SEI Investments (SEIC) Q2 Earnings Beat Estimates, Stock Down

SEI Investments Co.’s SEIC second-quarter 2023 earnings of 89 cents per share beat the Zacks Consensus Estimate of 85 cents. The bottom line reflects a rise of 10% from the prior-year quarter.

Results benefited from higher revenues and an increase in assets under management (AUM) balance. However, rising expenses acted as an undermining factor. Shares of SEIC lost 1.5% in after-hours trading.

Net income was $118.9 million, up 7% from the year-ago quarter. Our estimate for the metric was $110.3 million.

Revenues & AUM Rise, Expenses Increase

Total revenues were $489.1 million, up 2% year over year. The rise was driven by higher asset management, administration and distribution fees, and information processing and software servicing fees. The top line surpassed the Zacks Consensus Estimate of $479.7 million.

Total expenses were $376.5 million, increasing 3%. The rise was due to higher compensation, benefits and other personnel costs; data processing and computer-related expenses; facilities, supplies and other costs; and depreciation costs. Our estimate for expenses was $364 million.

Operating income fell 3% year over year to $112.6 million.

As of Jun 30, 2023, AUM was $418 billion, reflecting a rise of 4%. Our estimate for AUM was $402 billion.

Client assets under administration (AUA) were $877.7 billion, down 3%. Client AUA did not include $11.7 billion related to Funds of Funds assets reported on Jun 30, 2023.

Share Repurchase Update

In the reported quarter, SEI Investments bought back 1.3 million shares for $75.5 million.

Conclusion

Persistently rising expenses are expected to hurt the company’s bottom line to an extent in the near term. SEIC’s increased exposure to fee-based revenues is another major concern. However, its robust AUM balance, global presence and diverse range of product offerings are expected to continue driving growth.

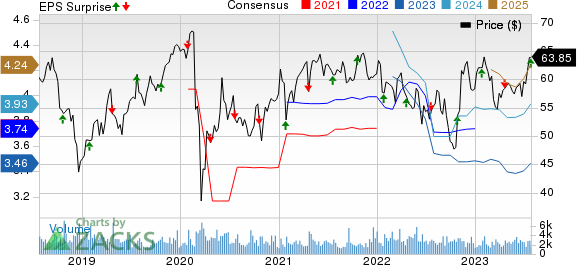

SEI Investments Company Price, Consensus and EPS Surprise

SEI Investments Company price-consensus-eps-surprise-chart | SEI Investments Company Quote

Currently, SEI Investments carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Release Date of Other Asset Managers

BlackRock, Inc.’s BLK second-quarter 2023 adjusted earnings of $9.28 per share handily surpassed the Zacks Consensus Estimate of $8.47. However, the figure reflects an increase of 26% from the year-ago quarter.

BLK’s results have benefited from a decline in expenses and higher non-operating income. Further, AUM balance witnessed improvement. However, lower revenues acted as a headwind.

Invesco’s IVZ second-quarter 2023 adjusted earnings of 31 cents per share lagged the Zacks Consensus Estimate of 40 cents. The bottom line plunged 20.5% from the prior-year quarter.

Results have been hurt by a rise in operating expenses and lower revenues. Nevertheless, an increase in AUM balance aided IVZ’s results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report