SelectQuote Inc (SLQT) Reports Revenue Growth and Raises FY2024 Guidance

Revenue: $405.4 million, a significant increase from the previous year's quarter.

Net Income: Reported at $19.4 million, slightly down from the same quarter last year.

Adjusted EBITDA: $67.4 million, showing improvement over the prior year.

Fiscal Year 2024 Guidance: Revenue expectations raised to $1.23 billion - $1.3 billion.

Senior Segment: Strong performance with $247.5 million in revenue and 234,576 approved Medicare Advantage policies.

Healthcare Services: Over 62,000 SelectRx members, surpassing full-year expectations.

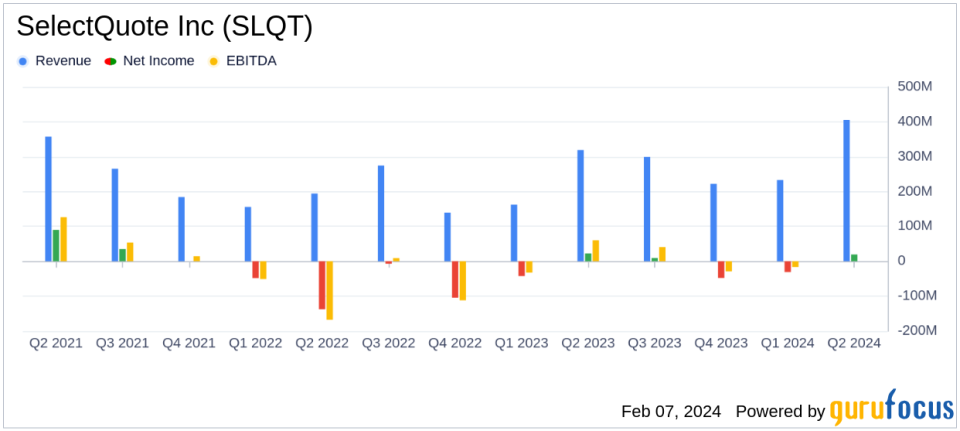

On February 7, 2024, SelectQuote Inc (NYSE:SLQT) released its 8-K filing, announcing its earnings for the second quarter of fiscal year 2024. The company, a leading Direct-to-consumer (DTC) distribution platform for insurance products, reported a revenue of $405.4 million, marking a notable increase from $319.2 million in the same quarter of the previous fiscal year. Despite a slight decrease in net income from $22.5 million to $19.4 million year-over-year, the company's Adjusted EBITDA improved to $67.4 million from $63.6 million.

Performance Highlights and Challenges

SelectQuote's performance this quarter reflects the company's robust growth strategy and operational efficiency, particularly within its Senior segment, which saw an 11% increase in revenue to $247.5 million. The company's CEO, Tim Danker, highlighted the eighth consecutive quarter of performance exceeding expectations and expressed confidence in the strategy for predictable and cash-efficient growth. However, the slight decline in net income indicates challenges in maintaining profitability amidst growth investments.

The company's Senior segment, which includes Medicare Advantage policies, showed strong results with a double-digit revenue increase and an Adjusted EBITDA margin of 32%. The Healthcare Services segment, particularly the SelectRx business, also exceeded expectations with a member count surpassing 62,000, contributing to a 101% revenue increase year-over-year for the segment.

Financial Achievements and Industry Significance

The company's financial achievements, such as the raised guidance for fiscal year 2024, are significant indicators of its strong position in the insurance industry. The upward revision of revenue expectations to a range of $1.23 billion to $1.3 billion, from the prior range of $1.05 billion to $1.2 billion, underscores SelectQuote's ability to capitalize on market opportunities and scale its operations effectively.

Moreover, the company's anticipation of approaching positive free cash flow in fiscal 2024 is a testament to its operational efficiency and strategic focus on cash generation. These financial milestones are crucial for SelectQuote as they demonstrate the company's potential for sustainable growth and profitability in the competitive insurance market.

Analysis of Financial Statements

Reviewing the detailed financial statements, SelectQuote's balance sheet and cash flow statements reflect a company that is managing its growth with a keen eye on financial health. The company's ability to increase revenue while managing expenses is indicative of a disciplined approach to scaling its business. The focus on cash flow is particularly important for value investors who look for companies that can generate and sustain positive cash flows over time.

While the company expects a net loss for the fiscal year, the reduced range of expected net loss from $50 million to $22 million to $45 million to $22 million suggests that management is effectively controlling costs and improving operational efficiency. This is further supported by the increase in Adjusted EBITDA guidance, which is a key metric for assessing a company's operating performance.

"The second quarter marked SelectQuotes eighth consecutive quarter of performance ahead of expectations, and we remain confident that our strategy to prioritize predictable and cash efficient growth will continue to generate value for both our customers and shareholders," said CEO Tim Danker.

Overall, SelectQuote's second quarter fiscal 2024 results demonstrate the company's ability to navigate a complex insurance market while delivering value to its customers and shareholders. The raised guidance for the fiscal year is a positive sign for investors, and the company's focus on segments like Senior and Healthcare Services is yielding tangible results. As SelectQuote continues to execute on its strategic initiatives, it remains a company to watch in the insurance sector.

For more detailed information and analysis on SelectQuote Inc (NYSE:SLQT)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from SelectQuote Inc for further details.

This article first appeared on GuruFocus.