Seth Klarman's Baupost Trims Veritiv, Garrett Motion

Seth Klarman (Trades, Portfolio), a renowned value investor and the Portfolio Manager of The Baupost Group, recently filed his 13F report for the second quarter of 2023. Klarman, who is also the author of the highly sought-after book "Margin of Safety," holds an economics degree from Cornell University and an MBA from Harvard University. He founded The Baupost Group in 1983 and has since been known for his disciplined approach to value investing, focusing on buying securities that are undervalued and holding them until their price reflects their intrinsic value.

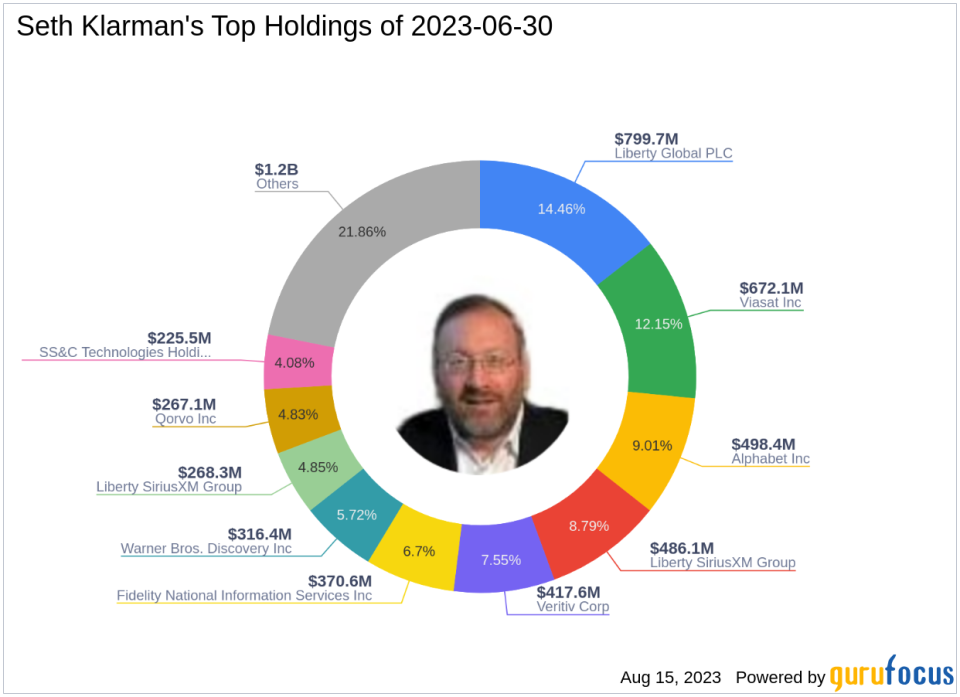

As of the end of Q2 2023, Klarman's portfolio contained 28 stocks with a total value of $5.53 billion. The top holdings were LBTYK (14.46%), VSAT (12.15%), and GOOG (9.01%).

Top Three Trades of the Quarter

Among the notable transactions in the quarter, Klarman reduced his investment in Veritiv Corp (NYSE:VRTV) by 509 shares, which had a 0% impact on the equity portfolio. The stock traded for an average price of $141.21 during the quarter. As of August 15, 2023, VRTV had a price of $168.25 and a market cap of $2.28 billion. The stock has returned 23.14% over the past year. GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, VRTV has a price-earnings ratio of 7.58, a price-book ratio of 2.59, a price-earnings-to-growth (PEG) ratio of 0.16, a EV-to-Ebitda ratio of 5.15 and a price-sales ratio of 0.36.

Klarman also reduced his investment in Garrett Motion Inc (NASDAQ:GTX) by 9,900,000 shares, impacting the equity portfolio by 1.29%. The stock traded for an average price of $7.6 during the quarter. As of August 15, 2023, GTX had a price of $7.95 and a market cap of $2.06 billion. The stock has returned 11.53% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, GTX has a EV-to-Ebitda ratio of 5.23 and a price-sales ratio of 0.15.

Lastly, Klarman sold out of his 25,480,292-share investment in Garrett Motion Inc (NASDAQ:GTXAP.PFD). The shares traded for an average price of $8.98 during the quarter. As of August 15, 2023, GTXAP.PFD had a price of $8.6 and a market cap of $0.00 million. The stock has returned 15.90% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, GTXAP.PFD has a EV-to-Ebitda ratio of 5.13 and a price-sales ratio of 0.15.

In conclusion, Seth Klarman (Trades, Portfolio)'s Q2 2023 portfolio update reveals his continued commitment to value investing, with strategic adjustments in holdings based on market conditions and company performance. His portfolio's composition and recent trades offer valuable insights for investors seeking to understand the strategies of one of the most successful value investors in the world.

This article first appeared on GuruFocus.