Shareholders in Appreciate Holdings (NASDAQ:SFR) are in the red if they invested a year ago

Appreciate Holdings, Inc. (NASDAQ:SFR) shareholders should be happy to see the share price up 30% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. During that time the share price has plummeted like a stone, down 83%. So it's not that amazing to see a bit of a bounce. Only time will tell if the company can sustain the turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Appreciate Holdings

Appreciate Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Appreciate Holdings saw its revenue grow by 3.8%. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the 83% share price implosion is unexpected.. We'd venture this growth was too low to give holders confidence that profitability is on the horizon. But if it will make money, albeit later than previously believed, this could be an opportunity.

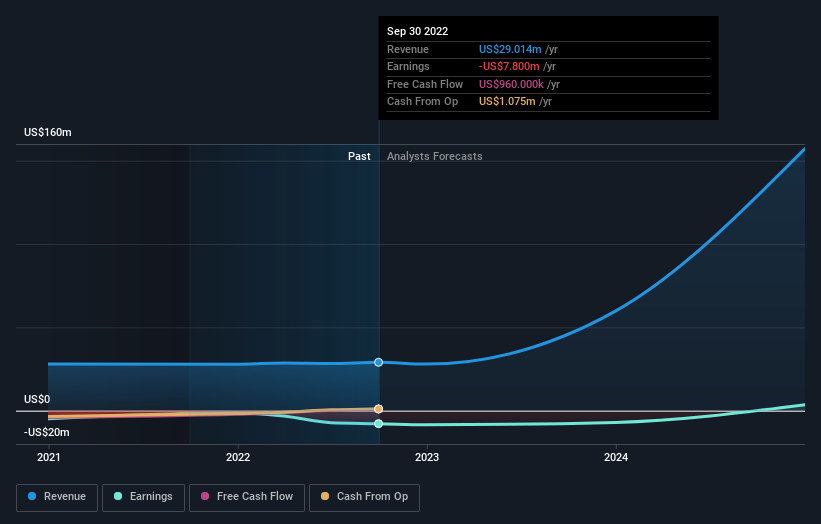

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Appreciate Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Appreciate Holdings shareholders are down 83% for the year, even worse than the market loss of 7.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Notably, the loss over the last year isn't as bad as the 83% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Appreciate Holdings is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here