Shareholders Will Most Likely Find First Interstate BancSystem, Inc.'s (NASDAQ:FIBK) CEO Compensation Acceptable

Under the guidance of CEO Kevin Riley, First Interstate BancSystem, Inc. (NASDAQ:FIBK) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26 May 2021. We present our case of why we think CEO compensation looks fair.

See our latest analysis for First Interstate BancSystem

How Does Total Compensation For Kevin Riley Compare With Other Companies In The Industry?

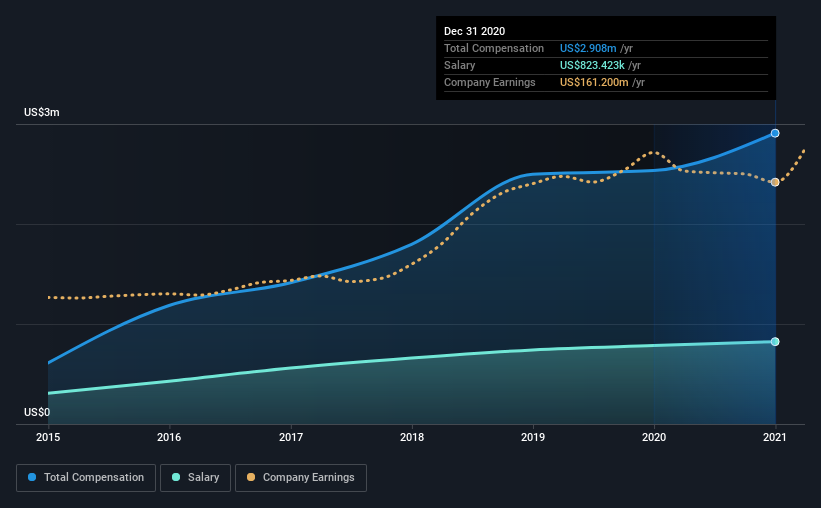

At the time of writing, our data shows that First Interstate BancSystem, Inc. has a market capitalization of US$2.9b, and reported total annual CEO compensation of US$2.9m for the year to December 2020. That's a notable increase of 15% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$823k.

For comparison, other companies in the same industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$3.4m. So it looks like First Interstate BancSystem compensates Kevin Riley in line with the median for the industry. Furthermore, Kevin Riley directly owns US$7.8m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$823k | US$784k | 28% |

Other | US$2.1m | US$1.8m | 72% |

Total Compensation | US$2.9m | US$2.5m | 100% |

On an industry level, around 42% of total compensation represents salary and 58% is other remuneration. It's interesting to note that First Interstate BancSystem allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at First Interstate BancSystem, Inc.'s Growth Numbers

First Interstate BancSystem, Inc.'s earnings per share (EPS) grew 9.7% per year over the last three years. It achieved revenue growth of 2.2% over the last year.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has First Interstate BancSystem, Inc. Been A Good Investment?

With a total shareholder return of 18% over three years, First Interstate BancSystem, Inc. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for First Interstate BancSystem (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.