Select Medical (SEM) Q4 Earnings Beat on Patient Admissions

Select Medical Holdings Corporation SEM reported fourth-quarter 2023 adjusted earnings of 36 cents per share, which surpassed the Zacks Consensus Estimate by 16.1%. The bottom line soared 63.6% year over year.

Net operating revenues amounted to $1.7 billion, which advanced 4.9% year over year. The metric beat the consensus mark by 3%.

The quarterly results benefited on the back of growth in patient days and admissions at the Critical Illness Recovery Hospital and Rehabilitation Hospital segments. Meanwhile, a higher number of patient visits aided the performance of Outpatient Rehabilitation and Concentra units. However, the upside was partly offset by an elevated expense level.

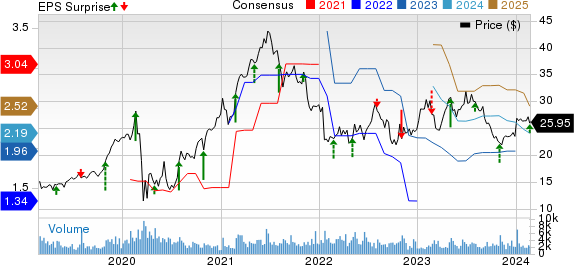

Select Medical Holdings Corporation Price, Consensus and EPS Surprise

Select Medical Holdings Corporation price-consensus-eps-surprise-chart | Select Medical Holdings Corporation Quote

Q4 Performance

Total costs and expenses increased 3% year over year to $1.55 billion in the quarter under review, higher than our estimate of $1.51 billion. The increase was due to escalating costs of services, exclusive of depreciation and amortization, and rising general and administrative expenses.

Adjusted EBITDA of $180.1 million rose 20.9% year over year and also outpaced the Zacks Consensus Estimate of $177.4 million.

Segmental Update

Critical Illness Recovery Hospital

Revenues of the segment amounted to $567.1 million in the fourth quarter, which inched up 0.9% year over year and beat the consensus mark of $566 million and our estimate of $566.1 million. The unit benefited from a 4.6% year-over-year increase in revenue per patient day, partly offset by declines of 3.5% and 1.6%, in patient days and admissions, respectively.

Adjusted EBITDA of $57.4 million climbed 29.4% year over year but fell short of the Zacks Consensus Estimate of $58 million and our estimate of $58.3 million. Adjusted EBITDA margin improved 220 basis points (bps) year over year to 10.1%.

Rehabilitation Hospital

The segment’s revenues improved 9.4% year over year to $260.2 million in the quarter under review. The figure outpaced the consensus mark of $241 million. Year-over-year increases of 8.9% and 6.6%, respectively, in admissions and patient days contributed to the strong performance of the unit.

Adjusted EBITDA of $66.3 million rose 18.4% year over year and beat the Zacks Consensus Estimate and our estimate of $53 million. Adjusted EBITDA margin improved 190 bps year over year to 25.5%.

Outpatient Rehabilitation

Revenues amounted to $298.2 million in the segment, which grew 6.1% year over year in the fourth quarter and surpassed the consensus mark of $286 million. The improvement can be attributed to an 11% rise in patient visits, partially offset by a 2% decline in revenue per visit.

Adjusted EBITDA of $22.5 million surged 40.9% year over year but missed the Zacks Consensus Estimate and our estimate of $25.2 million. Adjusted EBITDA margin improved 180 bps year over year to 7.5%.

Concentra

The segment reported revenues of $440.7 million, which advanced 6.2% year over year and outpaced the consensus mark of $433 million and our estimate of $433.4 million. A year-over-year increase of 1.2% in visits coupled with 5.4% growth in revenue per visit benefited the unit’s results.

Adjusted EBITDA improved 9.7% year over year to $68.3 million in the quarter under review but lagged the Zacks Consensus Estimate of $83 million. Adjusted EBITDA margin of 15.5% improved 50 bps year over year.

Financial Position (as of Dec 31, 2023)

Select Medical exited the fourth quarter with cash and cash equivalents of $84 million, which declined 14.2% from the 2022-end figure. It had $434.2 million left under its revolving facility as of Dec 31, 2023.

Total assets of $7.7 billion inched up 0.3% from the level at 2022 end.

Long-term debt, net of the current portion, amounted to $3.6 billion, down 6.5% from the figure as of Dec 31, 2022.

