Sensient Technologies Corp (SXT) Navigates Transitional Market with Optimistic Outlook for 2024

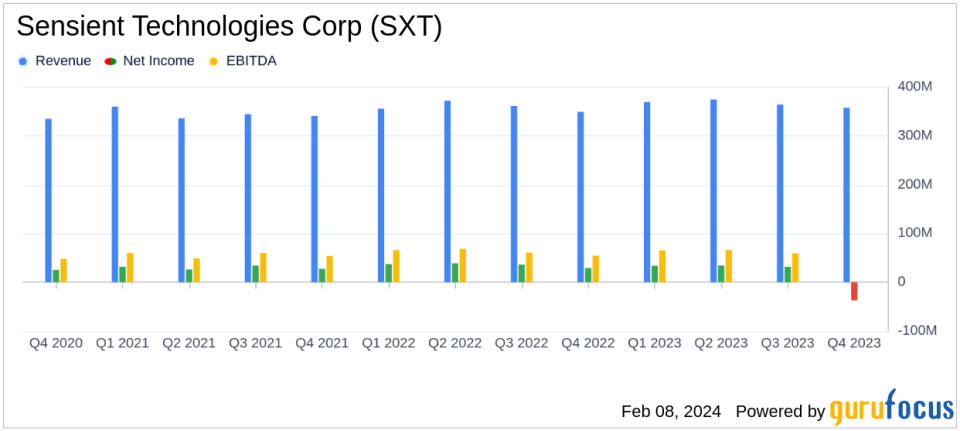

Revenue: Slight increase of 0.2% in Q4 and 1.4% YTD, reaching $349.3 million and $1.456 billion respectively.

Operating Income: Significant drop of 80.4% in Q4, with a 21.2% decrease YTD.

Net Earnings: Sharp decline to $(5.83) million in Q4, down 120% from the previous year.

Diluted Earnings Per Share (EPS): Decreased to $(0.14) in Q4, with a full-year figure of $2.21.

Portfolio Optimization Plan: Expected to deliver $8-10 million in annual cost savings by end of 2025.

2024 Outlook: Projected diluted EPS between $2.80 and $2.90, inclusive of optimization costs.

Sensient Technologies Corp (NYSE:SXT) released its 8-K filing on February 8, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a global leader in the manufacture and marketing of colors, flavors, and specialty ingredients, faced a challenging market environment characterized by inflation and destocking, which impacted its financial results.

Financial Performance Overview

The Flavors & Extracts Group saw a modest revenue increase in Q4, while the Color Group and Asia Pacific Group experienced declines due to lower volumes and market challenges. Despite these setbacks, Sensient's leadership remains optimistic about a return to volume growth and strong sales win rates in 2024. The company's proactive cost reduction efforts, including the Portfolio Optimization Plan, are expected to yield significant savings.

Corporate & Other operating expenses rose notably due to the optimization plan costs, which were primarily non-cash. The company is also in the process of consulting with employee groups in Europe that may be affected by the plan.

Leadership and Board Developments

With the retirement of Stephen Rolfs as CFO, Tobin Tornehl is set to take over the role, signaling strong internal succession planning. Additionally, Brett Bruggeman's nomination to the Board of Directors is anticipated to bring valuable food industry and agribusiness insights to Sensient's strategic direction.

Looking Ahead to 2024

Sensient forecasts a low-to-mid single-digit growth rate in revenue, adjusted EBITDA, and adjusted diluted EPS on a local currency basis for 2024. The company anticipates increased interest expenses and a full-year tax rate between 24% and 25%.

The company's non-GAAP financial measures, such as adjusted operating income and adjusted net earnings, exclude certain costs to provide a clearer understanding of its operational performance. These measures should be considered alongside GAAP results for a comprehensive view of the company's financial health.

Sensient Technologies Corp (NYSE:SXT) is positioned to navigate through the transitional market conditions with a strategic focus on cost optimization and growth in its core business segments. Investors and stakeholders can expect the company to leverage its global supply chain capabilities and specialized solutions to meet the evolving demands of the food, pharmaceutical, and personal care industries.

For a more detailed analysis of Sensient Technologies Corp's financial results and future outlook, investors are encouraged to join the upcoming conference call or access the webcast on the company's website.

Explore the complete 8-K earnings release (here) from Sensient Technologies Corp for further details.

This article first appeared on GuruFocus.