SenesTech (SNES) Expands in the Netherlands With Q-chem Deal

In a move to revolutionize animal pest population management in the Netherlands, SenesTech, Inc. SNES has inked a pivotal distribution agreement with Q-chem, a prominent pest control product supplier in the region. This partnership marks a significant milestone for SenesTech as it ventures into the European market, poised to introduce its advanced fertility control technology, Evolve, to combat pest infestations, particularly rat populations.

The financial terms of the deal have been kept under wraps.

Strategic Implication of the Deal

SenesTech's collaboration with Q-chem is strategically aligned with the Netherlands' Integrated Pest Control (“IPM”) program, which was initiated four years ago to curb the reliance on anticoagulant rodenticides. With the European Union's stringent regulations aiming to phase out toxic rodenticides, the demand for alternative, environmentally friendly solutions has surged, creating a ripe market for innovative approaches like Evolve.

Navigating Regulatory Landscapes

Evolve offers a non-biocidal, fertility control-based solution, circumventing the arduous regulatory pathways associated with conventional rodenticides. Leveraging Q-chem's expertise, SenesTech navigates the regulatory landscape more efficiently, anticipating registration by the end of 2024 under the Veterinary Product Directive in the Netherlands. This streamlined approval process accelerates market penetration, positioning Evolve as the frontrunner in sustainable pest management.

The distribution agreement with Q-chem encompasses initial orders, annual minimums and regulatory facilitation, enabling SenesTech to scale up its presence in the Netherlands. By capitalizing on Q-chem's extensive distribution network and commitment to eco-friendly solutions, SenesTech anticipates widespread adoption of Evolve, heralding a paradigm shift in animal pest population control across Europe.

Image Source: Zacks Investment Research

Global Market Prospects

Going by an Exactitude Consultancy report, the global pest control market is expected to be worth more than $32.25 billion by 2029, boasting a 5.2% CAGR from 2023 to 2029. Factors such as stringent environmental regulations, government initiatives favoring bio-based pesticides and climate change driving pest expansion are key drivers. Despite challenges like chemical toxicity, R&D efforts toward bio-based insecticides present lucrative opportunities.

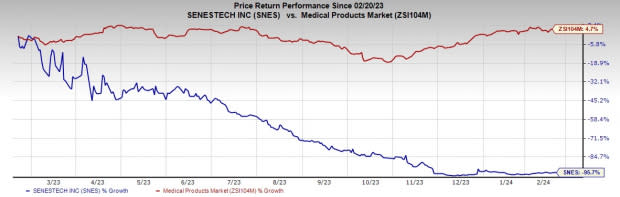

Share Price Performance

Shares of SNES have plunged 95.7% over the past year against the industry's 4.7% growth.

Zacks Rank and Other Key Picks

SenesTech currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space are DaVita DVA, Cardinal Health CAH and Stryker SYK. While DaVita presently sports a Zacks Rank #1 (Strong Buy), Cardinal Health and Stryker carry a Zacks Rank #2 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for DaVita’s 2024 earnings per share have moved up from $8.46 to $8.86 in the past 30 days. Shares of the company have increased 45.6% in the past year compared with the industry’s 7.9% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%. In the last reported quarter, it delivered an earnings surprise of 22.2%.

Cardinal Health’s stock has increased 32.6% in the past year. Earnings estimates for Cardinal Health have risen from $6.90 to $7.17 for fiscal 2024 and from $7.73 to $7.94 for fiscal 2025 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 15.6%. In the last reported quarter, it posted an earnings surprise of 16.7%.

Estimates for Stryker’s 2024 earnings per share have increased from $11.54 to $11.84 in the past 30 days. Shares of the company have moved 32.8% upward in the past year compared with the industry’s rise of 4.9%.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.1%. In the last reported quarter, it delivered an earnings surprise of 5.8%.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Senestech, Inc. (SNES) : Free Stock Analysis Report