Selling Detroit Lions Thanksgiving Day tickets? New IRS rules could trigger tax bill.

The Detroit Lions are one hot ticket, maybe not Taylor Swift smoking hot, but a roaring fire nonetheless. And tickets for the Thanksgiving Day game against the Green Bay Packers are no exception with some tickets priced from $300 to $350 each at Ticketmaster a week before Thanksgiving.

But here's a cautionary tax tip to discuss as you drown those mashed potatoes in gravy: Anyone who resells their Lions tickets at a big gain now needs to be prepared to get hit with a tax bill on their 2023 tax return.

The Internal Revenue Service is bound to find out, thanks to some new tax rules.

Not the same old Lions, not the same old tax rules

George Smith, a CPA with Andrews Hooper Pavlik in Bloomfield Hills, has had Lions season tickets for decades so he knows, perhaps too well, that it hasn't always been this way for the Detroit Lions.

Given that these aren't the same old Lions — and attending a football game on Thanksgiving can create some family tension — Smith decided to take his chances and try to sell his three tickets for the Green Bay game back in October.

"This team is hyped up," he thought then, "let's see what's out there."

He went on NFL.com — which offers the NFL Ticket Exchange through Ticketmaster — to sell his three tickets; each cost him roughly $55.

He easily sold them for $315 each or $945 total.

He's going to be paying taxes on a roughly $780 profit when he files his 2023 federal income tax return next year.

"I'm surprised at the market that's out there, but I guess I shouldn't be surprised for a pro football team," Smith said.

Like most accountants and tax professionals, he's well aware of the new rules relating to 1099-K forms. The rules were supposed to go into place last year for items sold in 2022. The 1099s would have been issued in early 2023 but was delayed.

A new $600 threshold — with no minimum number of transactions — was set in the American Rescue Plan of 2021 as a way to encourage compliance for gig workers and others. Even a single resale of a hot concert ticket or game ticket can trigger the form, if the gross sale price is large enough.

While workers should report their income, experts say, much taxable income falls through the cracks and goes unreported now in cases where there isn't a 1099.

But the transition was delayed a year after tax professionals and others sounded the alarm bells, saying the tax season was heading for mass confusion if the IRS went ahead with plans that would have flooded mailboxes early this year with 1099-K forms.

On Dec. 23, 2022, the IRS announced that it would delay implementing the rollout of extra 1099-K paperwork for one year.

"Everyone was in a hoopla a year ago but it's been out of sight, out of mind" for a while, Smith said.

Some might not realize that the new 1099 reporting rules are off the bench and back in the game.

"I'm sure a lot of other people are going to be shocked when they get that 1099-K from Ticketmaster," he said. "And they're going to have to go through the math to figure out how to report this correctly."

Who will get a 1099-K?

Tougher tax reporting standards, which will now apply to transactions beginning in 2023, will greatly expand how many 1099-Ks are issued next year to those who make extra money in the gig economy — or reselling tickets to concerts, National Basketball Association games, National Football League games and other big events.

Casual online sellers are looking at receiving a 1099-K, too. But the new third-party tax reporting rule doesn't apply to gifts or other money transfers to family and friends on payment networks, including Venmo, PayPal, and Cash App, are not considered "payments for goods and services."

Companies, such as Ticketmaster and StubHub, are now required send out a 1099-K to taxpayers who received more than $600 when selling tickets in 2023. If you're selling at a loss, you're not going to owe taxes. But if you sold a $475 ticket to a Swiftie fan for $1,500 you're looking at a profit.

StubHub notes online: "Beginning Jan. 1, 2023, the IRS has updated its 1099-K regulations to require all businesses that process payments to file a 1099-K for all sellers with more than $600 in gross sales in a calendar year."

StubHub is requiring sellers to supply their Taxpayer Identification Number, which is often either a Social Security Number or an Employer Identification Number for businesses. StubHub said payment will be withheld from sellers until TIN information is provided.

StubHub is going to mail the 1099-K at the beginning of the year. Duplicate information will be sent to the IRS and state tax agencies.

Ticketmaster also provides information online relating to the 1099-K form. For any tax year when a Form 1099-K is required, Ticketmaster notes that it will typically provide a copy of the form by Jan. 31 of the following year.

