Senvest Management, LLC Boosts Stake in AudioCodes Ltd

On August 7, 2023, Senvest Management, LLC (Trades, Portfolio), a New York-based investment firm, significantly increased its holdings in AudioCodes Ltd (NASDAQ:AUDC), an Israel-based technology company. This article provides an in-depth analysis of the transaction, the profiles of both Senvest Management and AudioCodes Ltd, and an evaluation of AudioCodes Ltd's stock performance and financial health.

Details of the Transaction

Senvest Management, LLC (Trades, Portfolio) added 681,270 shares of AudioCodes Ltd to its portfolio at a trade price of $11.19 per share. This transaction increased the firm's total holdings in AudioCodes Ltd to 1,662,242 shares, representing 0.61% of its portfolio and 5.20% of AudioCodes Ltd's total shares. The transaction had a 0.25% impact on Senvest Management's portfolio.

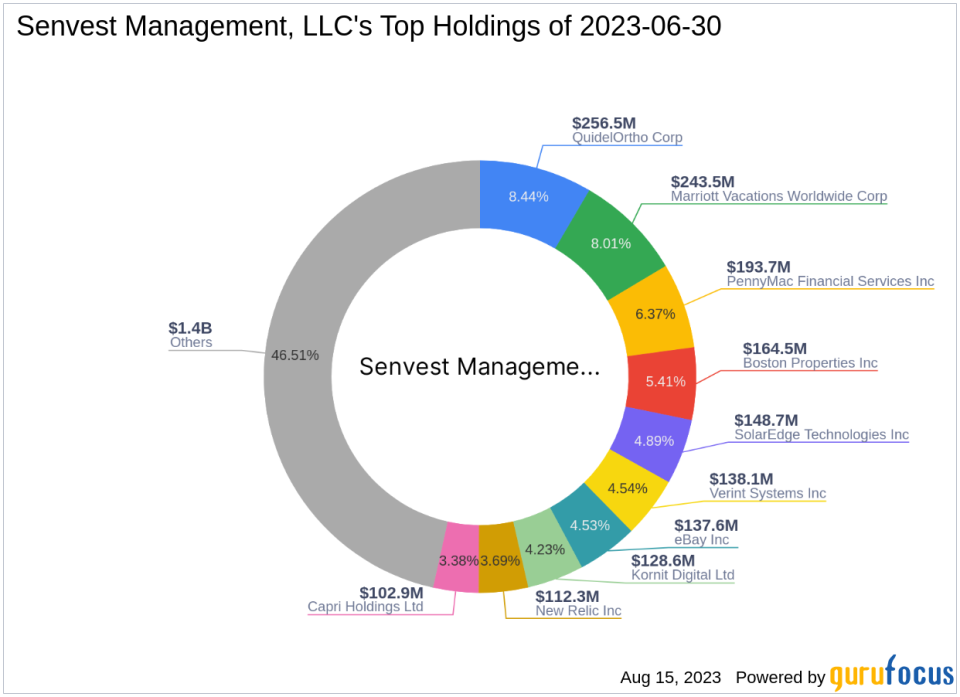

Profile of Senvest Management, LLC (Trades, Portfolio)

Senvest Management, LLC (Trades, Portfolio), located at 540 Madison Avenue, New York, NY 10022, is an investment firm with a diverse portfolio. As of the date of this article, the firm holds 58 stocks with a total equity of $3.04 billion. Its top holdings include QuidelOrtho Corp (NASDAQ:QDEL), SolarEdge Technologies Inc (NASDAQ:SEDG), Boston Properties Inc (NYSE:BXP), PennyMac Financial Services Inc (NYSE:PFSI), and Marriott Vacations Worldwide Corp (NYSE:VAC). The firm's preferred sectors are Technology and Consumer Cyclical.

Overview of AudioCodes Ltd

AudioCodes Ltd, headquartered in Israel, is a technology company that develops and sells advanced and converged voice over IP and data networking solutions. The company's products include IP phones, session border controllers, voice applications, multi-service business routers, digital and analog media gateways, among others. AudioCodes Ltd generates revenues from the sale of products through a direct sales force and sales representatives. The company's market segments are primarily in Israel, Americas, Europe, and the Far East.

