Sharecare Inc (SHCR) Reports Earnings: A Mixed Bag Against Analyst Expectations

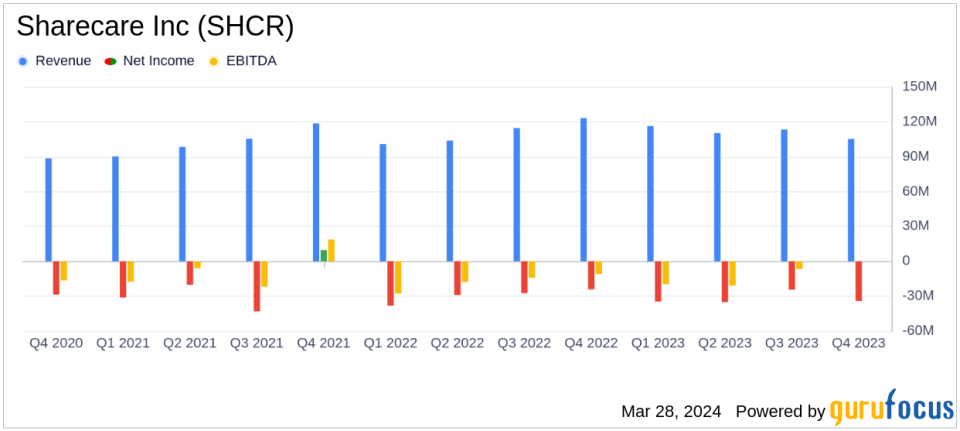

Revenue: Q4 revenue fell to $105.3 million, down 15% year-over-year and missing analyst estimates of $117.582 million.

Net Loss: Increased to $34.2 million in Q4, compared to a net loss of $24.1 million in the prior year, and was more significant than the estimated net loss of $19.2365 million.

Earnings Per Share (EPS): Reported a net loss per share of $0.10, which was wider than the estimated loss per share of $0.055.

Adjusted EBITDA: Slightly improved to $3.0 million, up from $2.5 million in the same quarter last year.

Balance Sheet: Ended the year with a strong cash position of $128.2 million.

On March 28, 2024, Sharecare Inc (NASDAQ:SHCR) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. The digital healthcare platform, which aims to consolidate and manage various components of health in one place, faced a challenging quarter with revenue and net loss not aligning with analyst expectations.

For the fourth quarter, Sharecare reported revenue of $105.3 million, a decrease of 15% compared to the same period last year. This decline was partly due to the elimination of nonperforming disputed contracts, which negatively impacted revenue by $14.2 million. The company's net loss widened to $34.2 million, up from a net loss of $24.1 million in the prior year's quarter. This included various non-cash and non-operational expenses, such as stock compensation and reorganizational costs.

Despite the revenue decline, Sharecare's adjusted EBITDA saw a slight increase to $3.0 million, up from $2.5 million in the fourth quarter of the previous year. This improvement reflects the company's cost optimization and globalization efforts, which are expected to yield $30 million in annualized cost savings.

Financial Highlights and Strategic Review

For the full year, Sharecare's revenue modestly increased to $445.3 million, up 1% from the previous year. However, the net loss for the year also increased, reaching $128.5 million compared to $118.7 million in 2022. The adjusted net loss per share rose slightly to $0.10 from $0.09 the previous year.

Brent Layton, CEO of Sharecare, expressed confidence in the company's innovation capabilities and the momentum in expanding their services to new markets, such as Medicaid and Medicare. Justin Ferrero, president and chief financial officer, highlighted the company's strong financial position, with over $182 million in available cash and positive cash flow in the fourth quarter.

Sharecare is currently undergoing a strategic review process, evaluating multiple proposals for a potential sale transaction and alternative value-creation opportunities. The special committee aims to maximize shareholder value, with a decision to be communicated upon conclusion of the review process.

Operational and Financial Challenges

The company's financial performance reflects the challenges of eliminating nonperforming contracts and the associated revenue impact. The increase in net loss and net loss per share also indicates the costs associated with reorganizational changes and investments in new product innovation.

However, Sharecare's financial achievements, such as the slight increase in adjusted EBITDA and the solid balance sheet with substantial cash reserves, are important indicators of the company's resilience and potential for long-term growth in the competitive healthcare providers and services industry.

As Sharecare continues to navigate its strategic review and potential restructuring, the company's ability to innovate and optimize costs will be crucial in driving future profitability and shareholder value.

Investors and stakeholders will be watching closely as Sharecare moves forward with its strategic initiatives and responds to the dynamic healthcare market.

For a more in-depth analysis and updates on Sharecare Inc (NASDAQ:SHCR), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Sharecare Inc for further details.

This article first appeared on GuruFocus.