ServisFirst Bancshares Inc (SFBS) Reports Fourth Quarter 2023 Earnings

Net Income: $42.1 million for Q4 2023, a decrease from $67.7 million in Q4 2022.

Diluted Earnings Per Share (EPS): Reported at $0.77 for Q4 2023, down from $1.24 in the same quarter last year.

Deposits Growth: Year-over-year increase of 15%, with new deposit accounts up by 12%.

Book Value Per Share: Increased to $26.45, marking a 10.7% rise from Q4 2022.

Dividend: Cash dividend raised from $0.28 to $0.30 per share, a 7% increase.

Credit Quality: Remains strong with non-performing assets to total assets at 0.14%.

Capital Position: Consolidated Common Equity Tier 1 capital to risk-weighted assets improved to 10.91%.

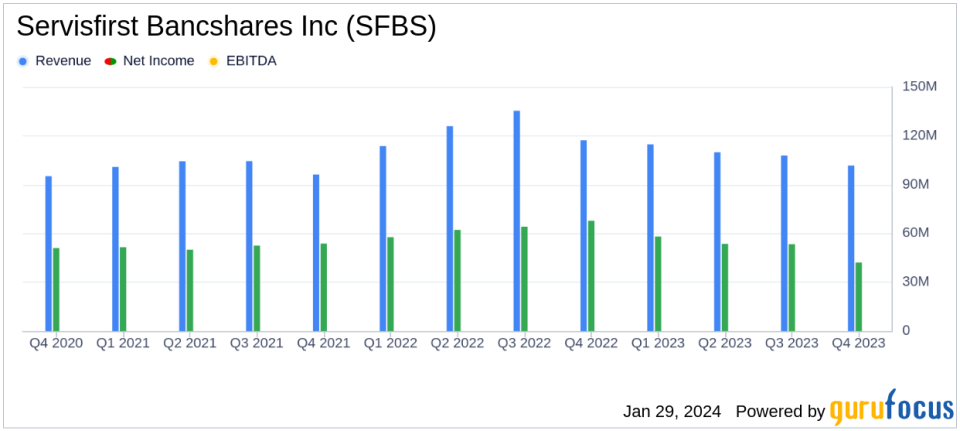

On January 29, 2024, ServisFirst Bancshares Inc (NYSE:SFBS) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The bank holding company, which provides a comprehensive suite of banking services, reported a net income of $42.1 million for the quarter, a decrease from the $67.7 million reported in the same period last year. The diluted earnings per share (EPS) for the quarter stood at $0.77, compared to $1.24 in the fourth quarter of 2022.

ServisFirst Bancshares Inc operates through its subsidiary, ServisFirst Bank, offering services such as commercial and consumer loan origination, deposit acceptance, and a range of electronic banking services including online and mobile banking. The company's presence spans across several states in the Southeastern region of the United States.

The company's performance in the fourth quarter reflects a challenging environment, with a year-over-year decrease in net income and EPS. However, the bank's deposits grew by 15%, and new deposit accounts increased by 12%, indicating strong customer acquisition and retention. The book value per share increased by 10.7% from the fourth quarter of 2022, signifying a solid growth in equity.

Financial Highlights and Challenges

The bank's financial achievements include a robust capital position, with the Consolidated Common Equity Tier 1 capital to risk-weighted assets increasing from 9.95% to 10.91% year-over-year. This improvement demonstrates the bank's strong capital adequacy and its ability to withstand potential losses. Additionally, the bank's credit quality remains strong, with non-performing assets to total assets at a low 0.14%.

Despite these achievements, the bank faced challenges, including a decrease in net interest margin from 3.52% in the fourth quarter of 2022 to 2.57% in the same period of 2023. This decline is attributed to increased liquidity and higher interest-bearing balances with banks, which, while beneficial for net interest income, impacted the net interest margin.

Detailed Financials

Net interest income for the fourth quarter of 2023 was $101.7 million, compared to $122.4 million for the same quarter in the previous year. The bank's loan yields increased to 6.32% during the fourth quarter of 2023, up from 5.32% in the fourth quarter of 2022. Average loans also saw a slight increase, indicating growth in the bank's lending activities.

Non-interest income saw a modest increase, while non-interest expense significantly increased due to one-time items such as the FDIC's special assessment to recapitalize the Deposit Insurance Fund and expenses related to the termination of an EDP contract.

Tom Broughton, Chairman, President, and CEO, commented on the bank's strategic expansion, stating, "We are pleased to announce our entrance into the Memphis, Tennessee market with the addition of Joel Smith, who is an outstanding banker with a commercial and industrial banking background." CFO Bud Foshee added, "We are well-positioned for growth in 2024, with strong liquidity in what we believe to be the best footprint in the United States."

The bank's balance sheet remains strong, with total assets increasing by 10.5% year-over-year to $16.1 billion. The bank's liquidity is also robust, with $2.1 billion in cash on hand and no FHLB advances or brokered deposits.

In conclusion, ServisFirst Bancshares Inc's fourth quarter results reflect a mix of financial strengths and challenges. While the bank's net income and EPS have decreased compared to the previous year, its strategic growth initiatives, strong deposit growth, and solid credit quality position it well for future performance. Investors and stakeholders will be watching closely to see how the bank navigates the evolving economic landscape in 2024.

For a more detailed analysis of ServisFirst Bancshares Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Servisfirst Bancshares Inc for further details.

This article first appeared on GuruFocus.