Seth Klarman's Baupost Group Bolsters Position in CRH PLC with a 3.56% Portfolio Stake

Insight into Baupost Group's Latest 13F Filings Reveals Strategic Moves in Q3 2023

Seth Klarman (Trades, Portfolio), the esteemed value investor and founder of The Baupost Group, is renowned for his prudent investment strategies and the authorship of the coveted book "Margin of Safety." A graduate of Cornell University and Harvard Business School, Klarman's investment approach is versatile, encompassing traditional value stocks to complex assets like distressed debt. His philosophy emphasizes risk-awareness over mere returns, and he is known for his patience, often holding cash when suitable opportunities are scarce.

New Additions to the Baupost Portfolio

The third quarter of 2023 saw Seth Klarman (Trades, Portfolio)'s Baupost Group make significant additions to its investment portfolio, including:

CRH PLC (NYSE:CRH), acquiring 3,345,543 shares, which now represent 3.56% of the portfolio, valued at $183 million.

Clarivate PLC (NYSE:CLVT), with a new holding of 22,500,000 shares, making up approximately 2.94% of the portfolio, worth $150.98 million.

Tower Semiconductor Ltd (NASDAQ:TSEM), adding 2,850,000 shares, accounting for 1.36% of the portfolio, with a total investment of $70 million.

Significant Increases in Existing Holdings

Klarman's Baupost Group also strategically increased its stakes in several companies during the quarter:

Willis Towers Watson PLC (NASDAQ:WTW), with an additional 653,300 shares, bringing the total to 1,555,667 shares. This represents a 72.4% increase in share count, impacting the portfolio by 2.65%, and valued at $325.07 million.

Dollar General Corp (NYSE:DG), adding 685,000 shares for a total of 927,000. This marks a 283.06% increase in share count, with a total value of $98.08 million.

Exiting Positions

Notably, Klarman's Baupost Group exited several positions in the third quarter:

Amazon.com Inc (NASDAQ:AMZN), selling all 963,946 shares, which had a -2.27% impact on the portfolio.

Union Pacific Corp (NYSE:UNP), liquidating all 175,000 shares, resulting in a -0.65% portfolio impact.

Reduced Positions

Reductions were also made in the Baupost Group's holdings, with significant cuts in:

Qorvo Inc (NASDAQ:QRVO), by 1,682,091 shares, leading to a -64.26% decrease in shares and a -3.1% impact on the portfolio. The stock traded at an average price of $102.11 during the quarter.

Garrett Motion Inc (NASDAQ:GTX), by 20,083,300 shares, resulting in a -77.03% reduction and a -2.75% portfolio impact. The stock's average trading price was $7.70 during the quarter.

