Seth Klarman Trims Stake in Garrett Motion Inc

Renowned value investor Seth Klarman (Trades, Portfolio) has recently reduced his stake in Garrett Motion Inc (NASDAQ:GTX), according to a 13DG filing. This article will delve into the details of the transaction, provide an overview of Klarman's investment philosophy, and analyze the financial health and prospects of Garrett Motion Inc. We will also examine the stock's performance and valuation, and discuss the current trends in the Vehicles & Parts industry.

Transaction Details

On July 25, 2023, Klarman's firm, The Baupost Group, reduced its holdings in Garrett Motion Inc by 24.84%, selling 5,250,000 shares at a price of $7.29 per share. This transaction had a -0.66% impact on the portfolio. After the sale, The Baupost Group still holds 15,887,289 shares of Garrett Motion Inc, representing 2% of its portfolio and 6.14% of the company's total shares.

Guru Profile: Seth Klarman (Trades, Portfolio)

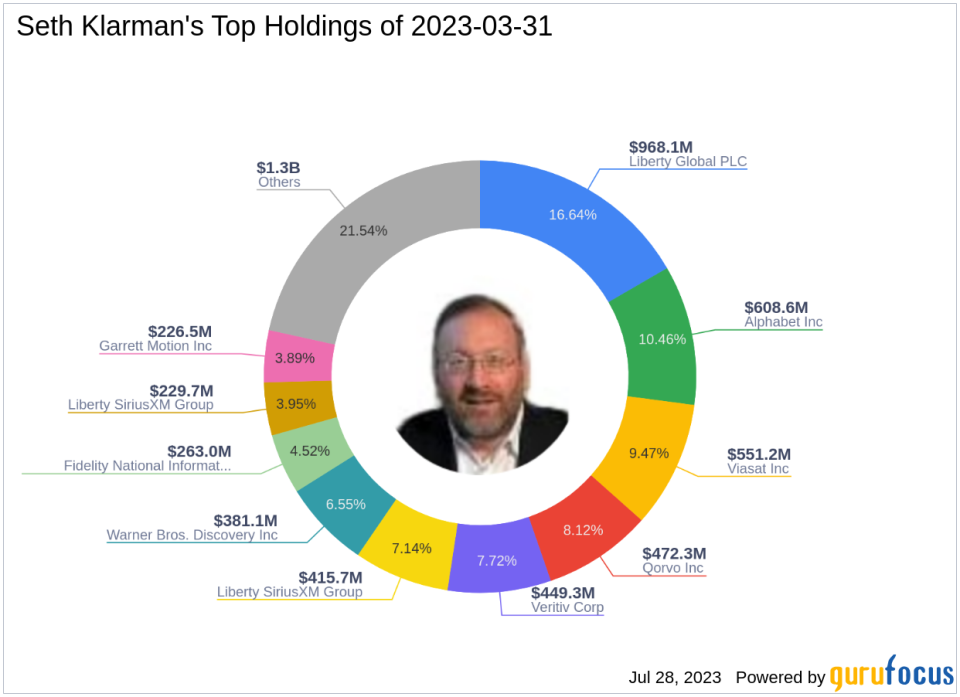

Seth Klarman (Trades, Portfolio), the founder and portfolio manager of The Baupost Group, is a highly respected figure in the investment world. He is known for his wide-ranging investment strategy, which includes traditional value stocks, distressed debt, liquidations, and foreign equities or bonds. Klarman's top holdings include Alphabet Inc(NASDAQ:GOOG), Liberty Global PLC(NASDAQ:LBTYK), Qorvo Inc(NASDAQ:QRVO), Viasat Inc(NASDAQ:VSAT), and Veritiv Corp(NYSE:VRTV). His firm manages an equity portfolio worth $5.82 billion, with a focus on the Communication Services and Technology sectors.

