Semtech Corp (SMTC) Navigates Market Challenges with Mixed Fiscal Year 2024 Results

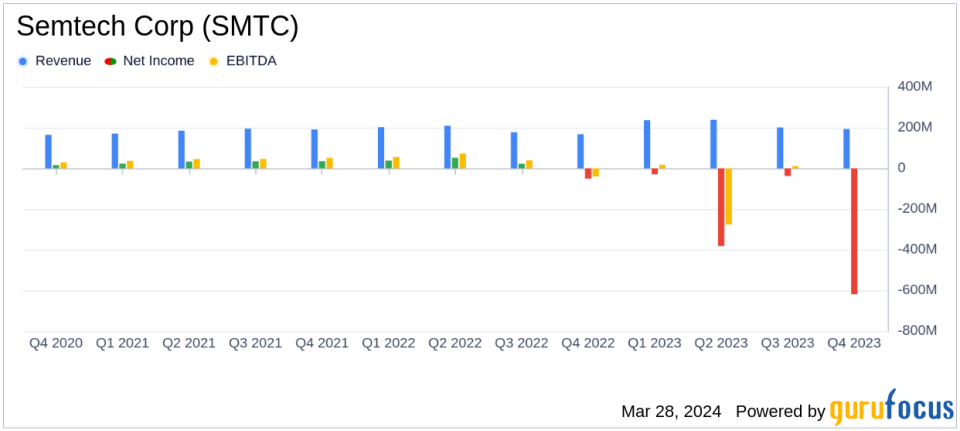

Net Sales: Reported $192.9 million for Q4 and $868.8 million for FY 2024, compared to analyst estimates of $200.5718 million for the quarter.

Gross Margin: GAAP gross margin at (0.2)% for Q4, affected by impairment charges, with Non-GAAP gross margin at 48.9%.

Diluted EPS: GAAP diluted loss per share of $9.98 for Q4, while Non-GAAP diluted loss per share stood at $0.06, aligning with analyst EPS estimates of $0.0199.

Operating Cash Flow: Positive operating cash flow of $13.9 million and free cash flow of $12.2 million for Q4.

Impairment Charges: Goodwill impairment of $755.6 million and intangible impairments of $131.4 million for FY 2024 reflect current market conditions.

Semtech Corp (NASDAQ:SMTC), a leading provider of high-performance semiconductors and advanced algorithms for the IoT, announced its fourth quarter and fiscal year 2024 results on March 28, 2024. The company, which specializes in signal integrity, advanced protection and sensing, and IoT systems, reported net sales of $192.9 million for the fourth quarter, which is below the analyst estimates of $200.5718 million. The company's GAAP gross margin took a significant hit, reporting at (0.2)% for the quarter, primarily due to goodwill and intangible asset impairment charges. However, the Non-GAAP gross margin stood at a healthier 48.9%, indicating underlying business strength. The company's GAAP diluted loss per share was $9.98, while the Non-GAAP diluted loss per share was $0.06, which is in line with the estimated earnings per share of $0.0199 provided by analysts. Semtech's full fiscal year 2024 net sales reached $868.8 million, with a GAAP gross margin of 34.1% and a Non-GAAP gross margin of 49.5%. The company also reported positive operating cash flow and free cash flow for the fourth quarter, at $13.9 million and $12.2 million, respectively. Semtech's financial performance was significantly impacted by goodwill impairment of $755.6 million and intangible impairments of $131.4 million, reflecting the challenges posed by reduced earnings forecasts and the current macroeconomic conditions, including an elevated interest rate environment. To read the detailed 8-K filing, please visit the SEC website.

Financial Performance and Market Position

Despite the challenging market conditions, Semtech's president and CEO, Paul H. Pickle, expressed optimism about the company's positioning for near-term growth trends, particularly in the infrastructure end market. The company's executive vice president and CFO, Mark Lin, highlighted working capital improvements and the completion of an optional principal prepayment on their credit facility as positive financial steps. The implementation of a single ERP system is expected to further enhance operational efficiencies and internal controls.

Looking Ahead

For the first quarter of fiscal year 2025, Semtech anticipates net sales to be around $200 million, with a Non-GAAP gross margin of approximately 49.5%. The company expects to maintain a normalized income tax rate of 12% and projects a diluted earnings per share of $0.00, with potential variability of +/- $0.04. Adjusted EBITDA is forecasted to be $27.8 million, plus or minus $3.0 million.

Semtech's focus on innovation and strategic market positioning, along with its ability to generate positive cash flow, underscores its resilience in navigating the semiconductor industry's cyclical nature and current economic pressures. As the company continues to adapt to market demands and optimize its operations, investors and stakeholders will be watching closely to see how these efforts translate into financial performance in the coming quarters.

For more in-depth analysis and updates on Semtech Corp (NASDAQ:SMTC) and other influential companies in the semiconductor industry, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Semtech Corp for further details.

This article first appeared on GuruFocus.