Select Medical (SEM) Stock Down 6.6% Despite Q3 Earnings Beat

Select Medical Holdings Corporation SEM shares have declined 6.6% since it reported third-quarter 2023 results on Nov 2. Although it reported strong third-quarter results on the back of the Rehabilitation Hospital and Concentra segments’ strength, the positives were partially offset by rising costs and expenses. Also, it revised its adjusted earnings outlook to exclude the actual tax-effected loss on early retirement of debt, marginally lowering the range.

It reported third-quarter 2023 adjusted earnings of 46 cents per share, which beat the Zacks Consensus Estimate by 21.1%. The bottom line jumped from 21 cents per share a year ago.

Net operating revenues improved 6.2% year over year to $1.7 billion in the quarter under review. The metric beat the consensus mark by 4.6%.

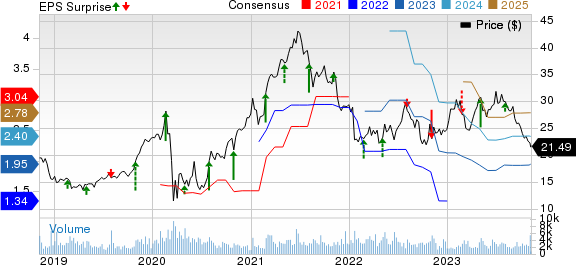

Select Medical Holdings Corporation Price, Consensus and EPS Surprise

Select Medical Holdings Corporation price-consensus-eps-surprise-chart | Select Medical Holdings Corporation Quote

Q3 Performance

Total costs and expenses of $1.54 billion increased 3.5% year over year in the third quarter and came higher than our estimate of $1.48 billion. The increase was due to the elevated cost of services, exclusive of depreciation and amortization, coupled with higher general and administrative expenses.

Adjusted EBITDA advanced 26.6% year over year to $193.8 million, higher than our estimate of $181.5 million.

Segmental Update

Critical Illness Recovery Hospital

The segment reported revenues of $563.6 million in the third quarter, which improved 7.4% year over year and outpaced our estimate of $538.6 million. The growth came on the back of an 11.6% rise in revenues per patient days in the segment.

Adjusted EBITDA increased more than three-fold year over year to $46.4 million but missed our estimate. Adjusted EBITDA margin of 8.2% improved 610 basis points (bps) year over year in the quarter under review.

Rehabilitation Hospital

The segment’s revenues of $247.1 million grew 7.7% year over year and surpassed our estimate of $233.6 million. The improvement can be attributed to 4.3% growth in admissions and 2.8% increase in patient days.

Adjusted EBITDA came in at $53.6 million, which advanced 7.7% year over year in the third quarter and beat our estimate of $51.2 million. Adjusted EBITDA margin remained flat at 21.7%.

Outpatient Rehabilitation

Revenues of the segment amounted to $291.8 million in the quarter under review, which rose 2.4% year over year but remained below our estimate of $297.5 million. The growth stemmed from a 9.3% rise in patient visits, partially offset by a 2.9% decline in revenue per visit.

Adjusted EBITDA increased 2.5% year over year to $26.3 million but came higher than our estimate of $25.9 million. Adjusted EBITDA margin of 9% remained flat compared with a year ago.

Concentra

The segment recorded revenues of $474 million in the third quarter, which improved 6.6% year over year and beat our estimate by 9.4%. A year-over-year increase of 0.2% in visits, along with a 6.3% rise in revenue per visit, drove the unit’s results.

Adjusted EBITDA rose 9.9% year over year to $98.9 million, higher than our estimate of $86.9 million. Adjusted EBITDA margin of 20.9% improved 70 bps year over year.

Financial Position (as of Sep 30, 2023)

Select Medical exited the third quarter with cash and cash equivalents of $77.4 million, which increased from $97.9 million at 2022 end. Total assets of $7.7 billion inched up 0.2% from the 2022-end level.

Select Medical had $374.2 million left under its revolving facility as of Sep 30, 2023.

Long-term debt, net of current portion, amounted to $3.7 billion, which decreased from the $3.8 billion figure as of Dec 31, 2022.

Total equity of $1.5 billion grew from the $1.4 billion figure at 2022 end.

Select Medical generated cash flow from operations of $116.3 million in the reported quarter, which climbed from $94.3 million a year ago.

Share Repurchase & Dividend Update

In the third quarter, the company did not buy back shares pursuant to the new $1 billion authorized share repurchase program, which is set to expire on Dec 31, 2025.

On Nov 2, 2023, management approved a cash dividend of 12.5 cents per share, which will be paid out on Nov 28, 2023, to its shareholders of record as of Nov 15.

2023 Outlook

Management reaffirms the revenue guidance of $6.55-$6.7 billion. The midpoint of the revised outlook indicates an improvement of 4.7% from the 2022 figure.

Adjusted EBITDA is estimated between $795 million and $825 million in 2023. The midpoint of the updated guidance implies 25.2% growth from the 2022 figure. The company now forecasts adjusted earnings per share within $1.85-$2.02 for this year.

Zacks Rank & Key Picks

Select Medical currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Medical space are Acadia Healthcare Company, Inc. ACHC, Centene Corporation CNC and Molina Healthcare, Inc. MOH, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Acadia Healthcare’s current-year earnings implies a 13% increase from the year-ago reported figure. The consensus mark for its current year revenues indicates 10.8% growth from a year ago. ACHC beat earnings estimates in two of the last four quarters, met once and missed on one occasion, with an average surprise of 2.8%.

The Zacks Consensus Estimate for Centene’s 2023 earnings indicates a 14.4% year-over-year increase to $6.61 per share. It has witnessed six upward estimate revisions over the past 30 days against no movement in the opposite direction. The consensus mark for SEM’s 2023 revenues indicates 4.6% growth from a year ago.

The Zacks Consensus Estimate for Molina Healthcare’s 2023 bottom line is pegged at $20.83 per share, suggesting 16.2% year-over-year growth. It beat earnings estimates in all the last four quarters, with an average surprise of 7.5%. The consensus mark for MOH’s current year revenues indicates 4.2% growth from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report