Sensata (ST) Introduces Two New Bidirectional Contactors

Sensata Technologies ST recently introduced Gigavac GTM400 and GTM500 bidirectional contactors for high-power applications, which need dependable switching and DC circuit protection like DC fast charging stations, energy storage systems and heavy-duty vehicles.

Gigavac GTM400 and GTM500 bidirectional contactors for are suited for applications which require up to 1500 Vdc, and 400A and 500A.

The latest introduction is a part of Sensata’s new GTM contactor product line, which boasts glass-to-metal seals (GTMS) technology. GTMS technique is used to create highly-effective electrically-insulative hermetic seal technology, which boost performance and reliability, highlighted Sensata.

Sensata Technologies Holding N.V. Price and Consensus

Sensata Technologies Holding N.V. price-consensus-chart | Sensata Technologies Holding N.V. Quote

These new contactors boast higher current carry capability owing to reduced size and weight, and has increased battery life. Per Sensata, these contactors offer “best-in-class break performance” and feature an advanced arc suppression performance which enhances dependability and product life.

ST further highlighted that new products offer “unmatched short circuit performance” and increased performance/cost ratio when compared with other available similar products.

Sensata is looking to expand the GTM product family for lower power applications such as material handling equipment, 2 and 3-wheeled vehicles and other electric vehicles among others.

Sensata develops, manufactures and sells innovative sensor-based solutions. It has a diversified portfolio of personalized and unique sensor-rich applications, from automotive braking systems to aircraft flight controls that are utilized ubiquitously.

The company’s performance is gaining from continued momentum in Performance Sensing business owing to higher automotive and heavy vehicle off-road revenues. Its automotive sector is winning traction owing to price realization and rapid market growth. Its electrification business is likely to benefit from ongoing demand for renewable power generation.

ST plans to generate about $2 billion in revenues from electrification business by 2026. Frequent product launches and synergies from the acquisition of Dynapower are tailwinds.

However, the company is affected due to a softness in Sensing Solutions business due to weakness in HVAC and appliance markets, and unfavorable foreign currency movement. Rising macroeconomic uncertainty, stiff competition and a leveraged balance sheet are other concerns.

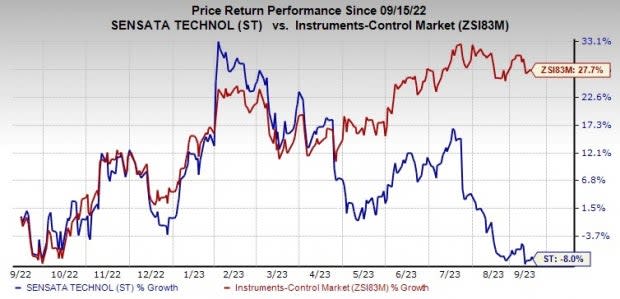

ST currently carries a Zacks Rank #4 (Sell). Shares of the company have lost 8% against the sub-industry’s growth of 27.7% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Badger Meter BMI, Synopsys SNPS and Adobe ADBE. All stocks carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 5.1% in the past 60 days to $2.86. BMI’s earnings beat estimates in the last four quarters, the average surprise being 6.7%. Shares of BMI have surged 72.1% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS is pegged at $11.09, up 2.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.4%.

SNPS’ earnings surpassed estimates in the last four quarters, the average beat being 4.2%. Shares of SNPS have rallied 47.8% in the past year.

The Zacks Consensus Estimate for Adobe’s fiscal 2023 EPS has remained unchanged in the past 60 days at $15.70. ADBE’s earnings outshined estimates in the last four quarters, the average surprise being 3.1%. Shares of ADBE have jumped 78.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Sensata Technologies Holding N.V. (ST) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report