Select Medical Holdings Corp (SEM) Reports Strong Q4 and Full-Year 2023 Earnings Growth

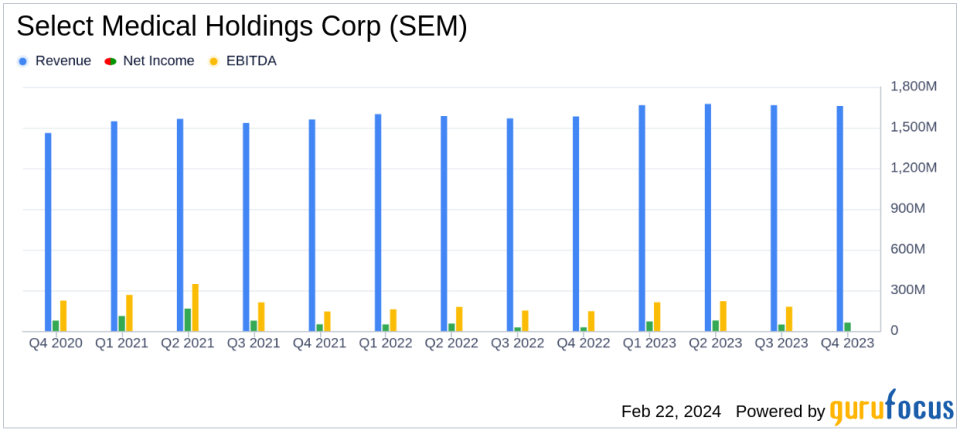

Revenue: Q4 revenue rose 4.9% to $1.66 billion; full-year revenue up 5.2% to $6.66 billion.

Net Income: Q4 net income surged 63.9% to $61.8 million; full-year net income increased 51.4% to $299.7 million.

Earnings Per Share (EPS): Q4 EPS jumped 63.6% to $0.36; full-year EPS climbed 54.9% to $1.91.

Adjusted EBITDA: Q4 Adjusted EBITDA grew 20.9% to $180.1 million; full-year Adjusted EBITDA up 24.8% to $807.4 million.

Dividend: Board declared a cash dividend of $0.125 per share, payable on or about March 13, 2024.

Stock Repurchase: Authorized a common stock repurchase program up to $1.0 billion, to be in effect until December 31, 2025.

2024 Outlook: Revenue expected to be between $6.9 billion and $7.1 billion, with Adjusted EBITDA between $830 million and $880 million.

Select Medical Holdings Corp (NYSE:SEM) released its 8-K filing on February 22, 2024, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading healthcare provider operating critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and Concentra institutions, reported a significant increase in revenue and net income for both the quarter and the year.

Financial Performance and Challenges

The company's fourth-quarter revenue increased by 4.9% to $1.66 billion, while full-year revenue saw a 5.2% increase to $6.66 billion compared to the previous year. This growth reflects the company's ability to expand its services and maintain a strong presence in the healthcare sector. Net income for the fourth quarter rose by a remarkable 63.9% to $61.8 million, and full-year net income increased by 51.4% to $299.7 million. The substantial growth in net income is indicative of SEM's operational efficiency and strategic initiatives that have positively impacted its bottom line.

Adjusted EBITDA, a key metric that reflects the company's earnings before interest, taxes, depreciation, and amortization, adjusted for certain items, increased by 20.9% to $180.1 million for the fourth quarter and by 24.8% to $807.4 million for the full year. This metric is crucial for investors as it provides a clearer picture of the company's operational performance and cash-generating ability.

Financial Achievements and Industry Significance

SEM's financial achievements, including the increase in earnings per common share (EPS) by 63.6% to $0.36 for the fourth quarter and by 54.9% to $1.91 for the full year, are significant for the company and the healthcare industry. These improvements demonstrate SEM's ability to enhance shareholder value and underscore its competitive position in the market.

The declaration of a cash dividend of $0.125 per share signals confidence in the company's financial stability and commitment to returning value to shareholders. Additionally, the authorization of a $1.0 billion stock repurchase program until December 31, 2025, emphasizes the company's strong cash flow and its proactive approach to capital allocation.

Analysis of Company's Performance

SEM's performance in 2023 was marked by robust growth across its segments. The critical illness recovery hospital segment saw a revenue increase of 0.9% to $567.1 million in Q4, with a significant jump in Adjusted EBITDA of 29.4% to $57.4 million. The rehabilitation hospital segment's revenue grew by 9.4% to $260.2 million, and its Adjusted EBITDA increased by 18.4% to $66.3 million in Q4. The outpatient rehabilitation segment reported a 6.1% increase in revenue to $298.2 million and a 40.9% increase in Adjusted EBITDA to $22.5 million. Lastly, the Concentra segment's revenue rose by 6.2% to $440.7 million, with Adjusted EBITDA growing by 9.7% to $68.3 million.

Looking ahead, SEM has provided a positive business outlook for 2024, with expected revenue in the range of $6.9 billion to $7.1 billion and Adjusted EBITDA between $830 million and $880 million. This outlook reflects the company's anticipation of continued growth and operational success.

Overall, Select Medical Holdings Corp's strong financial results and optimistic outlook for 2024 position the company as a solid investment opportunity for value investors interested in the healthcare sector. The company's ability to navigate industry challenges and capitalize on growth opportunities is evident in its impressive financial metrics and strategic initiatives.

Explore the complete 8-K earnings release (here) from Select Medical Holdings Corp for further details.

This article first appeared on GuruFocus.