Servisfirst Bancshares Inc's Dividend Analysis

Examining the Dividend Prowess of Servisfirst Bancshares Inc (NYSE:SFBS)

Servisfirst Bancshares Inc (NYSE:SFBS) recently announced a dividend of $0.3 per share, payable on 2024-01-08, with the ex-dividend date set for 2023-12-29. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Servisfirst Bancshares Inc's dividend performance and assess its sustainability.

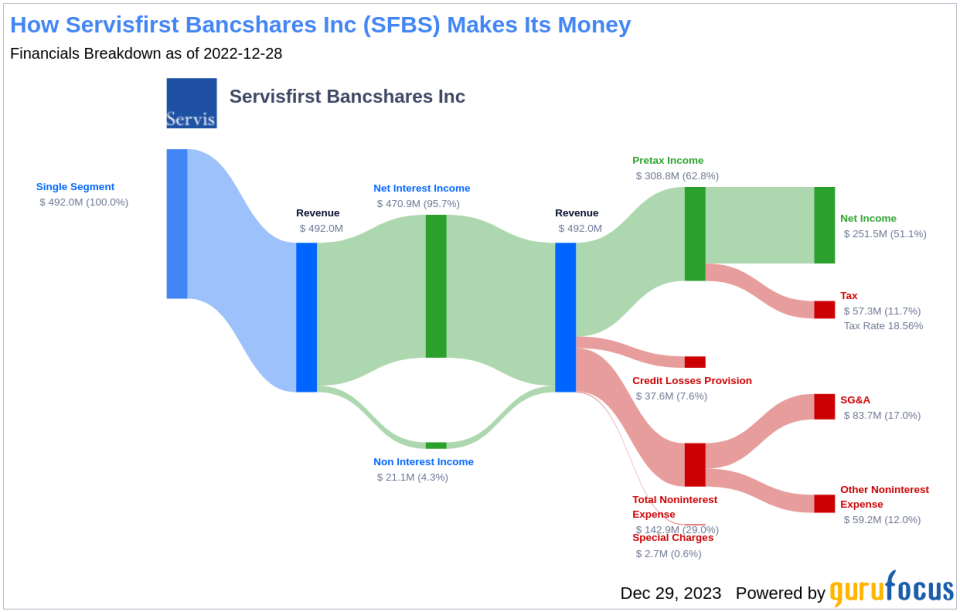

What Does Servisfirst Bancshares Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Servisfirst Bancshares Inc is a bank holding company that plays a pivotal role in the financial sector. It provides a comprehensive suite of services including commercial, consumer, and other loans, alongside deposit acceptance. The company prides itself on its electronic banking services, which encompass online and mobile banking platforms featuring remote deposit capture. Furthermore, Servisfirst Bancshares Inc offers treasury and cash management services and caters to other financial institutions. Its product range extends to telephone banking, direct deposit, Internet banking, mobile banking, safety deposit boxes, and automatic account transfers, ensuring a broad spectrum of financial solutions for its clients.

A Glimpse at Servisfirst Bancshares Inc's Dividend History

Servisfirst Bancshares Inc has established a reputation for reliability in dividend payments, having consistently rewarded shareholders since 2012. The company adheres to a quarterly dividend distribution schedule, ensuring a regular income stream for its investors. Below is a chart showing annual Dividends Per Share for tracking historical trends.

