Seres Therapeutics Inc (MCRB) Reports Encouraging Sales Growth and Strategic Cost Savings in 2023

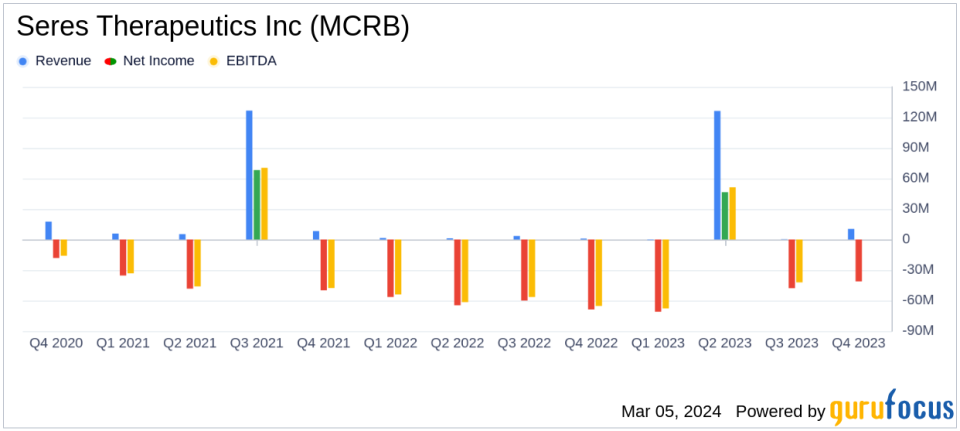

Net Sales: VOWST achieved $10.4 million in Q4 and $19.6 million in H2 2023 sales.

Net Loss Reduction: Full year net loss decreased to $113.7 million from $250.2 million in the previous year.

Research and Development: R&D expenses dropped to $26.8 million in Q4, down from $46.2 million in Q4 2022.

General and Administrative Expenses: G&A expenses were $17.2 million in Q4, a decrease from $22.4 million in the same period last year.

Restructuring Savings: Anticipated annual cash savings of $75-$85 million starting in 2024.

Cash Runway: Year-end cash balance expected to support operations into Q4 2024.

On March 5, 2024, Seres Therapeutics Inc (NASDAQ:MCRB) released its 8-K filing, announcing the fourth quarter and full year financial results for 2023. The company, a pioneer in microbiome therapeutics, has made significant strides with the launch of its first commercial product, VOWST, for the prevention of recurrent Clostridioides difficile infection (CDI).

Company Overview

Seres Therapeutics Inc is a trailblazer in the field of microbiome therapeutics, operating primarily in the United States. The company's innovative approach focuses on developing ecobiotic microbiome therapeutics designed to restore health by repairing the function of a dysbiotic microbiome. Seres Therapeutics Inc's flagship product, SER-109, is aimed at preventing further recurrences of CDI, a debilitating infection of the colon. The company is also advancing SER-262, SER-287, and SER-401 in its development pipeline.

Financial Performance and Challenges

The company reported a significant reduction in net loss for the full year of 2023, amounting to $113.7 million compared to a net loss of $250.2 million for the previous year. This improvement is attributed to the successful commercial launch of VOWST and strategic cost-saving measures. Despite these achievements, Seres Therapeutics Inc faces the ongoing challenge of maintaining the momentum of VOWST's adoption and managing the costs associated with its research and development programs.

Financial Achievements

The commercial success of VOWST is a testament to the company's innovative approach and the potential of microbiome therapeutics in the biotechnology industry. With net sales reaching $19.6 million since its launch in June 2023, VOWST has demonstrated significant market adoption, receiving 2,833 patient enrollment forms and achieving 2,015 new patient starts.

Key Financial Metrics

Research and development expenses for the fourth quarter of 2023 were $26.8 million, a decrease from the $46.2 million reported in the same period of the previous year. This reduction reflects the capitalization of VOWST commercial manufacturing costs following its approval in April 2023. General and administrative expenses also saw a decrease to $17.2 million in the fourth quarter, down from $22.4 million in the same quarter of the previous year, primarily due to the company's restructuring efforts.

"Our 2023 results since the launch of VOWST in June, exceeded our expectations across multiple dimensions," said Terri Young, Ph.D., Chief Commercial and Strategy Officer at Seres. "We saw quarterly acceleration in demand in terms of new patient starts and prescription enrollment forms as well as progress on the reimbursement front."

The company's balance sheet as of December 31, 2023, shows $128.0 million in cash, cash equivalents, and marketable securities, a decrease from $181.3 million at the end of 2022. The anticipated cash savings from the November 2023 restructuring, along with the expected quarter-over-quarter revenue growth of VOWST and the potential receipt of a $45 million Tranche B under the existing debt facility with Oaktree Capital Management, L.P., are expected to provide a financial runway into the fourth quarter of 2024.

Analysis of Performance

Seres Therapeutics Inc's performance in 2023 highlights the company's ability to successfully launch and commercialize a novel therapeutic product while implementing cost-saving measures to streamline operations. The reduction in net loss and controlled expenses reflect a strategic focus on long-term sustainability and growth within the competitive biotechnology sector.

Investors and stakeholders can look forward to the anticipated clinical data from the Phase 1b study with SER-155, which could further validate the company's microbiome therapeutic platform and potentially establish a new standard of care for protecting immunocompromised patients from life-threatening infections.

For a more detailed analysis and to stay updated on Seres Therapeutics Inc's progress, visit GuruFocus.com for comprehensive financial insights and investment opportunities.

Explore the complete 8-K earnings release (here) from Seres Therapeutics Inc for further details.

This article first appeared on GuruFocus.