Shareholders in Cue Health (NASDAQ:HLTH) have lost 75%, as stock drops 13% this past week

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. So spare a thought for the long term shareholders of Cue Health Inc. (NASDAQ:HLTH); the share price is down a whopping 75% in the last twelve months. A loss like this is a stark reminder that portfolio diversification is important. Cue Health hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

If the past week is anything to go by, investor sentiment for Cue Health isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Cue Health

Cue Health isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Cue Health saw its revenue fall by 22%. That looks pretty grim, at a glance. The share price fall of 75% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

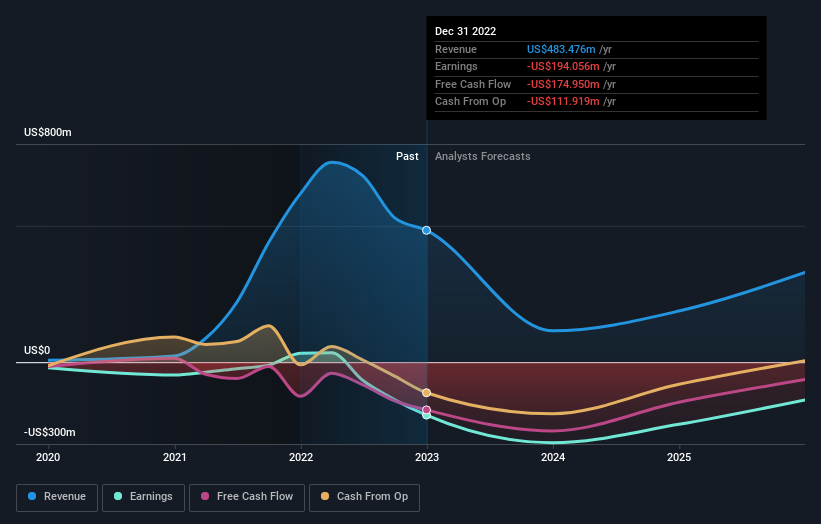

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Cue Health stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We doubt Cue Health shareholders are happy with the loss of 75% over twelve months. That falls short of the market, which lost 6.7%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 26% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Cue Health better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Cue Health you should be aware of, and 1 of them is a bit unpleasant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here