Shake Shack Inc (SHAK) Reports Robust Revenue Growth and Expansion in Fiscal Year 2023

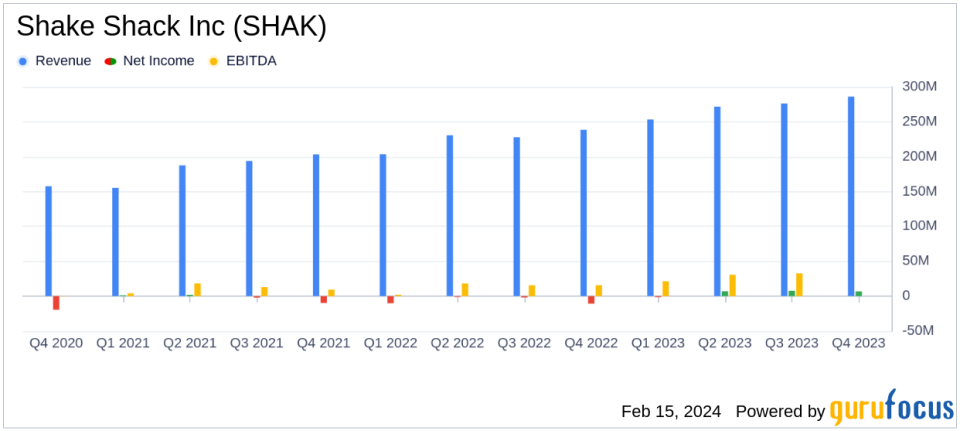

Total Revenue: Increased by 20.8% to $1,087.5 million in FY 2023.

Net Income: Grew to $20.5 million, with earnings of $0.47 per diluted share.

Shack-Level Operating Profit: Reached $208.2 million, representing 19.9% of Shack sales.

Same-Shack Sales: Improved by 4.4% compared to FY 2022.

New Shack Openings: 41 new domestic Company-operated Shacks and 44 new licensed Shacks.

Adjusted EBITDA: Increased to $131.8 million for the fiscal year.

On February 15, 2024, Shake Shack Inc (NYSE:SHAK) released its 8-K filing, announcing financial results for the fourth quarter and fiscal year 2023. The company, renowned for its premium burgers and classic American menu, demonstrated significant growth with a 20.8% increase in total revenue, reaching $1,087.5 million for the fiscal year. This growth was driven by a combination of $1,046.8 million in Shack sales and $40.7 million in Licensing revenue.

Shake Shack's commitment to quality ingredients and customer experience has paid off, with system-wide sales climbing by 23.5% to $1,702.1 million. The company also reported a positive trend in same-Shack sales, which rose by 4.4% compared to the previous year. This metric is particularly important as it indicates the health and appeal of the brand in its established locations.

Financial Performance and Expansion

Shake Shack's financial achievements are noteworthy in the competitive restaurant industry. The company's operating income turned positive, posting $5.9 million for the year, a significant improvement from the operating loss reported in the previous year. The net income attributable to Shake Shack Inc was $19.8 million, or $0.47 per diluted share, marking a substantial recovery from the prior year's loss.

The company's expansion strategy was aggressive, with 41 new domestic Company-operated Shacks and 44 new licensed Shacks opened during the fiscal year, including locations in Thailand and the Bahamas. This expansion not only increases the company's market presence but also diversifies its revenue streams and enhances brand recognition globally.

Key Financial Metrics

Shake Shack's balance sheet reflects a solid financial position with $224.7 million in cash and cash equivalents. The company's total assets amounted to $1,605.8 million, while total liabilities stood at $1,136.8 million. The balance sheet strength is crucial for supporting ongoing expansion and operational activities.

From the income statement, the company reported a Shack-level operating profit of $208.2 million, which is a clear indicator of the profitability of its individual outlets. This profit margin, representing 19.9% of Shack sales, is a critical measure for investors as it provides insight into the efficiency and effectiveness of the company's operations.

The cash flow statement showed net cash provided by operating activities at $132.1 million, although the company experienced a net decrease in cash and cash equivalents due to significant investments in property and equipment, necessary for its expansion efforts.

"Our strong performance in fiscal 2023 reflects the successful execution of our strategic priorities, including menu innovation, digital investment, and domestic and international expansion," said Randy Garutti, Chief Executive Officer. "We are excited about the opportunities ahead as we continue to grow the Shake Shack community worldwide."

Shake Shack's performance in fiscal year 2023 demonstrates the company's resilience and adaptability in a challenging economic environment. The company's strategic investments in menu development, digital initiatives, and global expansion have positioned it well for continued growth. For value investors, Shake Shack's robust revenue growth, improved profitability, and strategic expansion efforts make it a company worth watching in the restaurant industry.

For detailed financial figures and further information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Shake Shack Inc for further details.

This article first appeared on GuruFocus.