Select Medical (SEM) Q4 Earnings Miss Estimates, Revenues Up

Select Medical Holdings Corporation SEM reported fourth-quarter adjusted earnings of 22 cents per share, which missed the Zacks Consensus Estimate by 33.3%. The bottom line plunged 40.5% year over year.

Net operating revenues of $1,581.5 millioninched up 1.4% year over year in the quarter under review. But the top line missed the consensus mark by 2.4%.

Lower profits in the Outpatient Rehabilitation and Concentra segments coupled with higher costs and expenses affected its fourth-quarter earnings. However, the negatives were partially offset by improved admissions and occupancy rates in the Rehabilitation Hospital unit. Increased profitability in the Critical Illness Recovery Hospital business also provided some respite.

Total costs and expenses inched 0.5% year over year to $1,499.7 million.

Adjusted EBITDA came in at $148.9 million, which increased 7.6% year over year in the fourth quarter.

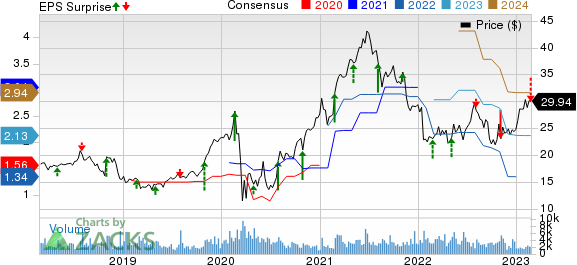

Select Medical Holdings Corporation Price, Consensus and EPS Surprise

Select Medical Holdings Corporation price-consensus-eps-surprise-chart | Select Medical Holdings Corporation Quote

Segmental Update

Critical Illness Recovery Hospital

The segment’s operating revenues of $561.9 million declined2.7% year over year due to a 5.2% decline in admissions, an 1.4% fall in occupancy rate and a 2.4% fall in patient days within the segment. Adjusted EBITDA of $44.3 million skyrocketed 80.5% year over year.

Rehabilitation Hospital

Revenues of $237.9 million improved 9.9% year over year in the segment,courtesy of 4.3% growth in patient days, a 6.3% rise in admissions and a 2.4% jump in occupancy rate. Adjusted EBITDA increased 42.5% year over year to $56 million in the quarter under review.

Outpatient Rehabilitation

The segment reported operating revenues of $281.1 million in the fourth quarter, up 1.3% year over year.The increase can be attributed to a 2.8% increase in visits. Adjusted EBITDA of $15.9 million plunged 42.2% year over year.

Concentra

Operating revenues of the segment amounted to $415 million, which rose 1.1% year over year.However, patient visits fell 0.9% year over year. Adjusted EBITDA declined 12% year over year to $62.2 million in the quarter under review.

Financial Position (as of Dec 31, 2022)

Select Medical exited the fourth quarter with cash and cash equivalents of $97.9 million,which climbed from the 2021-end level of $74.3 million. Total assets of $7,665.3 million increased from $7,360.2 million at 2021-end.

SEM had $148.5 million left under its revolving facility at 2022-end.

Long-term debt, net of the current portion, increased to $3,835.2 million from 2021-end of $3,556.4 million.

Total equity of $1,356.6 million rose from the $1,325.9 million figure in 2021-end.

Net cash provided by operating activities declined to $284.8 million in 2022 from $401.2 million a year ago.

Share Repurchase & Dividend Update

Select Medical bought back shares worth $185.1 million in 2022. It has authorized a buyback program with $1 billion in funds, which is expected to terminate on Dec 31, 2023.

On Feb 16, 2023, management sanctioned a cash dividend of 12.5 cents per share. The dividend will be paid out on Mar 15, 2023, to its shareholders of record as of Mar 3, 2023.

Full-Year Highlights

Earnings per share in 2022 was $1.23 compared with $2.98 in the prior year.

The revenue figure for 2022 rose to $6,333.5 million compared with $6,204.5 million at 2021-end.

Adjusted EBITDA was $646.9 million, much lower than $947.4 million at 2021-end.

2023 Business Outlook

The company expects revenues to be within the range of $6.5-$6.7 billion in 2023.

Zacks Rank

Select Medical currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Medical sector players that have reported fourth-quarter results so far are Elevance Health Inc. ELV, HCA Healthcare, Inc. HCA and AMN Healthcare Services, Inc. AMN. Let’s see how they have performed.

Elevance Health’s fourth-quarter 2022 earnings of $5.23 per share beat the Zacks Consensus Estimate of $5.20 by 0.6%. Additionally, the bottom line advanced 1.8% year over year. ELV’s operating revenues improved 10.1% year over year to $39,667 million in the quarter under review. The top line missed the consensus mark by a whisker. Medical membership of Elevance Health as of Dec 31, 2022, totaled 47.5 million, which rose 4.8% year over year in the fourth quarter. Premiums of $33,646 million rose 9.4% year over year.

HCA Healthcare reported fourth-quarter 2022 adjusted earnings of $4.64 per share, missing the Zacks Consensus Estimate by 3.1%. However, the bottom line advanced 5% year over year. Revenues of HCA improved 2.9% year over year to $15.5 billion in the fourth quarter and missed the consensus mark by a whisker. Same-facility equivalent admissions rose 5.4% year over year in the fourth quarter, and same-facility admissions grew 2.9% year over year.

AMN Healthcare Services reported fourth-quarter 2022 adjusted earnings of $2.48 per share, beating the Zacks Consensus Estimate by 14.3%. However, the bottom line declined 15.9% year over year. The top line surpassed the Zacks Consensus Estimate by 5.8% but declined 17.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report