Sensata (ST) Q1 Earnings & Revenues Top Estimates, Up Y/Y

Sensata Technologies Holding plc ST reported strong first-quarter 2023 results, with the top and bottom lines surpassing the Zacks Consensus Estimate.

On an adjusted basis, the company reported earnings of 92 cents per share compared with 78 cents reported in the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate of 88 cents per share.

Quarterly revenues aggregated $998.2 million, up 2.3% year over year. The top line beat the consensus estimate by 1.7%. Acquisitions and unfavorable currency changes reduced revenues by 0.1% and 2.3%, respectively.

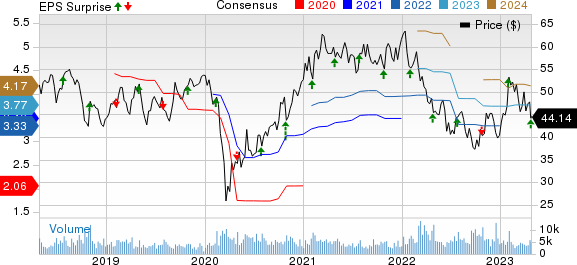

Sensata Technologies Holding N.V. Price, Consensus and EPS Surprise

Sensata Technologies Holding N.V. price-consensus-eps-surprise-chart | Sensata Technologies Holding N.V. Quote

Segmental Results

Performance Sensing revenues (75.3% of the total revenues) increased 4.7% year over year to $751.5 million. The Automotive sector benefited from price realization and strong market growth, partly offset by unfavorable foreign currency movement and launch delays. Segment operating income was $188.4 million compared with $180.6 million reported in the prior-year quarter.

Sensing Solutions revenues (24.7% of total revenues) were $246.7 million, down 4.4% from the year-ago quarter. The year-over-year downtick was caused by softness in HVAC and appliance markets and unfavorable foreign currency movement. The segment’s operating income decreased to $69.7 million from $72.5 million, mainly due to the dilutive impact of acquisitions.

On Apr 1, 2023, the company established a new Insights reporting segment to be consistent with new management reporting and offer visibility to the company’s revenue growth and margin advancement.

The financial results of Insights had previously been included in Performance Sensing. From the second quarter of 2023, Sensata will begin disclosing the financial results of its three segments - Performance Sensing, Sensing Solutions and Insights.

Other Details

In the quarter under review, overall organic revenues were up 4.7%. The heavy vehicle off-road business witnessed a 9.4% increase in organic revenue growth. The automotive business reported organic revenue growth of 6%. The industrial business declined 6.7% organically. The aerospace business witnessed a 33.2% increase in organic revenues.

Total operating expenses were $849.3 million, down 0.1% compared with the prior-year quarter, primarily due to lower restructuring charges. Adjusted operating income was $192.9 million, up 5.7% compared with the year-ago quarter. The uptick was mainly caused by favorable pricing and productivity improvements, partially offset by unfavorable movements in foreign currency and the dilutive impact of acquisitions.

Adjusted EBITDA totaled $225.5 million in the quarter, up from $214.8 million in the previous year’s quarter.

Cash Flow & Liquidity

In the quarter under review, Sensata generated $96.9 million of net cash from operating activities compared with $47.4 million in the prior year. Free cash flow was $60 million compared with $11.6 million a year ago.

As of Mar 31, 2023, the company had $1,034.1 million in cash and cash equivalents and $3,768.6 million of net long-term debt compared with $1,225.5 million and $3,958.9 million, respectively, as of Dec 31, 2022.

In the quarter under review, Sensata returned $16.8 million to shareholders via quarterly dividends.

Guidance

Sensata provided guidance for the second quarter of 2023. For the quarter, the company expects revenues of $1,000-$1,040 million, suggesting a decline of 2% to a rise of 2% year over year. Adjusted operating income is expected to be $190-206 million, indicating a year-over-year decline of 2% to a rise of 6%.

Adjusted earnings per share are estimated to be 88-98 cents, suggesting a rise of 6 to 18%. Adjusted net income is expected to be $137-151 million, suggesting a year-over-year rise of 6% to 17%.

Zacks Rank & Stocks to Consider

Sensata currently has a Zacks Rank #3 (Hold)

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Asure Software ASUR and Salesforce CRM. Asure Software and Salesforce currently sport a Zacks Rank #1 (Strong Buy), whereas Arista Networks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 1.2% in the past 60 days to $5.83 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 32% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings has increased 25% in the past 60 days to 35 cents per share. The long-term earnings growth rate is anticipated to be 25%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 445.8%. Shares of ASUR have increased 176.1% in the past year.

The Zacks Consensus Estimate for Salesforce’s 2023 earnings has increased 21.5% in the past 60 days to $7.11 per share. The long-term earnings growth rate is anticipated to be 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.6%. Shares of the company have increased 15.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Sensata Technologies Holding N.V. (ST) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report