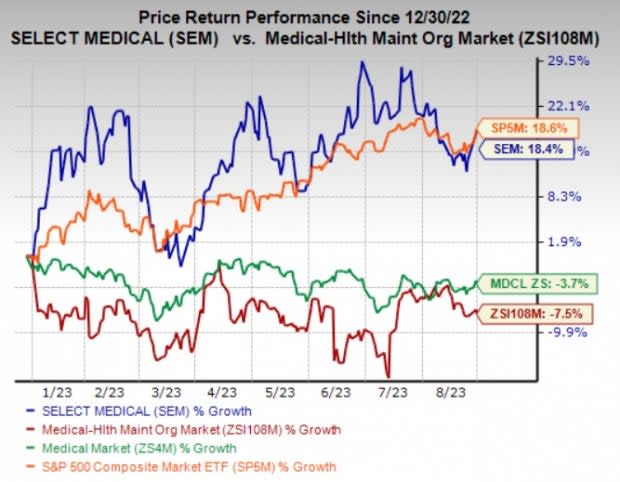

Select Medical (SEM) Up 18% Year to Date: More Room to Run?

Shares of Select Medical Holdings Corporation SEM have gained 18.4% year to date against the industry’s 7.5% decline. The Medical sector fell 3.7% but the S&P 500 composite index rose 18.6% in the same time frame. With a market capitalization of $3.7 billion, the average volume of shares traded in the last three months was 0.5 million.

Image Source: Zacks Investment Research

Expanded patient volumes, joint ventures (JVs) with healthcare entities and a commendable financial position continue to drive Select Medical.

The expected long-term earnings growth rate of SEM is pegged at 23.4%, better than the industry’s average of 15.2%.

Can SEM Retain the Momentum?

The Zacks Consensus Estimate for Select Medical’s 2023 earnings is pegged at $1.93 per share, which implies a 56.9% surge from the 2022 reported figure. The same for revenues stands at $6.6 billion, suggesting 4.2% growth from the year-ago figure. It has witnessed one upward estimate revision compared to none for 2023 earnings over the past 30 days.

The consensus estimate for 2024 earnings is pegged at $2.40 per share, which indicates a rise of 24.7% from the 2023 estimate. The same for revenues stands at $6.8 billion, hinting at 3.6% growth from the 2023 estimate.

Select Medical’s revenues continue to benefit on the back of growing patient admissions. An aging U.S. population belonging to a medically vulnerable population may sustain the solid demand for SEM’s healthcare facilities in the days ahead.

The dire need for effective rehabilitation services, which equip individuals recovering from chronic illness and injuries to resume daily life activities, is likely to provide SEM an opportunity to capitalize on through its rehabilitation hospitals. Management anticipates revenues to be within $6.55-$6.7 billion in 2023, the midpoint of which indicates an improvement of 4.7% from the 2022 figure.

Select Medical pursues an impressive growth strategy of acquiring healthcare facilities or entering into JVs with several U.S. healthcare providers. Such initiatives expand its capabilities and subsequently, upgrade its healthcare portfolio. This year, SEM purchased Vibra Hospital of Richmond to provide enhanced critical illness recovery care across Virginia while it entered into a JV with Lutheran Health Network of Indiana to provide critical illness recovery care and inpatient rehabilitation across Indiana.

Growth-related initiatives are also a means for the Zacks Rank #2 (Buy) leading U.S. healthcare facility operator to expand its geographical presence and delve deeper into regions grappling with inadequate care access. Its care network encompassed 108 critical illness recovery hospitals, 32 rehabilitation hospitals and 1,944 outpatient rehabilitation clinics spread across 39 states and the District of Columbia as of Jun 30, 2023.

To pursue such interrupted growth-related initiatives, a sound financial position is of dire need. Expanding cash reserves and solid cash-generating abilities of Select Medical are testaments to the same. It generated operating cash flows of $286.3 million in the first half of 2023, which surged 60.8% year over year.

Select Medical boasts an impressive VGM Score of A. VGM Score helps identify stocks with the most attractive value, the best growth and the most promising momentum.

Other Stocks to Consider

Some other top-ranked stocks in the Medical space are Medpace Holdings, Inc. MEDP, IRadimed Corporation IRMD and Surgery Partners, Inc. SGRY, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 22.28%. The consensus estimate for MEDP’s 2023 earnings suggests 15.3% growth, while the same for revenues indicates growth of 27.8% from the respective year-ago reported figures.

The consensus estimate for MEDP’s 2023 earnings has moved 2.1% north in the past seven days. Shares of Medpace have gained 28.5% year to date.

IRadimed’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.83%. The consensus estimate for IRMD’s 2023 earnings indicates a rise of 26.4%, while the same for revenues suggests an improvement of 22% from the corresponding year-ago reported estimates.

The consensus estimate for IRMD’s 2023 earnings has moved 6.1% north in the past seven days. Shares of IRadimed have soared 71.3% year to date.

Surgery Partners’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the mark once, the average surprise being 269.64%. The consensus estimate for SGRY’s 2023 earnings is pegged at 71 cents share, which indicates a more than four-fold increase from the prior-year reported figure. The same for revenues indicates growth of 8.7% from the year-ago reported figure.

The Zacks Consensus Estimate for SGRY’s 2023 earnings has moved 31.5% north in the past 30 days. Shares of Surgery Partners have rallied 30.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

iRadimed Corporation (IRMD) : Free Stock Analysis Report

Surgery Partners, Inc. (SGRY) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report