Analysis of AudioCodes Ltd's Stock Performance

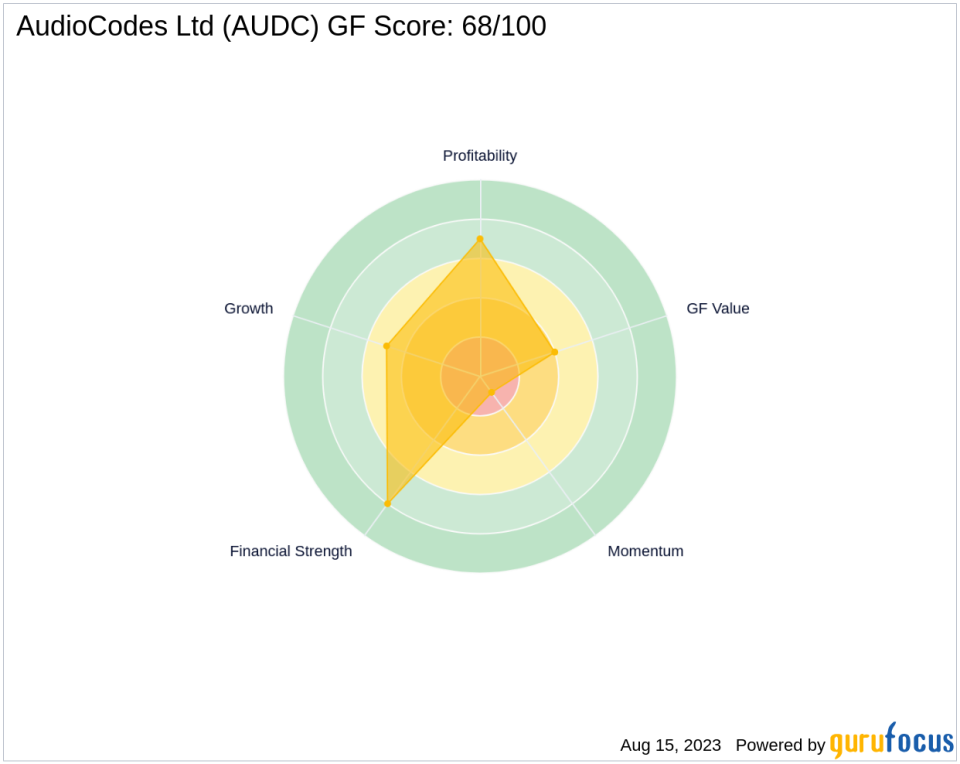

As of August 16, 2023, AudioCodes Ltd has a market capitalization of $338.607 million and a stock price of $10.7. The company's PE percentage is 25.48, indicating a profitable operation. According to GuruFocus, the stock is significantly undervalued with a GF Score of 68/100 and a GF Value of 27.23. The Price to GF Value is 0.39, suggesting a potential for significant growth.

Evaluation of AudioCodes Ltd's Financial Health

AudioCodes Ltd has a strong financial strength with a balance sheet rank of 8/10. The company's profitability rank is 7/10, and its growth rank is 5/10. The Piotroski F-Score is 5, and the Altman Z score is 2.90, indicating a low risk of bankruptcy. The company's cash to debt ratio is 3.89, ranking 781st in the industry.

Assessment of AudioCodes Ltd's Industry Performance

AudioCodes Ltd operates in the Hardware industry. The company's interest coverage is 24.53, ranking 645th in the industry. The company's ROE is 7.46, and its ROA is 4.32. The gross margin growth is 2.40, indicating a healthy profitability.

Review of AudioCodes Ltd's Momentum and Predictability

AudioCodes Ltd's RSI 5 Day is 52.32, RSI 9 Day is 60.22, and RSI 14 Day is 61.65. The company's Momentum Index 6 - 1 Month is -43.85, and Momentum Index 12 - 1 Month is -56.86. The company's predictability rank is not available.

In conclusion, Senvest Management, LLC (Trades, Portfolio)'s recent acquisition of AudioCodes Ltd shares could potentially yield significant returns given the company's strong financial health and undervalued stock. However, investors should also consider the company's momentum and predictability metrics when making investment decisions.

This article first appeared on GuruFocus.