ON Semiconductor Corp (ON) Reports Record Automotive Revenue Growth in 2023

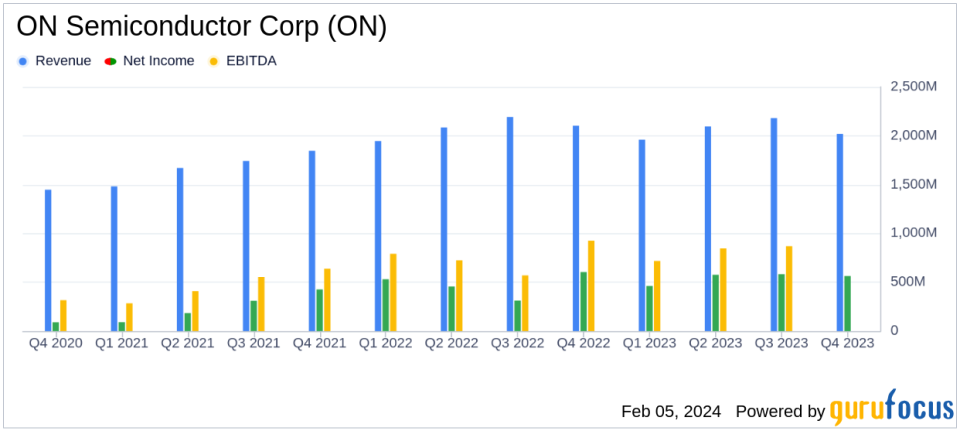

Revenue: Full year revenue slightly decreased by 1% year-over-year to $8,253.0 million.

Net Income: GAAP net income for 2023 increased to $2,183.7 million from $1,902.2 million in 2022.

Earnings Per Share: Diluted earnings per share rose to $4.89 in 2023, up from $4.25 in the previous year.

Gross Margin: Gross margin for 2023 was 47.1%, a decrease from 49.0% in 2022.

Automotive Revenue: Record automotive revenue in 2023, with a 29% increase year-over-year.

Outlook: Q1 2024 revenue is projected to be between $1,800 to $1,900 million with a gross margin of 44.5% to 46.5% on a non-GAAP basis.

On February 5, 2024, ON Semiconductor Corp (NASDAQ:ON) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading supplier of power semiconductors and sensors, primarily serving the automotive and industrial markets, has reported a record year for its automotive revenue, which surged by 29% compared to the previous year. This growth is particularly significant as it underscores ON Semiconductor's strategic focus on high-growth areas such as electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

Financial Performance Highlights

ON Semiconductor Corp (NASDAQ:ON) has demonstrated resilience in a challenging market, achieving a GAAP net income of $2,183.7 million for the year, an increase from $1,902.2 million in 2022. The company's diluted earnings per share also saw an uptick, rising to $4.89 in 2023 from $4.25 in the prior year. Despite a slight decrease in full-year revenue, down 1% to $8,253.0 million, the company's focus on operational efficiency and strategic growth areas has borne fruit.

However, the company did face headwinds, with a year-over-year decrease in gross margin from 49.0% in 2022 to 47.1% in 2023. This contraction reflects the competitive and dynamic nature of the semiconductor industry, where pricing pressures and cost management remain critical factors.

Segment Performance and Future Outlook

The Power Solutions Group (PSG) and Intelligent Sensing Group (ISG) segments experienced growth, with PSG increasing by 6% and ISG by 3% year-over-year. Conversely, the Advanced Solutions Group (ASG) saw a decline of 12%. For the first quarter of 2024, ON Semiconductor projects revenue to range between $1,800 to $1,900 million with a non-GAAP gross margin of 44.5% to 46.5%.

President and CEO Hassane El-Khoury expressed confidence in the company's direction, stating,

Our momentum continued this past year as we achieved record automotive revenue and 4x year-over-year growth in silicon carbide revenue. We continue to transform the business by building resilience into our model, enabling us to navigate uncertain market conditions and deliver more predictable and sustainable results,"

highlighting the strategic initiatives driving ON Semiconductor's success.

Investor and Analyst Insights

Investors and analysts may find ON Semiconductor's performance in the automotive sector particularly compelling, as it aligns with global trends towards vehicle electrification and advanced safety features. The company's strategic pivot towards high-growth markets and its upcoming analog and mixed signal platform could position it favorably for future growth.

ON Semiconductor will host a conference call to discuss these results and provide further insights into its strategy and outlook, offering an opportunity for the financial community to delve deeper into the company's performance and future plans.

For detailed financial information, including income statements, balance sheets, and cash flow statements, interested parties are encouraged to review the full 8-K filing.

Value investors and potential GuruFocus.com members can find comprehensive coverage and analysis of ON Semiconductor's earnings and strategic direction on GuruFocus.com, providing valuable insights into the company's financial health and investment potential.

Explore the complete 8-K earnings release (here) from ON Semiconductor Corp for further details.

This article first appeared on GuruFocus.