Shareholders in DATA MODUL Produktion und Vertrieb von elektronischen Systemen (ETR:DAM) are in the red if they invested five years ago

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen (ETR:DAM) shareholders for doubting their decision to hold, with the stock down 21% over a half decade. The falls have accelerated recently, with the share price down 12% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for DATA MODUL Produktion und Vertrieb von elektronischen Systemen

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, DATA MODUL Produktion und Vertrieb von elektronischen Systemen actually saw its earnings per share (EPS) improve by 12% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

It's strange to see such muted share price performance despite sustained growth. Perhaps a clue lies in other metrics.

We don't think that the 0.2% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 3.2% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

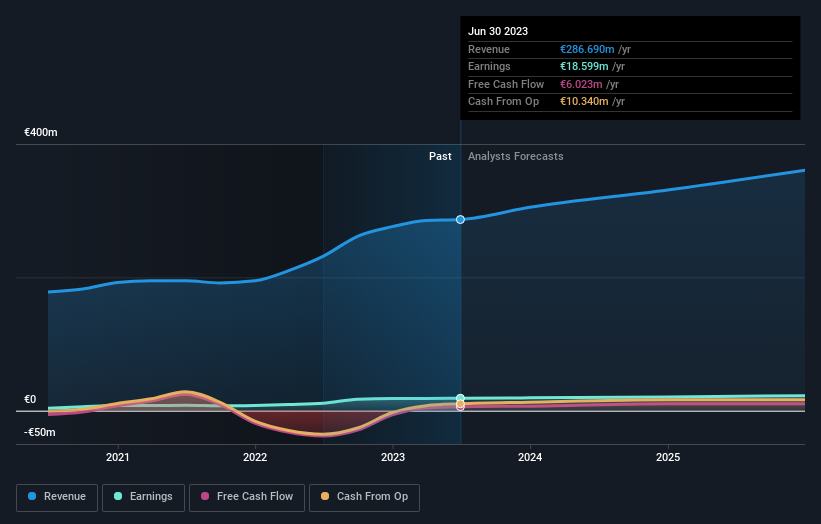

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how DATA MODUL Produktion und Vertrieb von elektronischen Systemen has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling DATA MODUL Produktion und Vertrieb von elektronischen Systemen stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in DATA MODUL Produktion und Vertrieb von elektronischen Systemen had a tough year, with a total loss of 1.7% (including dividends), against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 4% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before forming an opinion on DATA MODUL Produktion und Vertrieb von elektronischen Systemen you might want to consider these 3 valuation metrics.

We will like DATA MODUL Produktion und Vertrieb von elektronischen Systemen better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.