncertainty and delivered solid growth and core profitability. Our 2023 results reflect strong sales activityparticularly in our technology, investment processing, and operations segmentsdemonstrating traction in growth segments where we believe SEI has significant opportunity," said CEO Ryan Hicke.

Analysis of Company's Performance

SEIC's performance in the fourth quarter of 2023 reflects a company that is effectively leveraging its diverse offerings to navigate a complex market environment. The company's strategic acquisitions, such as the National Pensions Trust and Altigo, indicate a forward-looking approach to expanding its capabilities and market reach. The repurchase of shares also signals confidence in the company's value proposition and commitment to shareholder returns.

As SEIC continues to focus on strategic growth and operational efficiency, the company appears well-positioned to maintain its momentum and deliver long-term, sustainable growth for its stakeholders.

For more detailed information and to view the full earnings report, please visit SEI Investments Co's 8-K filing.

Explore the complete 8-K earnings release (here) from SEI Investments Co for further details.

This article first appeared on GuruFocus.