Semler Scientific Inc (SMLR) Reports Robust Revenue and Net Income Growth in Q4 and Full Year 2023

Revenue Growth: Fourth quarter revenues increased by 9% to $15.1 million, while full year revenues jumped 20% to $68.2 million.

Net Income Surge: Net income for the fourth quarter grew by 31% to $4.2 million, with a full year increase of 44% to $20.6 million.

Customer Base Diversification: The company's reliance on its two largest customers decreased in 2023, indicating a broader customer base.

Cash Position: Semler Scientific's cash balance saw a significant increase, ending the year at $57.3 million.

Operational Efficiency: Despite a $2.5 million write-off for prepaid software licenses, the company maintained profitability and operational efficiency.

On March 5, 2024, Semler Scientific Inc (NASDAQ:SMLR) released its 8-K filing, showcasing a strong financial performance for both the fourth quarter and the full year of 2023. The company, known for its innovative medical products like QuantaFlo for peripheral arterial disease testing, has reported significant growth in revenues and net income, reflecting its successful market strategies and product demand.

Financial Performance Highlights

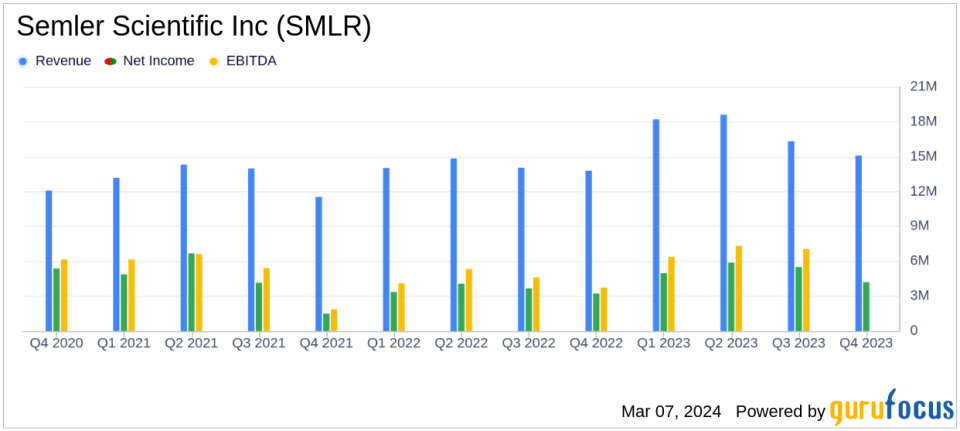

Semler Scientific's financial results for the fourth quarter and full year of 2023 were marked by noteworthy increases in revenue and net income. The fourth quarter revenue rose to $15.1 million, a 9% increase from the previous year, while the full year revenue reached $68.2 million, marking a 20% rise. This growth trajectory is particularly significant for a company in the Medical Devices & Instruments industry, where innovation and market penetration are key drivers of success.

The net income figures were even more impressive, with a 31% increase in the fourth quarter to $4.2 million and a 44% surge for the full year to $20.6 million. These figures not only demonstrate Semler Scientific's ability to grow its top line but also its efficiency in translating revenue into profit, a critical aspect for value investors.

Financial Statements Analysis

Examining the income statement, Semler Scientific managed to keep its operating expenses in check, with a total of $45.9 million for the year, compared to $39.5 million in 2022. The balance sheet reflects a strong financial position, with a notable increase in cash and cash equivalents to $57.2 million, up from $23 million the previous year. This robust cash position provides the company with the flexibility to invest in growth opportunities and innovation.

The cash flow statement further underscores the company's operational efficiency, with net cash provided by operating activities amounting to $21.3 million for the year. This is a substantial increase from the $17.5 million reported in 2022, indicating a healthy cash generation capability.

"We are pleased to report continued growth in year-over-year quarterly and full year revenues and net income, predominately from sales of QuantaFlo for peripheral arterial disease testing," said Doug Murphy-Chutorian, MD, chief executive officer of Semler Scientific. "We remain focused on continuing to market our product while seeking a new 510(k) clearance from the FDA with expanded labeling for use as an aid in the diagnosis of other cardiovascular diseases."

Strategic and Operational Insights

One of the challenges highlighted in the report was the $2.5 million write-off of prepaid software licenses for Insulin Insights. However, this did not significantly impede the company's profitability. Semler Scientific's strategic focus on diversifying its customer base is evident from the reduced revenue concentration from its largest customers, which is a positive move towards reducing dependency and risk.

The company's pursuit of a new 510(k) clearance from the FDA for expanded use of its QuantaFlo product indicates a proactive approach to growth and an effort to capture a larger share of the cardiovascular disease diagnosis market.

In conclusion, Semler Scientific Inc (NASDAQ:SMLR) has demonstrated a strong financial performance in the fourth quarter and full year of 2023, with significant revenue and net income growth. The company's solid cash position and operational efficiency, along with its strategic initiatives, position it well for continued success in the competitive medical devices and instruments industry. Investors and potential GuruFocus.com members will find Semler Scientific's financial resilience and market strategy to be of considerable interest.

For a more detailed analysis and to stay updated on Semler Scientific Inc's financial developments, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Semler Scientific Inc for further details.

This article first appeared on GuruFocus.