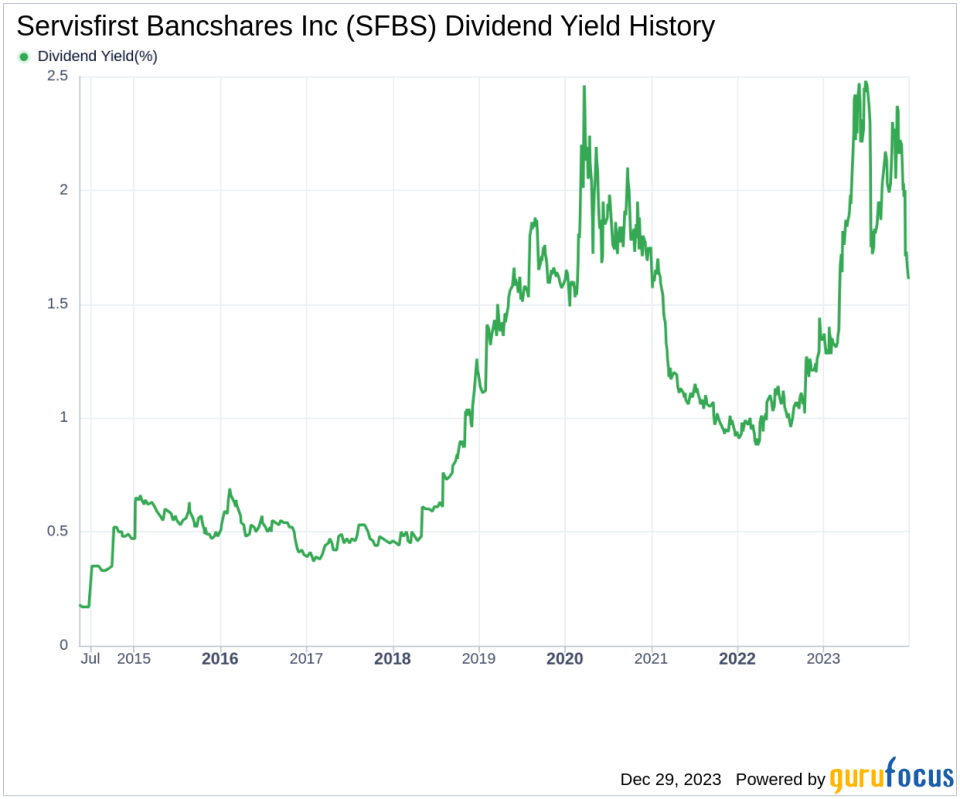

Breaking Down Servisfirst Bancshares Inc's Dividend Yield and Growth

As of today, Servisfirst Bancshares Inc boasts a 12-month trailing dividend yield of 1.64% and a forward dividend yield of 1.75%, indicating an anticipated increase in dividend payments over the next 12 months. The company's dividend growth has been impressive, with an annual growth rate of 15.80% over the past three years. This growth rate accelerates to 31.90% when viewed over a five-year period. These figures culminate in a 5-year yield on cost for Servisfirst Bancshares Inc stock of approximately 6.55% as of today, reflecting the fruitful returns on investment for long-term shareholders.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a critical indicator of a dividend's sustainability. Servisfirst Bancshares Inc's payout ratio stands at 0.26 as of 2023-09-30, suggesting a healthy balance between income distribution and earnings retention for future growth and stability. The company's profitability rank, evaluated at 7 out of 10, underscores its solid earnings capability relative to industry peers. The consistent positive net income over the past decade reinforces Servisfirst Bancshares Inc's robust financial position.

Growth Metrics: The Future Outlook

Growth metrics are essential for the long-term viability of dividends. Servisfirst Bancshares Inc's growth rank of 7 out of 10 portrays a promising growth trajectory. The company's revenue per share, coupled with a 3-year revenue growth rate, indicates a potent revenue model, outperforming 86.38% of global competitors with an average annual increase of 16.70%. Additionally, the 3-year EPS growth rate of 19.40% per year and the 5-year EBITDA growth rate of 19.30% surpass the performance of 75.47% and 80.91% of global competitors, respectively.

Engaging Conclusion: Dividend Prospects of Servisfirst Bancshares Inc

In conclusion, Servisfirst Bancshares Inc's consistent dividend payments, robust dividend growth rate, prudent payout ratio, and strong profitability and growth metrics paint a promising picture for value investors. The company's financial health and strategic initiatives suggest that its dividends may not only be sustainable but also poised for potential growth. How will Servisfirst Bancshares Inc leverage its financial acumen to further reward its shareholders in the future? For investors seeking high-dividend yield opportunities, GuruFocus Premium offers a High Dividend Yield Screener to discover similar investment prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.