Sentiment Still Eluding Whole Earth Brands, Inc. (NASDAQ:FREE)

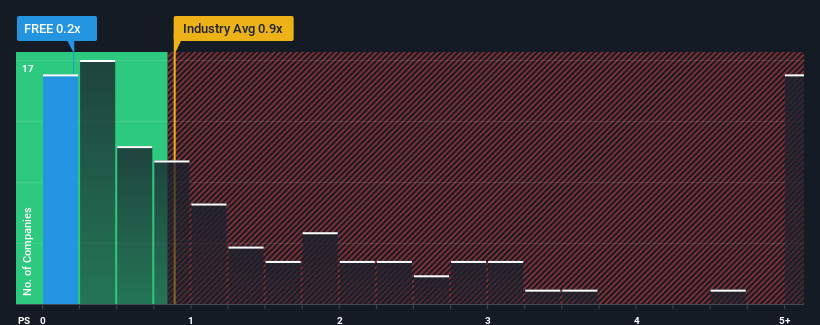

With a price-to-sales (or "P/S") ratio of 0.2x Whole Earth Brands, Inc. (NASDAQ:FREE) may be sending bullish signals at the moment, given that almost half of all the Food companies in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Whole Earth Brands

What Does Whole Earth Brands' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Whole Earth Brands has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Whole Earth Brands' future stacks up against the industry? In that case, our free report is a great place to start.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Whole Earth Brands' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.0% last year. The latest three year period has also seen an excellent 98% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 4.8% per annum as estimated by the seven analysts watching the company. That's shaping up to be similar to the 3.3% per annum growth forecast for the broader industry.

With this information, we find it odd that Whole Earth Brands is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Whole Earth Brands' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Whole Earth Brands that you should be aware of.

If you're unsure about the strength of Whole Earth Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here