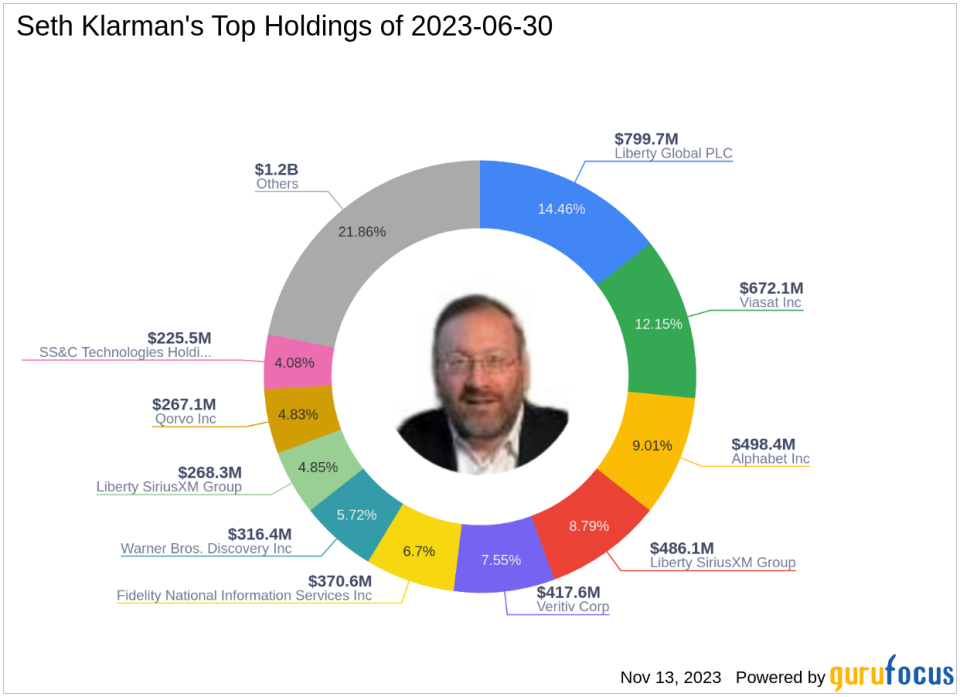

Portfolio Overview

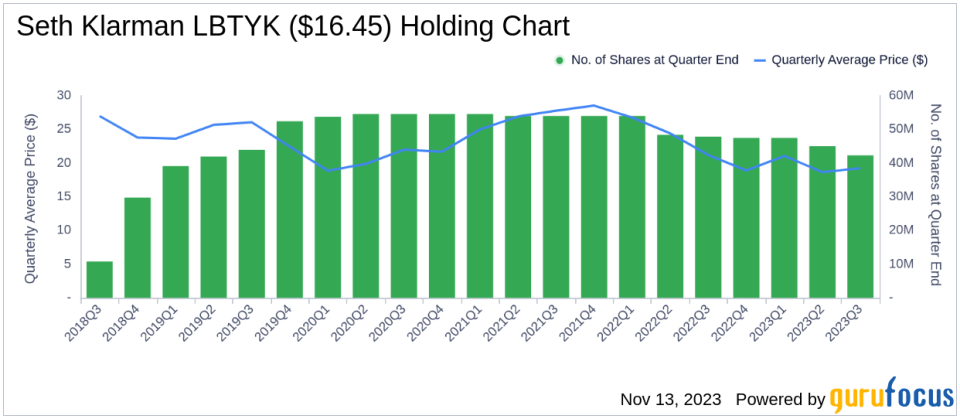

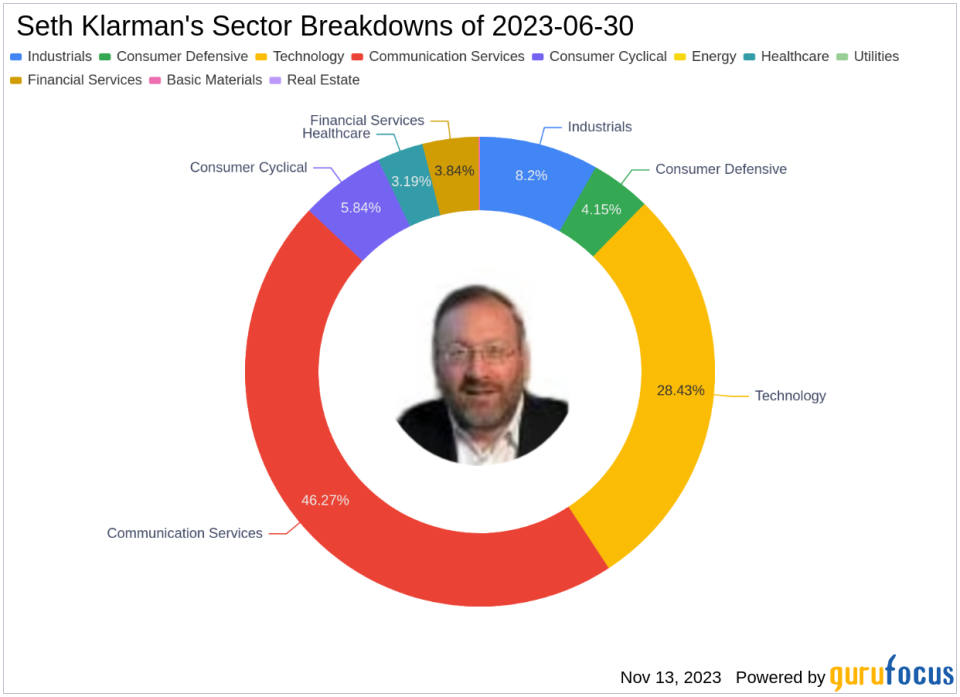

As of the third quarter of 2023, Seth Klarman (Trades, Portfolio)'s Baupost Group held 31 stocks, with top positions in Liberty Global PLC (NASDAQ:LBTYK), Veritiv Corp (NYSE:VRTV), Alphabet Inc (NASDAQ:GOOG), Fidelity National Information Services Inc (NYSE:FIS), and Liberty SiriusXM Group (NASDAQ:LSXMK). The portfolio is primarily concentrated across eight industries: Communication Services, Technology, Industrials, Financial Services, Basic Materials, Consumer Defensive, Healthcare, and Consumer Cyclical.

The strategic moves made by Seth Klarman (Trades, Portfolio) in the third quarter reflect his commitment to value investing and risk management. The adjustments in the Baupost Group's portfolio, particularly the increased stake in CRH PLC, demonstrate Klarman's confidence in these selected companies and his ongoing search for investment opportunities that align with his philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.