Shake Shack (NYSE:SHAK) shareholders notch a 8.7% CAGR over 5 years, yet earnings have been shrinking

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But Shake Shack Inc. (NYSE:SHAK) has fallen short of that second goal, with a share price rise of 52% over five years, which is below the market return. However, more recent buyers should be happy with the increase of 40% over the last year.

Since it's been a strong week for Shake Shack shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Shake Shack

We don't think that Shake Shack's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Shake Shack saw its revenue grow at 17% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 9% over the period isn't that impressive compared to the overall market. That's surprising given the strong revenue growth. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

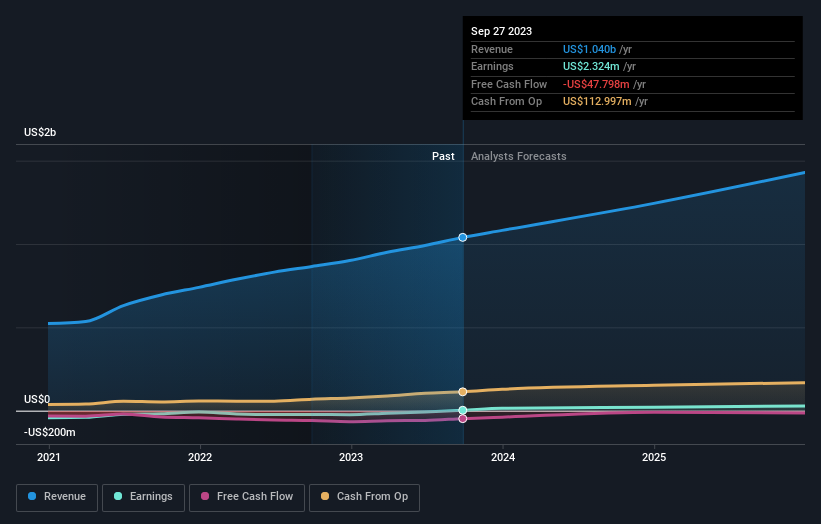

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Shake Shack shareholders have received a total shareholder return of 40% over the last year. That gain is better than the annual TSR over five years, which is 9%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Shake Shack may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.