ShaMaran Petroleum Corp. (CVE:SNM) Screens Well But There Might Be A Catch

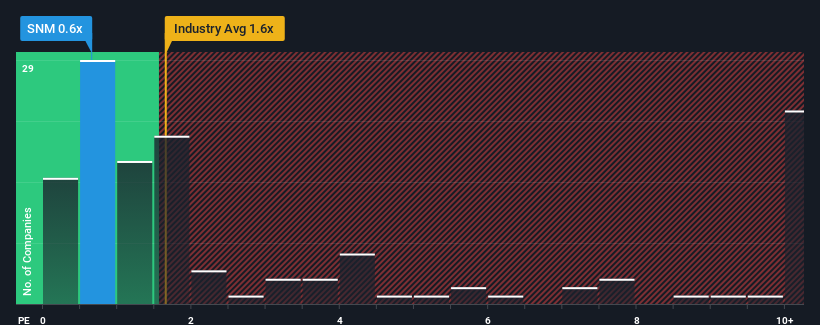

With a price-to-sales (or "P/S") ratio of 0.6x ShaMaran Petroleum Corp. (CVE:SNM) may be sending bullish signals at the moment, given that almost half of all the Oil and Gas companies in Canada have P/S ratios greater than 1.6x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ShaMaran Petroleum

How Has ShaMaran Petroleum Performed Recently?

There hasn't been much to differentiate ShaMaran Petroleum's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on ShaMaran Petroleum will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on ShaMaran Petroleum will help you uncover what's on the horizon.

Is There Any Revenue Growth Forecasted For ShaMaran Petroleum?

The only time you'd be truly comfortable seeing a P/S as low as ShaMaran Petroleum's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 50% gain to the company's top line. Pleasingly, revenue has also lifted 132% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 57% during the coming year according to the lone analyst following the company. Meanwhile, the broader industry is forecast to contract by 5.3%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that ShaMaran Petroleum's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of ShaMaran Petroleum's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for ShaMaran Petroleum (of which 2 are a bit unpleasant!) you should know about.

If you're unsure about the strength of ShaMaran Petroleum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here