Selective Insurance Group Inc (SIGI) Reports Strong Q4 and Full-Year 2023 Results

Net Premiums Written (NPW): Increased by 17% in Q4 and 16% for the full year.

GAAP Combined Ratio: Improved to 93.7% in Q4, 1-point better than the previous year.

Net Investment Income: Grew by 20% in Q4 and 33% for the full year.

Book Value Per Common Share: Rose to $45.42, an 18% increase over the last quarter.

Non-GAAP Operating ROE: Achieved 18.2% in Q4 and 14.4% for the full year, marking the 10th consecutive year of double-digit performance.

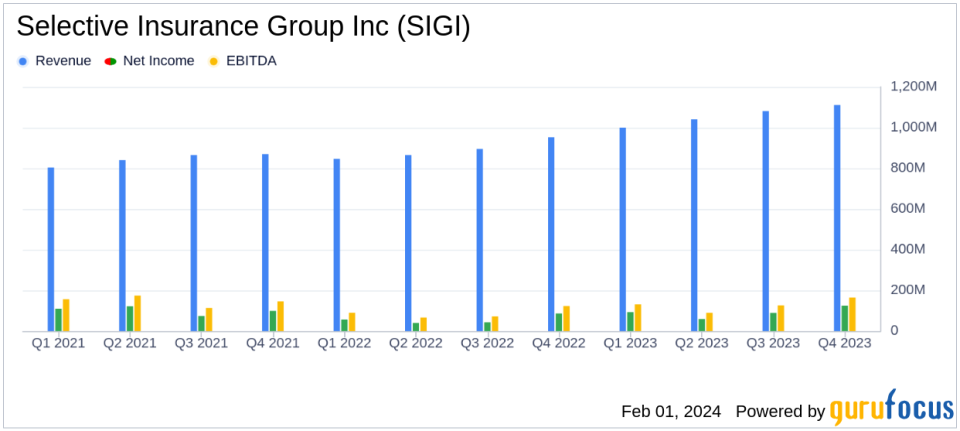

On January 31, 2024, Selective Insurance Group Inc (NASDAQ:SIGI) released its 8-K filing, disclosing robust financial results for the fourth quarter and full year ended December 31, 2023. The company, a regional property-casualty insurer, reported significant growth in net premiums written and a solid combined ratio, reflecting disciplined underwriting and effective management of its insurance portfolio.

Selective Insurance Group Inc, based in New Jersey, operates primarily in the New York metropolitan area. Since 1977, the company has been catering to small businesses, offering a range of commercial products such as workers' compensation, general liability, property, and auto insurance. It also provides personal insurance, including auto and homeowner's coverage, though this segment accounts for less than 20% of total premiums.

Financial Performance Highlights

The company's net income per diluted common share stood at $2.01, with non-GAAP operating income per share at $1.94. The GAAP combined ratio, a key measure of underwriting profitability, improved to 93.7%, reflecting a 1-point improvement from the fourth quarter of 2022. The growth in net premiums written by 17% in the fourth quarter and 16% for the full year was a testament to the company's strong top-line growth across all insurance segments.

After-tax net investment income saw a notable increase of 20% in the fourth quarter, amounting to $78 million, and a 33% increase for the full year, reaching $310 million. This growth in investment income contributed significantly to the company's non-GAAP operating return on equity (ROE), which stood at 18.2% for the quarter and 14.4% for the full year, surpassing the 12% target and marking a decade of double-digit operating ROE.

Challenges and Strategic Focus

Despite the positive results, Selective Insurance Group Inc faces challenges in an environment characterized by elevated and uncertain loss trends. The company remains committed to disciplined underwriting to consistently achieve its 95% combined ratio target. Notably, the Standard Commercial Lines and Excess & Surplus Lines, which represent approximately 90% of NPW, are performing at or better than the combined ratio target and are experiencing excellent top-line growth.

John J. Marchioni, Chairman, President, and CEO of Selective, emphasized the company's focus on transitioning to the mass affluent market and implementing aggressive profit improvement plans, particularly in the Standard Personal Lines segment. He also highlighted the company's consistent ROE over the past decade and the strategic initiatives that have contributed to the doubling of NPW and book value per share.

Investment and Balance Sheet Strength

The Investments segment played a crucial role in the company's financial achievements, with after-tax net investment income increasing due to higher interest rates, active portfolio management, and strategic cash flow deployment. The segment contributed 12.4 points to the non-GAAP operating ROE in 2023.

On the balance sheet, total assets grew by 9% to $11.8 billion, with total investments up by 11%. Book value per common share increased by 18% to $45.42, driven by net income and a reduction in after-tax net unrealized losses on the fixed income securities portfolio. The company's financial strength was further underscored by an 18% increase in common stockholders' equity and a debt-to-total capitalization ratio that improved by 2 points.

Selective Insurance Group Inc's financial stability and strategic initiatives position it well for continued success in 2024. The company's guidance for the upcoming year includes a GAAP combined ratio of 95.5%, after-tax net investment income of $360 million, and an effective tax rate of approximately 21%.

For a more detailed analysis of Selective Insurance Group Inc's financial results and strategic outlook, investors and interested parties are encouraged to review the supplemental investor package available on the company's website and to join the upcoming quarterly analyst conference call.

Value investors looking for a company with a strong track record of growth and profitability may find Selective Insurance Group Inc an appealing option. The company's consistent performance, disciplined underwriting, and strategic focus on profitable segments suggest a robust outlook for the future.

Explore the complete 8-K earnings release (here) from Selective Insurance Group Inc for further details.

This article first appeared on GuruFocus.