Sequential Brands Group (NASDAQ:SQBG) Use Of Debt Could Be Considered Risky

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Sequential Brands Group, Inc. (NASDAQ:SQBG) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Sequential Brands Group

How Much Debt Does Sequential Brands Group Carry?

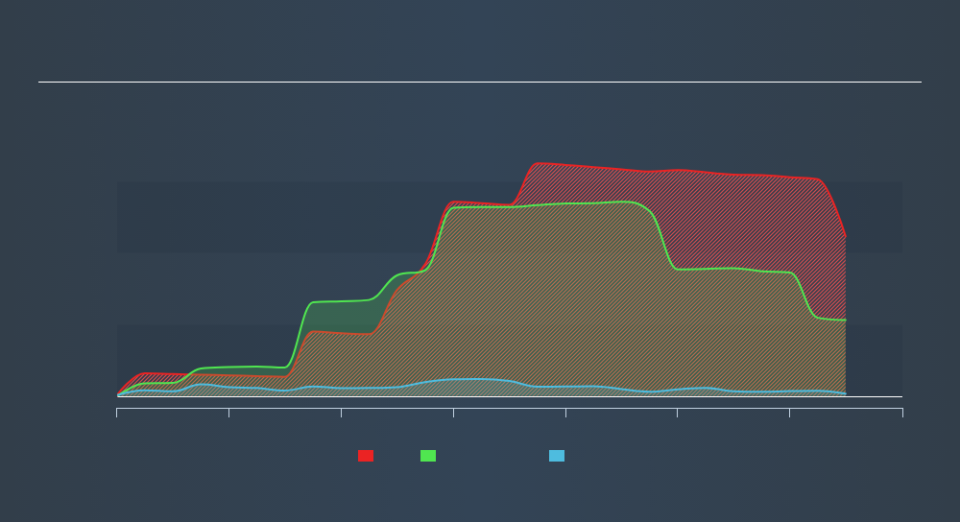

The image below, which you can click on for greater detail, shows that Sequential Brands Group had debt of US$445.9m at the end of June 2019, a reduction from US$617.7m over a year. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Sequential Brands Group's Balance Sheet?

According to the last reported balance sheet, Sequential Brands Group had liabilities of US$54.0m due within 12 months, and liabilities of US$505.4m due beyond 12 months. Offsetting these obligations, it had cash of US$6.92m as well as receivables valued at US$45.9m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$506.6m.

This deficit casts a shadow over the US$28.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt At the end of the day, Sequential Brands Group would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Sequential Brands Group shareholders face the double whammy of a high net debt to EBITDA ratio (5.7), and fairly weak interest coverage, since EBIT is just 1.2 times the interest expense. The debt burden here is substantial. Another concern for investors might be that Sequential Brands Group's EBIT fell 12% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Sequential Brands Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Sequential Brands Group recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Sequential Brands Group's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its conversion of EBIT to free cash flow is not so bad. Taking into account all the aforementioned factors, it looks like Sequential Brands Group has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given our concerns about Sequential Brands Group's debt levels, it seems only prudent to check if insiders have been ditching the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.