Senior Vice President David Clement Sells 2,842 Shares of Vulcan Materials Co (VMC)

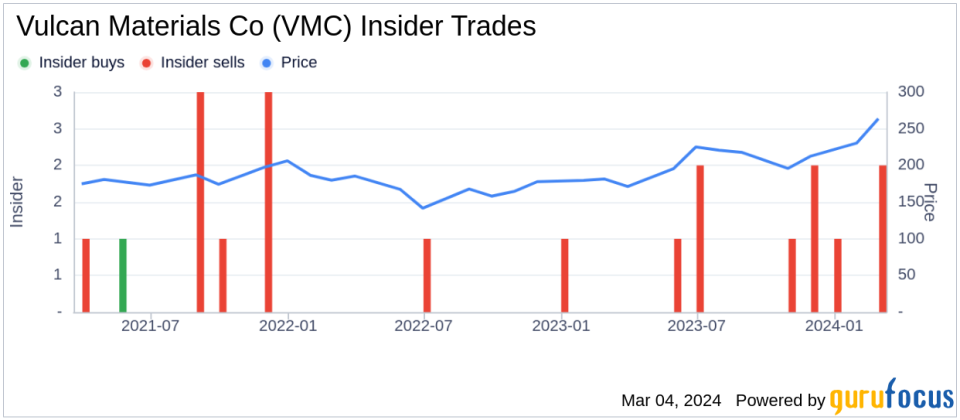

Senior Vice President David Clement has sold 2,842 shares of Vulcan Materials Co (NYSE:VMC) on February 29, 2024, according to a recent SEC filing. The transaction was executed at an average price of $263 per share, resulting in a total sale amount of $747,446.Vulcan Materials Co is a leading producer of construction aggregates, primarily crushed stone, sand, and gravel. The company is also a major producer of aggregates-based construction materials, including asphalt and ready-mixed concrete. With a strong presence in the United States, Vulcan Materials Co plays a critical role in the infrastructure and construction sectors.Over the past year, David Clement has sold a total of 6,759 shares of Vulcan Materials Co and has not made any share purchases. This latest sale continues a trend of insider selling activity at the company, with a total of 10 insider sells and no insider buys occurring over the same timeframe.

The insider transaction history suggests a pattern of insider sales, which may be of interest to investors monitoring insider behaviors.On the valuation front, Vulcan Materials Co's shares were trading at $263 on the day of the insider's recent sale, giving the company a market capitalization of $35.417 billion. The price-earnings ratio stands at 38.37, which is above both the industry median of 16.35 and the company's historical median price-earnings ratio.

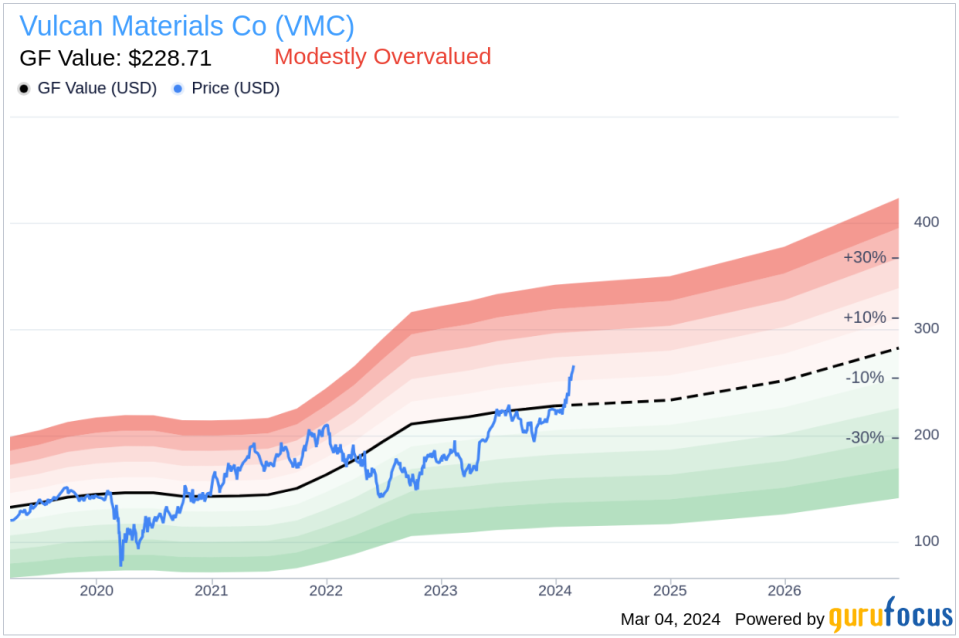

Considering the stock's price of $263 and the GuruFocus Value of $228.71, Vulcan Materials Co has a price-to-GF-Value ratio of 1.15, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.For investors and analysts monitoring Vulcan Materials Co, the insider selling activity, valuation metrics, and GF Value assessment provide data points that may inform their understanding of the company's stock performance and market position.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.