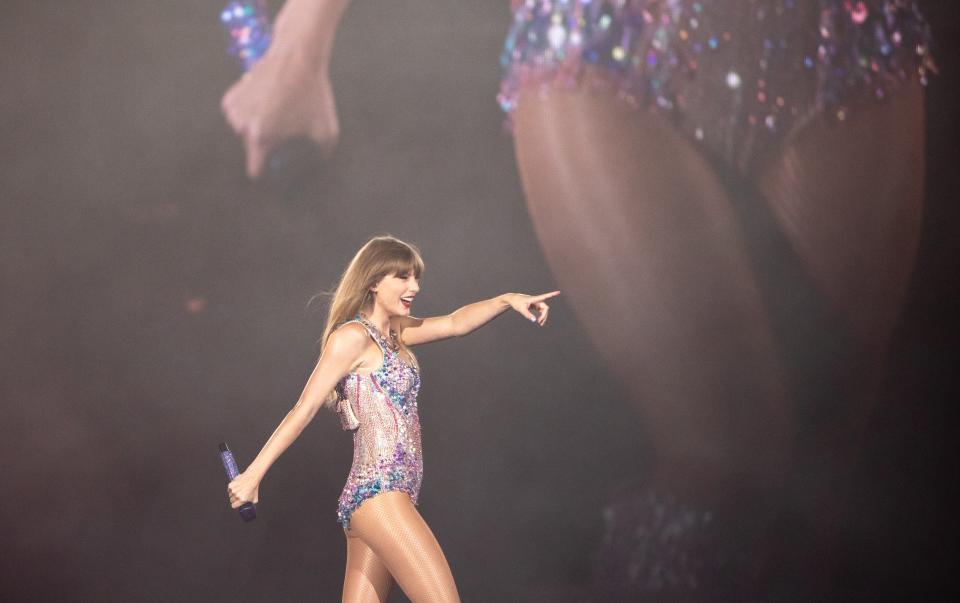

The shift in tax rules hits in a calendar year that was packed with blockbuster events, which inflated prices on ticket resale platforms. Taylor Swift brought her Eras Tour extravaganza to Ford Field on June 9 and June 10. Beyoncé dazzled a sold-out Ford Field on July 26. The nonprofit Tax Foundation even published a blog on "Tax Karma for Ticket Scalpers" relating to the astronomical markups that re-sellers were asking across the country for Taylor Swift tickets.

And now we have the Lions.

Prices soar for Thanksgiving Day Detroit Lions tickets

The Detroit-Green Bay Thanksgiving Day game is the "best-selling game of the Lions' entire season," according to StubHub, outselling the popular Las Vegas Raiders-Detroit Lions game earlier this season on a Monday night by 10%.

The Thanksgiving Day game at Ford Field is the second best-selling game of all games in Week 12 of the season, according to a StubHub spokesperson, behind the Washington Commanders-Dallas Cowboys Thanksgiving Day game.

The average resale ticket price for the Lions game on Thanksgiving was around $369 each in mid-November, according to StubHub. But fans were able to find tickets starting at $278 each. A bit more than 2,000 tickets were available for that game on StubHub in mid-November.

When you sell a few tickets here and there, you might not expect to see a 1099, but you easily could during the tax season next year after some sky-high ticket prices.

Before the rule change, 1099-K paperwork was only sent to those who had received more than $20,000 and had more than 200 transactions in a year, including reselling tickets, via a digital wallet or payment apps.

The IRS estimates that the new, significantly lower threshold will trigger an extra 28 million 1099-Ks being issued in 2024 for reporting on 2023 tax returns. The IRS said its current estimate is based on "information provided by a few large filers and some states who had enacted a similar reduction in the filing threshold." The IRS expects to update the numbers as more information becomes available in 2024.

We're looking a flood of tax paperwork ahead.

About 44 million 1099-K forms will be issued in 2024 covering tax year 2023, up 175% from 16 million in 2022, according to IRS estimates.

This year, some groups — including the American Institute of CPAs — have supported House and Senate legislation that would raise the reporting threshold.

Bipartisan Senate legislation, known as the Red Tape Reduction Act, would establish a $10,000 reporting threshold, instead of the $600.

Reselling tickets for more than you paid for them has always counted as taxable income. The new threshold for paperwork will make it easier for the IRS to spot those sales and collect taxes on the profits.

Smith said it will be important for secondhand ticket sellers to document what they paid for them and keep careful records. The 1099-K will show how much you received when you sold the tickets. But you faced a cost when you bought them. So if an average fan buys 10 tickets for $100 each but then resells them for $600, you wouldn't report a profit. You also couldn't deduct a loss.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X (Twitter) @tompor.

This article originally appeared on Detroit Free Press: Detroit Lions Thanksgiving tickets: Selling could trigger tax bill