Some Shareholders Feeling Restless Over European Wax Center, Inc.'s (NASDAQ:EWCZ) P/S Ratio

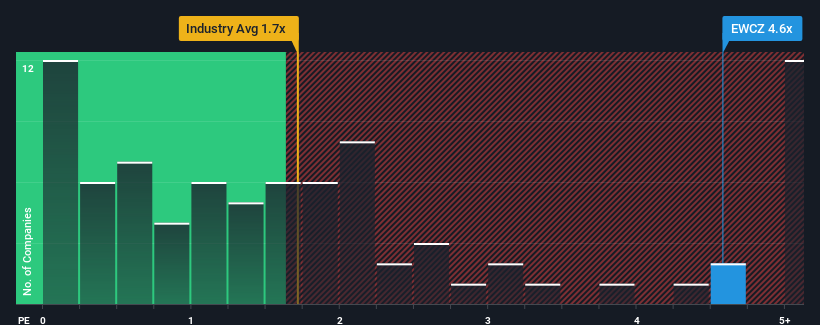

European Wax Center, Inc.'s (NASDAQ:EWCZ) price-to-sales (or "P/S") ratio of 4.6x may look like a poor investment opportunity when you consider close to half the companies in the Consumer Services industry in the United States have P/S ratios below 1.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for European Wax Center

What Does European Wax Center's P/S Mean For Shareholders?

Recent times have been advantageous for European Wax Center as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying to much for the stock.

Keen to find out how analysts think European Wax Center's future stacks up against the industry? In that case, our free report is a great place to start.

How Is European Wax Center's Revenue Growth Trending?

European Wax Center's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 11% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that European Wax Center is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting European Wax Center's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for European Wax Center that you need to be mindful of.

If these risks are making you reconsider your opinion on European Wax Center, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here