Overview of Garrett Motion Inc

Garrett Motion Inc, based in Switzerland, is a leading provider of engineered turbocharger and electric-boosting technologies for light and commercial vehicle original equipment manufacturers (OEMs) and the vehicle independent aftermarket. The company also offers automotive software solutions. With a market cap of $2.1 billion, the company's stock is currently trading at $7.92 per share, with a PE ratio of 11.00. However, GuruFocus's valuation suggests that the stock could be a possible value trap, with a GF Value of $15.87 and a Price to GF Value ratio of 0.50.

Stock Performance and Valuation

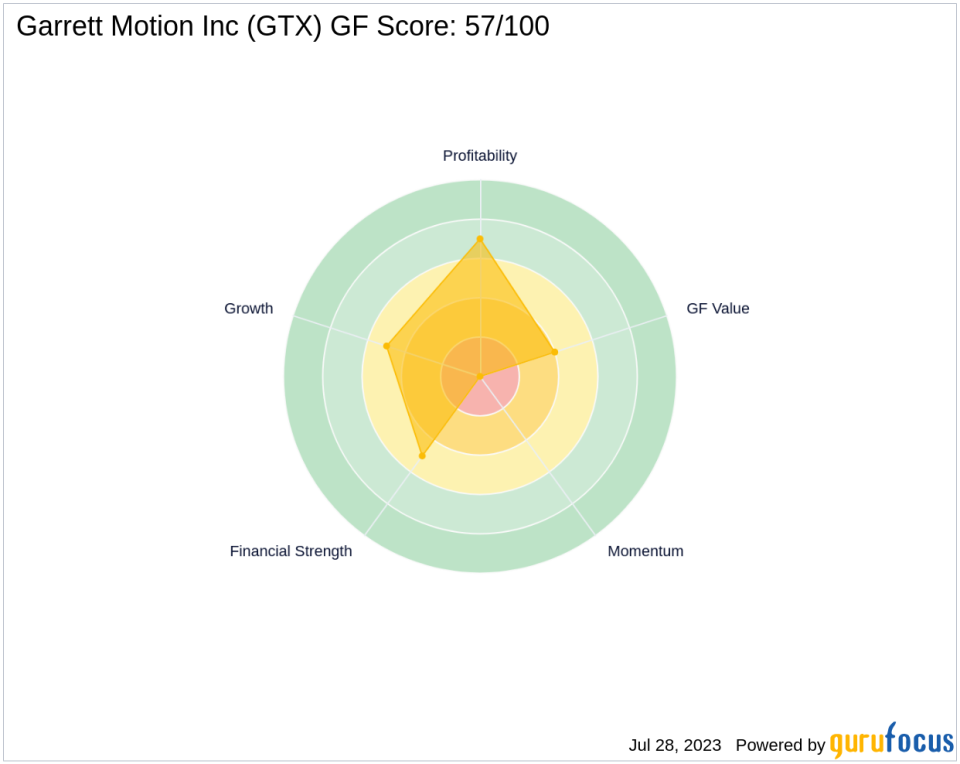

Since its IPO on May 3, 2021, Garrett Motion Inc's stock has gained 44%. Year-to-date, the stock has seen a modest gain of 0.25%. The stock's GF Score stands at 57/100, indicating a poor future performance potential. The company's balance sheet, profitability, and growth ranks are 5/10, 7/10, and 5/10 respectively, while its GF Value rank is 4/10. The stock's momentum rank is currently not applicable.

Industry Overview

Garrett Motion Inc operates in the Vehicles & Parts industry, which has been witnessing significant developments in recent years. The increasing focus on electric and autonomous vehicles, coupled with stringent emission norms, is driving innovation and growth in this industry.

Other Gurus' Investments

Other notable gurus who hold shares in Garrett Motion Inc include Mario Gabelli (Trades, Portfolio) and Prem Watsa (Trades, Portfolio). Their investment strategies and holdings could potentially influence the stock's performance.

Conclusion

In conclusion, Seth Klarman (Trades, Portfolio)'s recent reduction in Garrett Motion Inc's stake is a significant move that could have implications for both the stock and his portfolio. While the company's financial health and growth prospects seem promising, the stock's valuation suggests caution. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.