Total equity of $1.5 billion rose 14.1% from the 2022-end figure.

Select Medical generated cash flow from operations of $179.4 million in the reported quarter, which increased more than 14-fold year over year.

Share Repurchase & Dividend Update

Select Medical did not buy back shares in 2023 under the $1 billion authorized share repurchase program, which is set to expire on Dec 31, 2025.

On Feb 13, 2024, management approved a cash dividend of 12.5 cents per share, which will be paid out on or about Mar 13, 2024, to shareholders of record as of Mar 1, 2024.

2024 Outlook Unveiled

Management anticipates revenues between $6.9 billion and $7.1 billion, the mid-point of which suggests 4.5% growth from the 2023 reported figure of $6.7 billion.

Adjusted EBITDA is forecast between $830 million and $880 million for 2024, the mid-point of which implies a 5.9% rise from the 2023 reported figure of $807.4 million.

Earnings per share (EPS) are estimated between $1.88 and $2.18, the mid-point of which indicates an improvement of 6.3% from the 2023 reported figure of $1.91.

Zacks Rank

Select Medical currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported fourth-quarter 2023 results so far, the bottom-line results of Zimmer Biomet Holdings, Inc. ZBH, Centene Corporation CNC and Intuitive Surgical, Inc. ISRG beat the Zacks Consensus Estimate.

Zimmer Biomet posted fourth-quarter 2023 adjusted EPS of $2.20, exceeding the Zacks Consensus Estimate by 2.3%. The adjusted figure increased 17% year over year. Fourth-quarter net sales of $1.94 billion increased 6.3% (up 6.1% at constant exchange rate or CER) year over year. The figure beat the Zacks Consensus Estimate by 0.5%. During the fourth quarter, sales generated in the United States totaled $1.13 billion (up 4.4% year over year), while International sales grossed $811.9 million (up 8.7% year over year at CER).

Sales in the Knees unit improved 5.6% year over year at CER to $798.3 million. Revenues in the S.E.T. unit were up 6.4% year over year at CER to $453.3 million. Other revenues increased 15.9% to $183.7 million at CER in the fourth quarter. Adjusted gross margin, after excluding the impact of intangible asset amortization, was 72.2%, reflecting an expansion of 74 bps in the fourth quarter. The adjusted operating margin of ZBH expanded 342 bps to 29.2% in the quarter.

Centene’s fourth-quarter 2023 adjusted EPS of 45 cents beat the Zacks Consensus Estimate by 4.7%. The bottom line declined 47.7% year over year. Revenues amounted to $39.5 billion, which improved 11% year over year. The top line outpaced the consensus mark by 9.6%. Revenues from Medicaid declined 1% year over year to $21.1 billion, while Medicare revenues fell 3% year over year to $5.3 billion. Meanwhile, commercial revenues jumped 68% year over year to $7.4 billion.

Premiums of Centene improved 7.4% year over year to $34.2 billion. CNC’s total membership was almost 27.5 million as of Dec 31, 2023, which increased 1.5% year over year but lagged our estimate of 27.8 million. The Health Benefits Ratio of 89.5% for the fourth quarter of 2023 was higher than the year-ago period’s 88.7%. It reported adjusted net earnings of $240 million, which declined from $485 million a year ago. Adjusted SG&A expense ratio increased to 9.7% in the fourth quarter from 9.3% a year ago.

Intuitive Surgical reported fourth-quarter 2023 adjusted EPS of $1.60, which beat the Zacks Consensus Estimate of $1.47 by 8.8%. The bottom line improved 30% year over year. It reported revenues of $1.93 billion, up 17% from the year-ago quarter’s recorded number. The top line also beat the consensus estimate by 3.2%. Revenues from the Instruments & Accessories segment totaled $1.14 billion, indicating a year-over-year improvement of 21.6%. The Systems segment’s revenues totaled $480.2 million, up 15.6% year over year. Intuitive Surgical shipped 415 da Vinci Surgical Systems compared with 369 in the year-ago quarter.

Revenues in the Systems and Services segments improved 5.6% and 3.9%, respectively, from their corresponding year-ago quarter’s level. Adjusted gross profit was $1.31 billion, up 16.1% year over year. As a percentage of revenues, the gross margin was 68%, down approximately 20 bps from the year-ago quarter’s figure. As a percentage of revenues, the operating margin was 35.8%, up approximately 20 bps from the year-ago quarter’s figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report