Shareholders in Lyft (NASDAQ:LYFT) have lost 71%, as stock drops 5.1% this past week

Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame Lyft, Inc. (NASDAQ:LYFT) shareholders if they were still in shock after the stock dropped like a lead balloon, down 71% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Even if you look out three years, the returns are still disappointing, with the share price down67% in that time. The falls have accelerated recently, with the share price down 19% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Lyft

Because Lyft made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Lyft saw its revenue grow by 51%. That's a strong result which is better than most other loss making companies. So the hefty 71% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

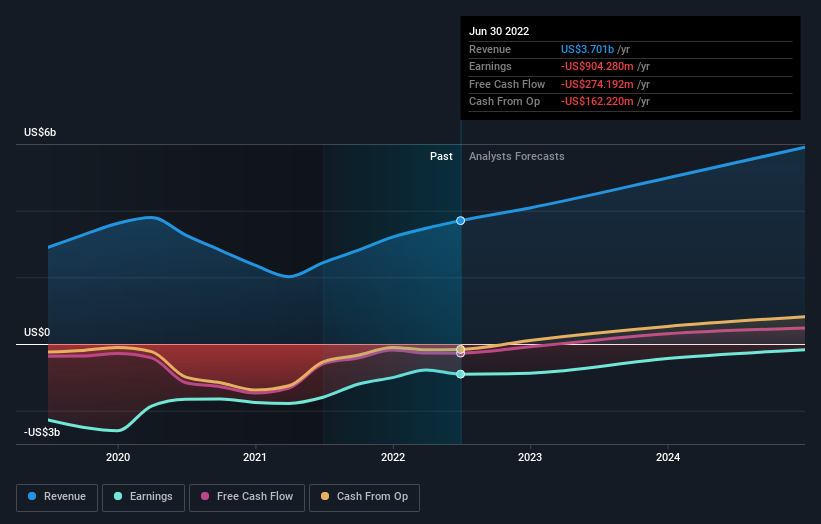

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Lyft is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Lyft stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

The last twelve months weren't great for Lyft shares, which performed worse than the market, costing holders 71%. The market shed around 25%, no doubt weighing on the stock price. The three-year loss of 19% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Lyft , and understanding them should be part of your investment process.

We will like Lyft better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here