Some Shareholders Feeling Restless Over Kymera Therapeutics, Inc.'s (NASDAQ:KYMR) P/S Ratio

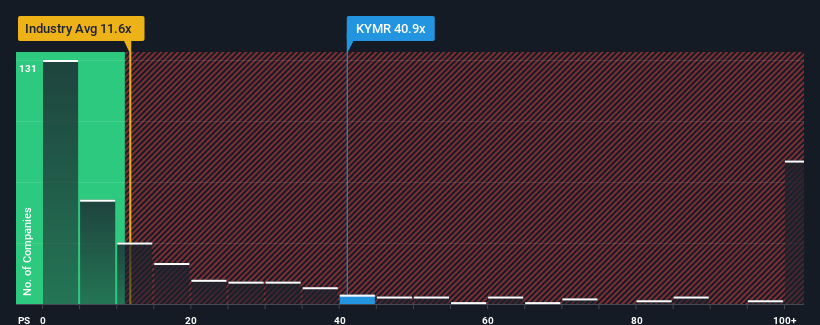

With a price-to-sales (or "P/S") ratio of 40.9x Kymera Therapeutics, Inc. (NASDAQ:KYMR) may be sending very bearish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios under 11.6x and even P/S lower than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Kymera Therapeutics

What Does Kymera Therapeutics' Recent Performance Look Like?

Kymera Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Kymera Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Kymera Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 97% per annum growth forecast for the broader industry.

With this information, we find it concerning that Kymera Therapeutics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Kymera Therapeutics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Kymera Therapeutics that you should be aware of.

If these risks are making you reconsider your opinion on Kymera Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here