Shareholders in Mesa Laboratories (NASDAQ:MLAB) are in the red if they invested three years ago

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Mesa Laboratories, Inc. (NASDAQ:MLAB) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 64% drop in the share price over that period. And over the last year the share price fell 28%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 23% in a month.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for Mesa Laboratories

While Mesa Laboratories made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Mesa Laboratories grew revenue at 24% per year. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 18% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

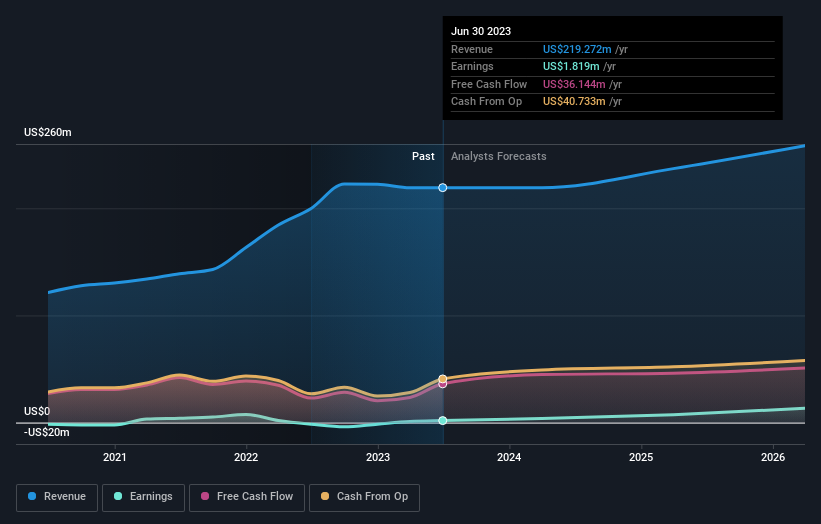

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Mesa Laboratories has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Mesa Laboratories in this interactive graph of future profit estimates.

A Different Perspective

Investors in Mesa Laboratories had a tough year, with a total loss of 28% (including dividends), against a market gain of about 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Mesa Laboratories in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Mesa Laboratories better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.